Comparing Whole Life Insurance Providers in the US

A detailed comparison of leading whole life insurance providers in the US, focusing on features and customer reviews.

Comparing Whole Life Insurance Providers in the US

Understanding Whole Life Insurance What It Is and Why It Matters

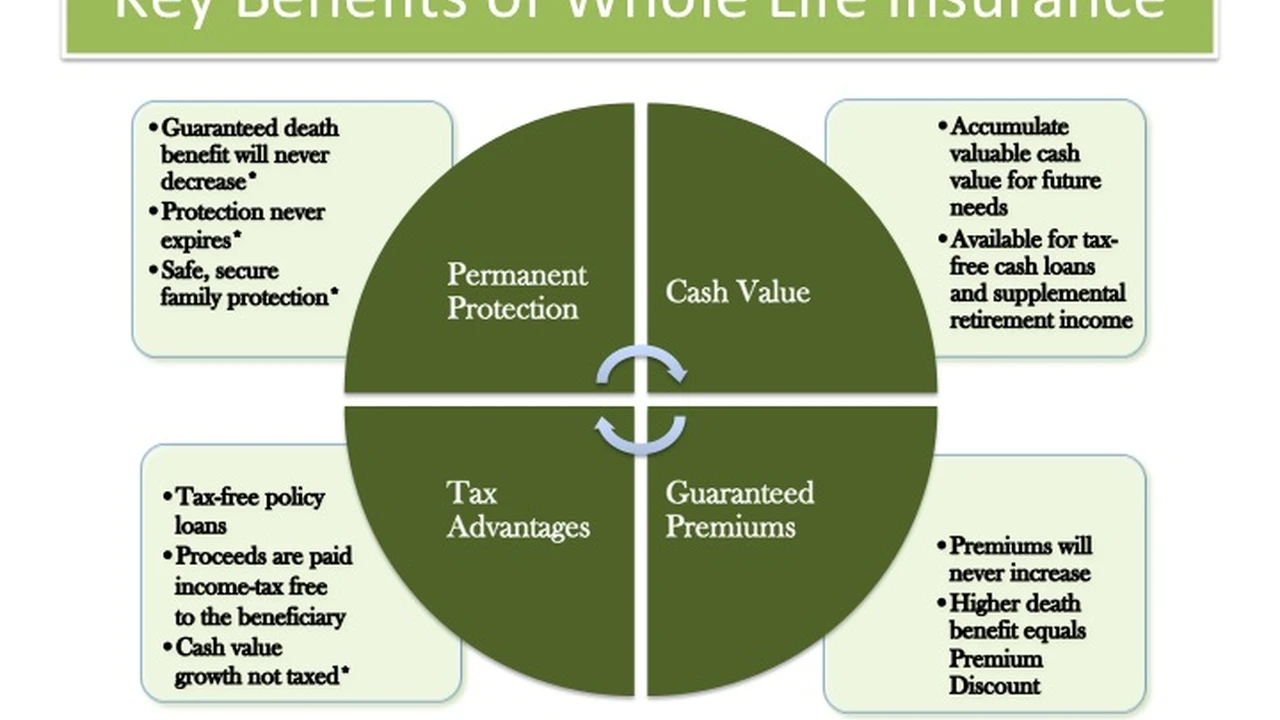

Hey there! So, you're looking into whole life insurance, huh? That's a smart move, especially if you're thinking long-term financial security for yourself and your loved ones. Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as premiums are paid. Unlike term life insurance, which covers you for a specific period, whole life policies offer a guaranteed death benefit and, perhaps more importantly, a cash value component that grows over time on a tax-deferred basis. This cash value can be accessed later in life through withdrawals or loans, making it a versatile financial tool. It's like having a safety net that also builds a little nest egg for you. For many, it's about peace of mind, knowing that their family will be taken care of financially no matter what, and having a living benefit they can tap into if needed. But with so many providers out there, how do you pick the right one? That's exactly what we're going to dive into today.

Key Features to Look for in Top Whole Life Insurance Companies

When you're comparing whole life insurance providers, it's not just about the cheapest premium. Oh no, there's a lot more to it! You want to look at the whole package. Here are some key features that really set the best companies apart:

- Financial Strength and Stability: This is huge. You're entering into a long-term contract, so you want to make sure the company will be around to pay out when needed. Look for high ratings from agencies like A.M. Best, S&P, Moody's, and Fitch.

- Dividend-Paying Policies: Many whole life policies are 'participating,' meaning policyholders can receive dividends. These aren't guaranteed, but they can significantly boost your cash value or reduce premiums. Companies with a long history of paying strong dividends are often preferred.

- Cash Value Growth: How quickly does the cash value accumulate? Some policies offer faster growth in the early years, while others might be more conservative. Understand the guaranteed growth rate and any potential non-guaranteed growth.

- Policy Riders and Customization: Can you add riders to tailor the policy to your specific needs? Think about things like waiver of premium, accelerated death benefit, or long-term care riders.

- Customer Service and Reputation: You'll be dealing with this company for decades. Check out their customer service ratings, online reviews, and complaint ratios. A good reputation for handling claims efficiently is also vital.

- Underwriting Process: How thorough and flexible is their underwriting? Some companies are more lenient with certain health conditions, while others might offer simplified issue options.

- Policy Loan Interest Rates: If you plan to access your cash value via loans, the interest rate charged on those loans can make a big difference over time.

Top Whole Life Insurance Providers in the US A Detailed Comparison

Alright, let's get to the good stuff! We're going to break down some of the leading whole life insurance providers in the US. Keep in mind that 'best' can be subjective, as it really depends on your individual needs and financial goals. But these companies consistently rank high for their financial strength, customer satisfaction, and robust product offerings.

Northwestern Mutual Whole Life Insurance Review

Northwestern Mutual is often considered a gold standard in the whole life insurance world, and for good reason. They've been around for ages and are known for their exceptional financial strength (consistently top-rated by all major agencies). They are a mutual company, meaning they are owned by their policyholders, which often translates to a strong focus on policyholder benefits, including competitive dividends.

- Key Features: High financial strength ratings, a long history of paying strong dividends, personalized service through dedicated financial advisors, and a focus on long-term value. Their policies are designed for steady, reliable cash value growth.

- Target Audience/Use Cases: Ideal for individuals and families seeking maximum financial security, long-term wealth accumulation, and estate planning. Great for those who value personalized advice and a company with a rock-solid reputation.

- Product Comparison: Their whole life policies are often compared to those from MassMutual and New York Life due to their mutual structure and dividend performance. Northwestern Mutual often stands out for its consistent dividend payouts and strong advisor network.

- Pricing: Generally, Northwestern Mutual's premiums can be on the higher side compared to some competitors, reflecting their strong financial position and comprehensive service. However, the potential for dividends can offset this over time. For a healthy 35-year-old male seeking a $500,000 whole life policy, premiums could range from $400-$600 per month, depending on various factors and riders.

- Customer Reviews: Very high customer satisfaction ratings, particularly regarding their advisors and claims process. Some minor complaints might revolve around the initial premium cost or the complexity of understanding the policy without advisor guidance.

MassMutual Whole Life Insurance Review

Another powerhouse in the mutual insurance space, MassMutual, also boasts impressive financial strength and a long history of paying dividends. They are known for their comprehensive product suite and a strong commitment to policyholder value. MassMutual offers a variety of whole life options, including those with enhanced cash value growth.

- Key Features: Excellent financial ratings, consistent dividend payments, a wide range of riders for customization (e.g., chronic illness, waiver of premium), and strong customer support. They also offer a variety of participating whole life policies.

- Target Audience/Use Cases: Suitable for individuals looking for reliable, long-term coverage with strong cash value growth potential. Popular for estate planning, business succession, and supplemental retirement income.

- Product Comparison: Similar to Northwestern Mutual and New York Life, MassMutual excels in dividend performance and financial stability. They often offer competitive cash value growth rates and a slightly broader range of policy options.

- Pricing: Premiums are competitive within the mutual company segment, often similar to Northwestern Mutual. A healthy 35-year-old male for a $500,000 policy might see premiums in the $380-$580 per month range. Their dividend scale can be very attractive.

- Customer Reviews: Generally positive, with high marks for financial strength and dividend performance. Some feedback might mention the need for a good agent to navigate policy options.

New York Life Whole Life Insurance Review

New York Life is the largest mutual life insurance company in the US and has an unparalleled history of financial strength and dividend payments, dating back over 160 years. They are renowned for their conservative investment strategy, which contributes to their stability and consistent performance.

- Key Features: Highest financial strength ratings, longest continuous dividend payment history among major insurers, a wide network of agents, and a focus on guaranteed values. They offer various whole life products, including those designed for maximum death benefit or cash value.

- Target Audience/Use Cases: Excellent for those prioritizing maximum security, guaranteed growth, and a company with an impeccable track record. Ideal for estate planning, charitable giving, and long-term financial planning.

- Product Comparison: New York Life is often benchmarked against Northwestern Mutual and MassMutual. They are particularly strong in their guaranteed values and consistent dividend history, often appealing to those who prefer a more conservative approach.

- Pricing: Premiums are typically in line with other top mutual companies. For a healthy 35-year-old male seeking a $500,000 whole life policy, expect premiums around $390-$590 per month. Their dividend history is a significant draw.

- Customer Reviews: Very strong customer satisfaction, especially regarding their financial stability and claims processing. Some users might find their policies less flexible than universal life options, but that's inherent to whole life.

Guardian Life Insurance Whole Life Review

Guardian Life is another highly respected mutual company with a strong financial standing and a history of paying dividends. They are known for their personalized approach and a good balance of guaranteed growth and competitive dividend performance. Guardian offers a range of whole life products, including those with early cash value accumulation.

- Key Features: Strong financial ratings, competitive dividend scale, a focus on personalized service, and a variety of riders. They are also known for their dental and disability insurance, which can be a plus if you're looking for a broader insurance relationship.

- Target Audience/Use Cases: Good for individuals and families looking for a reliable mutual company with strong cash value growth and a personalized experience. Suitable for wealth transfer, business planning, and long-term savings.

- Product Comparison: Guardian competes well with other mutual companies like MassMutual and New York Life, often offering competitive dividend rates and strong cash value performance. They might be a good alternative if you're looking for a slightly different advisor experience.

- Pricing: Premiums are competitive, often falling within a similar range as other top mutuals. A healthy 35-year-old male for a $500,000 policy might see premiums from $370-$570 per month.

- Customer Reviews: Generally positive, with good feedback on their financial strength and customer service. Some reviews might point to the importance of finding a knowledgeable agent.

Penn Mutual Whole Life Insurance Review

Penn Mutual is one of the oldest mutual life insurance companies in the US, with a rich history and a strong commitment to its policyholders. They are known for their innovative whole life products and competitive dividend performance, often focusing on maximizing cash value growth.

- Key Features: Excellent financial strength, a long history of dividend payments, and a focus on flexible whole life products that can be tailored to various financial goals. They offer policies designed for early cash value growth and strong long-term performance.

- Target Audience/Use Cases: Ideal for those seeking strong cash value accumulation, particularly for retirement planning or business funding. Also suitable for estate planning and wealth preservation.

- Product Comparison: Penn Mutual often stands out for its competitive cash value growth and dividend performance, sometimes even surpassing other mutuals in certain scenarios. They are a strong contender for those prioritizing the living benefits of whole life.

- Pricing: Premiums are competitive, often slightly lower than the very top-tier mutuals while still offering strong performance. For a healthy 35-year-old male seeking a $500,000 whole life policy, premiums could be in the $360-$550 per month range.

- Customer Reviews: Positive reviews, highlighting their financial stability and strong policy performance. Some feedback might mention the need for a good financial advisor to fully leverage their product features.

How to Choose the Best Whole Life Insurance Provider for You

Okay, so we've looked at some of the big players. Now, how do you actually make a decision? It's not a one-size-fits-all situation, remember?

Assessing Your Personal Financial Goals and Needs

First things first, what are you trying to achieve? Are you primarily focused on a guaranteed death benefit for your family? Or is the cash value growth for future income or emergencies more important? Do you need it for estate planning, or perhaps to fund a business buy-sell agreement? Your goals will heavily influence which provider and policy type is the best fit.

Evaluating Financial Strength and Dividend History

As we mentioned, financial strength is paramount. Always check those ratings from A.M. Best, S&P, Moody's, and Fitch. Look for companies with consistently high ratings (A+ or higher is generally excellent). For dividend-paying policies, a long and consistent history of strong dividend payouts is a huge indicator of a company's financial health and commitment to policyholders. Don't just look at the current dividend rate; look at the trend over decades.

Comparing Policy Features and Riders

Dive into the specifics of each policy. What are the guaranteed cash value growth rates? What are the projected non-guaranteed rates? What riders are available? Do they offer a waiver of premium if you become disabled? An accelerated death benefit if you become terminally ill? These riders can add significant value and flexibility to your policy.

Understanding Customer Service and Claims Process

You want a company that's easy to deal with, especially when it comes to making a claim. Check out customer reviews on independent sites, look at complaint ratios with organizations like the National Association of Insurance Commissioners (NAIC), and see how responsive their customer service is. A smooth claims process can make a world of difference during a difficult time.

Working with a Qualified Financial Advisor

This is probably the most crucial piece of advice. Whole life insurance can be complex, and a good financial advisor can help you navigate the options, understand the projections, and tailor a policy to your unique situation. They can also help you compare illustrations from different companies side-by-side, which can be incredibly insightful. Don't just go with the first quote you get; work with someone who understands your goals and can explain everything clearly.

Real-World Scenarios and Product Recommendations

Let's put this into perspective with a couple of scenarios:

Scenario 1 Young Family Seeking Long-Term Security and Savings

Meet the Johnsons, a couple in their early 30s with two young children. They want to ensure their kids are financially protected if something happens to either parent, and they also want a way to build some long-term, tax-advantaged savings. They're looking for a policy that offers reliable cash value growth and a guaranteed death benefit.

- Recommended Providers: Northwestern Mutual, MassMutual, or New York Life.

- Why: These mutual companies offer strong financial stability, a long history of consistent dividend payments, and robust cash value growth. The guaranteed nature of whole life from these providers offers the peace of mind the Johnsons are looking for.

- Specific Product Focus: A participating whole life policy with a focus on maximizing cash value accumulation. They might consider adding a 'paid-up additions' rider to accelerate cash value growth and increase the death benefit over time.

- Estimated Cost: For a $750,000 policy for each parent, premiums could range from $600-$900 per month per person, depending on health and specific policy features. The long-term cash value growth and potential dividends would be a significant benefit.

Scenario 2 Business Owner Planning for Succession and Estate

Sarah, a 50-year-old successful business owner, wants to ensure her business transitions smoothly to her children and that her estate is protected from taxes. She needs a policy that offers significant death benefit and can be used for wealth transfer.

- Recommended Providers: New York Life, Guardian Life, or Penn Mutual.

- Why: These companies excel in providing high-value whole life policies suitable for complex estate planning and business succession needs. Their financial strength ensures the policy will be there when needed, and their dividend performance can enhance the overall value.

- Specific Product Focus: A whole life policy with a substantial death benefit, potentially structured to fund a buy-sell agreement or to provide liquidity for estate taxes. Riders like an accelerated death benefit could also be valuable.

- Estimated Cost: For a $2,000,000 policy, premiums could be in the range of $2,000-$3,000 per month, depending on health and specific policy design. The tax-advantaged growth of the cash value and the guaranteed death benefit are key for Sarah's goals.

Navigating the Application and Underwriting Process

Once you've narrowed down your choices, you'll go through the application and underwriting process. This usually involves:

- Application Form: Filling out a detailed application with personal, financial, and health information.

- Medical Exam: Most whole life policies require a medical exam, which typically includes a physical, blood and urine samples, and sometimes an EKG. This helps the insurer assess your health risk.

- Medical Records: The insurer may request your medical records from your doctors.

- Financial Underwriting: For larger policies, the insurer will assess your financial need for the coverage to ensure it's appropriate.

- Offer and Acceptance: If approved, you'll receive an offer with the premium rates. You then accept the policy and make your first payment.

Be honest and thorough during this process. Any misrepresentations could lead to issues down the road. A good advisor can help you prepare for the medical exam and understand what information the underwriters will be looking for.

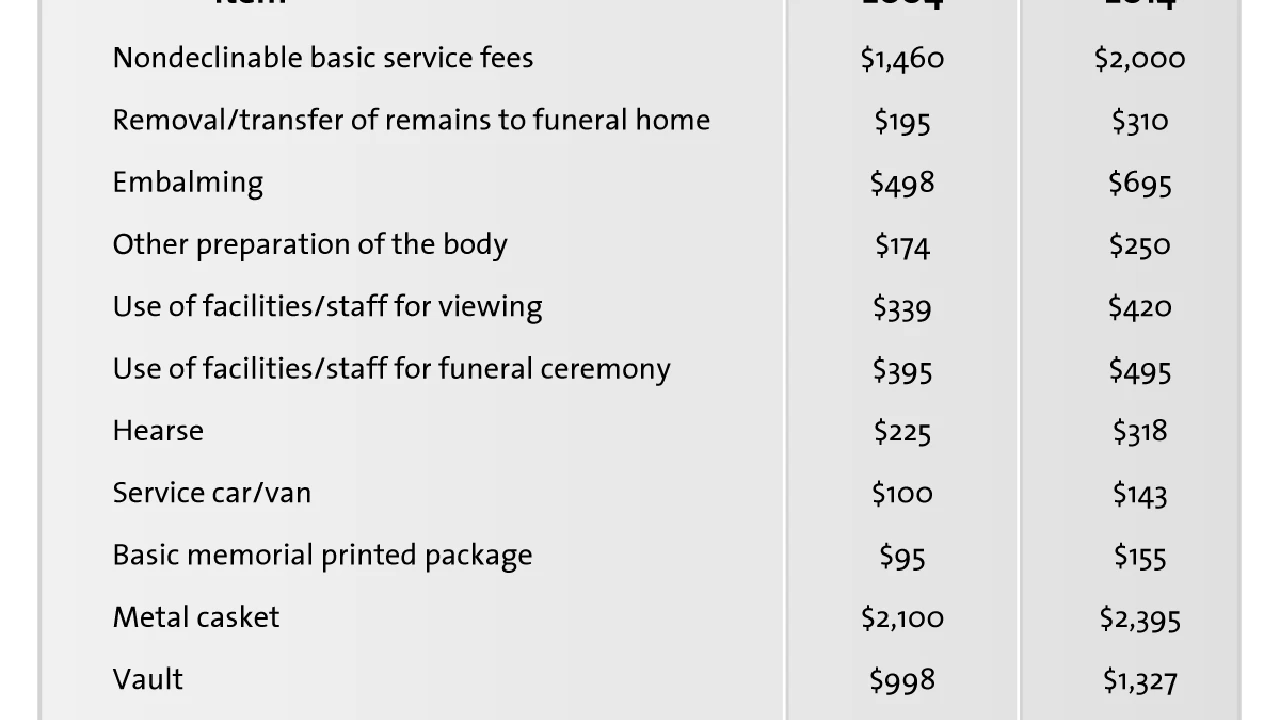

The Long-Term Value of Whole Life Insurance Beyond the Death Benefit

It's easy to focus on the death benefit, but the living benefits of whole life insurance are equally compelling. The cash value component grows on a tax-deferred basis, meaning you don't pay taxes on the gains until you withdraw them. You can access this cash value through policy loans, which are typically tax-free and don't require a credit check. This can be a fantastic resource for emergencies, funding a child's education, or supplementing retirement income. Unlike a 401(k) or IRA, there are no age restrictions on when you can access the cash value, and the growth is not tied to market fluctuations, offering a level of stability that other investments might not. This makes whole life a unique and powerful tool in a well-rounded financial plan, providing both protection and a reliable source of funds throughout your life.

Final Thoughts on Choosing Your Whole Life Partner

Choosing a whole life insurance provider is a significant financial decision, one that will impact your family's security for decades. Take your time, do your research, and don't hesitate to ask a lot of questions. Focus on companies with a proven track record of financial strength, consistent dividend performance, and excellent customer service. And seriously, work with a qualified financial advisor who can help you understand the nuances of each policy and how it fits into your overall financial strategy. It's about finding a partner you can trust to be there for you and your loved ones, come what may.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)