Choosing the Right Life Insurance Agent or Broker

Advice on how to select a qualified and trustworthy life insurance agent or broker to guide your purchase.

Choosing the Right Life Insurance Agent or Broker

Navigating the world of life insurance can feel like trying to solve a complex puzzle. With so many policy types, riders, and providers, it's easy to get overwhelmed. That's where a good life insurance agent or broker comes in. They're not just salespeople; they're your guides, helping you understand your options, assess your needs, and ultimately make one of the most important financial decisions for your family's future. But how do you find the right one? It's not about picking the first name that pops up in a search engine. It's about finding a trusted advisor who genuinely has your best interests at heart. Let's dive into what makes a great agent or broker and how you can identify them.

Understanding the Role of a Life Insurance Agent vs Broker What You Need to Know

Before we talk about choosing, let's clarify the difference between an agent and a broker, as these terms are often used interchangeably but have distinct meanings. Understanding this distinction is crucial because it impacts the range of options they can offer you.

Life Insurance Agent Defined

An insurance agent typically works for a specific insurance company. Think of them as a direct representative of that company. Their primary goal is to sell you policies from their employer's product line. This isn't necessarily a bad thing. Agents who work for highly reputable companies often have deep expertise in their company's offerings, allowing them to provide detailed insights into specific policies, their features, and how they compare to other products within that same company's portfolio. They are experts in their specific brand.

For example, if you approach an agent from 'Acme Life Insurance Co.', they will present you with Acme's term life, whole life, universal life, and other specialized policies. They can explain the nuances of Acme's 'Preferred Plus' health rating, their specific riders, and their claims process. The benefit here is often a streamlined process and a deep understanding of one company's ecosystem. The potential drawback is that their recommendations are limited to that single company's products, which might not always be the absolute best fit or the most competitively priced option for your unique situation.

Life Insurance Broker Explained

An insurance broker, on the other hand, is an independent professional. They don't work for a single insurance company. Instead, they work for you. A broker has relationships with multiple insurance carriers – sometimes dozens or even hundreds. This means they can shop around on your behalf, comparing policies and prices from a wide array of companies to find the best fit for your specific needs and budget. They act as an intermediary, helping you navigate the entire market.

Imagine a broker as a personal shopper for insurance. You tell them what you're looking for, and they go out and find the best deals and most suitable products from various stores. This often leads to more competitive pricing and a broader range of options, especially if you have unique health conditions or specific coverage requirements that might be better met by a niche insurer. The downside? Sometimes, the sheer volume of options can be overwhelming, and you'll need to trust your broker's ability to distill those options effectively.

Key Qualities of a Trustworthy Life Insurance Advisor What to Look For

Whether you choose an agent or a broker, certain qualities are non-negotiable. These are the hallmarks of a professional who will genuinely serve your best interests.

Experience and Expertise in Life Insurance Products

This might seem obvious, but it's worth emphasizing. You want someone who has been in the business for a while and understands the intricacies of life insurance. They should be able to explain complex concepts in simple terms, answer all your questions, and anticipate potential issues. Ask about their years in the industry, their specializations (e.g., estate planning, business insurance), and how they stay updated on industry changes.

Licenses and Certifications for Insurance Professionals

Ensure they are properly licensed in your state or region. You can usually verify this through your state's department of insurance website. Beyond basic licensing, look for professional designations like:

- CLU (Chartered Life Underwriter): This designation signifies advanced knowledge in life insurance and estate planning.

- ChFC (Chartered Financial Consultant): Indicates expertise in comprehensive financial planning, which often includes life insurance.

- CFP (Certified Financial Planner): While broader than just insurance, a CFP will integrate life insurance into a holistic financial plan.

These certifications demonstrate a commitment to professional development and ethical standards.

Strong Communication Skills and Client Education

A great agent or broker doesn't just sell you a policy; they educate you. They should be patient, clear, and willing to take the time to ensure you fully understand what you're buying. They should listen more than they talk, asking probing questions to truly grasp your needs and concerns. Avoid anyone who rushes you, uses jargon without explanation, or makes you feel pressured.

Reputation and Client Testimonials for Insurance Services

Word-of-mouth is powerful. Check online reviews on platforms like Google, Yelp, or industry-specific sites. Ask for references from current clients. A reputable professional will have a track record of satisfied customers. Look for consistent themes in reviews – are they praised for their honesty, responsiveness, or ability to find great deals? Be wary of agents with numerous negative reviews or a lack of online presence.

Ethical Conduct and Fiduciary Responsibility in Insurance

This is paramount. You need someone you can trust implicitly. A good agent or broker will always act in your best interest, even if it means recommending a policy that earns them a lower commission. They should be transparent about their compensation and any potential conflicts of interest. While brokers aren't always fiduciaries in the same legal sense as some financial advisors, the best ones operate with a fiduciary mindset, prioritizing your needs above their own.

Where to Find a Qualified Life Insurance Agent or Broker Top Resources

Now that you know what to look for, where do you start your search?

Online Search Engines and Directories for Insurance Professionals

A simple Google search for 'life insurance agent near me' or 'independent life insurance broker [your city/state]' is a good starting point. Websites like the National Association of Insurance and Financial Advisors (NAIFA) or the Independent Insurance Agents & Brokers of America (IIABA) often have 'find an agent' tools. Online marketplaces like Policygenius, SelectQuote, or Quotacy can also connect you with brokers who work with multiple carriers.

Referrals from Trusted Sources for Life Insurance Advice

Ask friends, family, colleagues, or other financial professionals (like your financial planner, accountant, or attorney) for recommendations. A personal referral often comes with an implicit level of trust and can save you a lot of legwork. If your financial planner doesn't sell insurance, they likely work with trusted insurance professionals they can refer you to.

Professional Organizations and Industry Associations for Agents

Organizations like NAIFA or the Million Dollar Round Table (MDRT) represent top-tier professionals in the insurance and financial services industry. While membership doesn't guarantee a perfect fit, it often indicates a commitment to professional standards and ongoing education.

Questions to Ask Your Prospective Life Insurance Advisor Essential Inquiry

Once you've identified a few potential candidates, it's time for an interview. Here are some crucial questions to ask:

- "How long have you been in the life insurance business?" (Look for at least 5 years of experience.)

- "Are you an agent or a broker? Which companies do you represent or work with?" (This clarifies their scope.)

- "What professional designations or certifications do you hold?" (CLU, ChFC, CFP are good signs.)

- "How do you determine the right amount and type of coverage for my situation?" (They should ask detailed questions about your finances, family, and goals.)

- "Can you explain the different types of life insurance policies and which ones you think might be suitable for me, and why?" (They should be able to simplify complex topics.)

- "How are you compensated?" (Most are commission-based, but transparency is key.)

- "What is your process for helping clients with claims?" (A good agent will assist your beneficiaries.)

- "Can you provide references from current clients?" (A confident agent will readily provide these.)

- "How often do you recommend reviewing my policy?" (Life changes, so policies should be reviewed periodically.)

- "What are your service standards? How quickly do you respond to calls/emails?" (Responsiveness is important.)

Comparing Life Insurance Products and Scenarios Practical Examples

A great agent or broker won't just tell you about policies; they'll show you how they apply to your life. Let's consider a few scenarios and how a good advisor would guide you.

Scenario 1 Young Family with Mortgage and Children

Client Profile: John and Jane, both 35, with two young children (ages 3 and 5). They have a $500,000 mortgage and combined annual income of $150,000. Their primary concern is ensuring their children are financially secure if something happens to either parent.

Advisor's Approach: A good advisor would likely recommend Term Life Insurance. Why? Because it's generally the most affordable option for a large death benefit, which is crucial for covering a mortgage, childcare, and future education costs during their peak earning years. They would calculate the coverage needed based on the DIME method (Debt, Income, Mortgage, Education) or a similar needs analysis.

Product Recommendation Example (Illustrative):

- Product: 'Guardian Level Term 20' (20-year term life policy)

- Coverage: $1,000,000 for each spouse

- Estimated Annual Premium (for healthy non-smokers): ~$600 - $800 per person (highly variable based on health, specific company, and state)

- Why this product: Guardian is known for competitive rates and strong financial ratings. A 20-year term would cover the critical years until their children are grown and potentially through college. The level premium ensures predictable costs.

- Alternative Comparison: The advisor might also show quotes from 'Protective Life' or 'Banner Life' to demonstrate competitive pricing and slightly different underwriting criteria, explaining how each company might view their health profiles. They would highlight that while Protective might be slightly cheaper, Banner might have a more lenient view on a specific past medical condition, making it a better fit for one of them.

Scenario 2 Mid-Career Professional Seeking Wealth Accumulation

Client Profile: Sarah, 45, single, high-earning professional ($250,000 annually). She has maxed out her retirement accounts and is looking for additional tax-advantaged ways to save and leave a legacy. She also wants flexibility.

Advisor's Approach: Here, the advisor might explore Universal Life (UL) Insurance, specifically Indexed Universal Life (IUL) or Variable Universal Life (VUL), due to their cash value growth potential and flexibility. They would explain the risks and rewards of each.

Product Recommendation Example (Illustrative):

- Product: 'Pacific Life Pacific Discovery Xelerator IUL'

- Coverage: $2,000,000 (to provide a substantial death benefit and allow for significant cash value accumulation)

- Estimated Annual Premium: ~$15,000 - $25,000 (designed for maximum cash value funding, not minimum premium)

- Why this product: Pacific Life is a strong carrier in the IUL space, known for competitive caps and participation rates. The IUL offers market-linked growth potential (tied to an index like the S&P 500) without direct market risk to the principal, plus tax-deferred growth and tax-free access to cash value via loans/withdrawals.

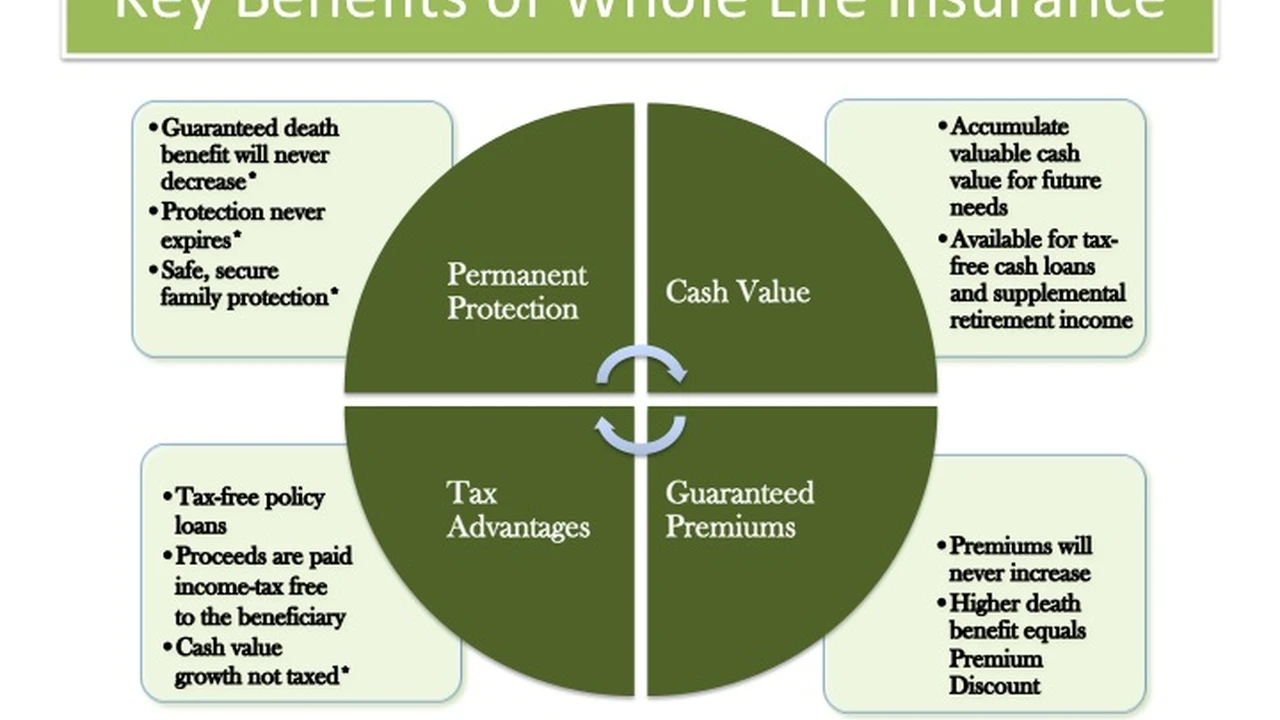

- Alternative Comparison: The advisor would compare this to a 'Northwestern Mutual Whole Life' policy, explaining the guaranteed growth and dividends of whole life versus the potential for higher, but non-guaranteed, growth in an IUL. They would also discuss the investment options and higher risk of a 'Prudential VUL' if Sarah is comfortable with direct market exposure for potentially greater returns. The advisor would clearly outline the fees associated with each product, especially the surrender charges and cost of insurance in the early years of UL policies.

Scenario 3 Senior Looking for Final Expense Coverage

Client Profile: Robert, 70, retired, on a fixed income. He wants to ensure his funeral and final expenses are covered without burdening his children. He has some minor health issues (controlled high blood pressure).

Advisor's Approach: For Robert, the advisor would likely recommend Final Expense Life Insurance (a type of whole life insurance with smaller death benefits and simplified underwriting) or Guaranteed Issue Life Insurance if his health conditions are more severe.

Product Recommendation Example (Illustrative):

- Product: 'Mutual of Omaha Living Promise Whole Life' (Simplified Issue)

- Coverage: $15,000 - $25,000

- Estimated Monthly Premium: ~$70 - $120 (depending on age, gender, and specific health questions)

- Why this product: Mutual of Omaha is a leader in the final expense market. Their 'Living Promise' offers simplified underwriting (a few health questions, no medical exam) and immediate coverage for many common health conditions. It's a whole life policy, so premiums are fixed, and coverage lasts a lifetime.

- Alternative Comparison: If Robert's health was more challenging (e.g., recent cancer history), the advisor might present 'Gerber Life Guaranteed Acceptance Whole Life'. They would explain that while Gerber offers guaranteed acceptance, it typically has a two-year waiting period before the full death benefit is paid (unless death is accidental), and premiums can be higher for the same coverage amount. The advisor would clearly articulate the trade-offs between simplified issue (some health questions, immediate coverage for many) and guaranteed issue (no health questions, but often a waiting period).

The Importance of Ongoing Relationship Management with Your Advisor

Your relationship with your life insurance agent or broker shouldn't end once you've signed the policy. Life insurance is a long-term commitment, and your needs will change over time. A good advisor will encourage regular reviews (at least every few years or after significant life events like marriage, birth of a child, new home, or career change).

They should be accessible for questions, help with beneficiary changes, and guide your loved ones through the claims process if the unthinkable happens. This ongoing support is a critical, often overlooked, aspect of choosing the right professional.

Ultimately, selecting a life insurance agent or broker is about finding a trusted partner. Take your time, do your research, ask the right questions, and don't be afraid to interview several candidates. The peace of mind that comes from knowing you have the right coverage, secured with the help of a knowledgeable and ethical professional, is truly invaluable.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)