How to Calculate Your Term Life Insurance Needs

Practical steps to determine how much term life insurance coverage you truly need to protect your family's financial future.

How to Calculate Your Term Life Insurance Needs A Step by Step Guide

Hey there! Thinking about term life insurance? That's a smart move. It's all about making sure your loved ones are financially secure if something unexpected happens to you. But here's the big question: how much coverage do you actually need? It's not a one-size-fits-all answer, and getting it right is crucial. Too little, and your family might struggle. Too much, and you could be overpaying for something you don't really need. Don't worry, we're going to break it down for you, step by step, so you can figure out the perfect amount of term life insurance to protect your family's financial future.

Understanding Why You Need Term Life Insurance Coverage

Before we dive into the numbers, let's quickly chat about why term life insurance is so important. It's essentially a financial safety net. If you're the primary breadwinner, or even if you contribute significantly to your household's finances, your income is vital. Without it, your family could face serious challenges like paying the mortgage, covering daily expenses, or funding future goals like college tuition. Term life insurance provides a lump sum payment to your beneficiaries upon your passing, giving them the financial resources to maintain their lifestyle and achieve their dreams, even when you're not there to provide for them directly. It's peace of mind, pure and simple.

The DIME Method A Popular Approach to Calculating Life Insurance

One of the most popular and straightforward methods for calculating your life insurance needs is the DIME method. DIME is an acronym that stands for Debt, Income, Mortgage, and Education. Let's explore each component:

D for Debt Assessing Your Outstanding Financial Obligations

First up, let's talk about debt. Most of us have some form of debt, whether it's credit card balances, car loans, personal loans, or even medical bills. If you were no longer around, would your family be burdened with these payments? Probably. So, the first step is to list out all your outstanding debts, excluding your mortgage for now (we'll get to that). Add up the total amount. This figure represents a portion of the coverage you'll need to ensure your family isn't left struggling to pay off your financial obligations.

- Credit Card Debt: High-interest debt that can quickly spiral.

- Car Loans: Often significant monthly payments.

- Personal Loans: Any other loans you've taken out.

- Medical Bills: Unexpected and potentially large expenses.

- Other Loans: Any other financial commitments.

Example: Let's say you have $10,000 in credit card debt, a $20,000 car loan, and a $5,000 personal loan. Your total non-mortgage debt would be $35,000.

I for Income Replacing Your Future Earnings for Your Family

This is often the biggest piece of the puzzle. Your income is what supports your family's day-to-day living, from groceries to utilities to entertainment. If your income suddenly disappeared, how would your family cope? The goal here is to replace a significant portion of your income for a certain number of years. A common recommendation is to multiply your annual income by 5 to 10 years. The exact number depends on factors like your children's ages, your spouse's income, and how long you want to provide financial support.

Consider these factors when deciding on the multiplier:

- Age of Dependents: If you have young children, you might want to cover their expenses until they're financially independent.

- Spouse's Income: If your spouse earns a good income, you might need less coverage than if they're a stay-at-home parent.

- Lifestyle: How much does your family need to maintain their current standard of living?

- Retirement Plans: Do you want to ensure your spouse can still retire comfortably?

Example: If your annual income is $70,000 and you want to replace it for 7 years, you'd need $490,000 in coverage for income replacement.

M for Mortgage Ensuring Your Family Stays in Their Home

For many families, the mortgage is the largest monthly expense. Imagine your family having to sell their home because they can no longer afford the payments. That's a scenario no one wants. So, it's crucial to include the outstanding balance of your mortgage in your life insurance calculation. This ensures that your family can pay off the house and continue living in a familiar and stable environment.

Example: If you have an outstanding mortgage balance of $250,000, you'd add this amount to your total.

E for Education Funding Future Dreams and Opportunities

If you have children, their education is likely a major financial goal. College tuition, even for public universities, can be incredibly expensive. Factor in the estimated cost of future education for each of your children. This could include tuition, room and board, books, and other related expenses. Even if your children are young, it's wise to start estimating these costs and include them in your life insurance plan.

Example: If you have two children and estimate $100,000 per child for college, you'd add $200,000 to your coverage needs.

Putting the DIME Method Together Calculating Your Total Coverage

Now, let's add up all the components from our examples:

- Debt: $35,000

- Income Replacement: $490,000

- Mortgage: $250,000

- Education: $200,000

Total DIME Coverage: $35,000 + $490,000 + $250,000 + $200,000 = $975,000

So, in this example, a term life insurance policy of approximately $975,000 would be a good starting point. Remember, this is a baseline. You might want to adjust it based on other factors.

Beyond DIME Considering Additional Factors for Comprehensive Coverage

While the DIME method is a fantastic starting point, it's not exhaustive. There are other important factors to consider that might increase or decrease your overall life insurance needs.

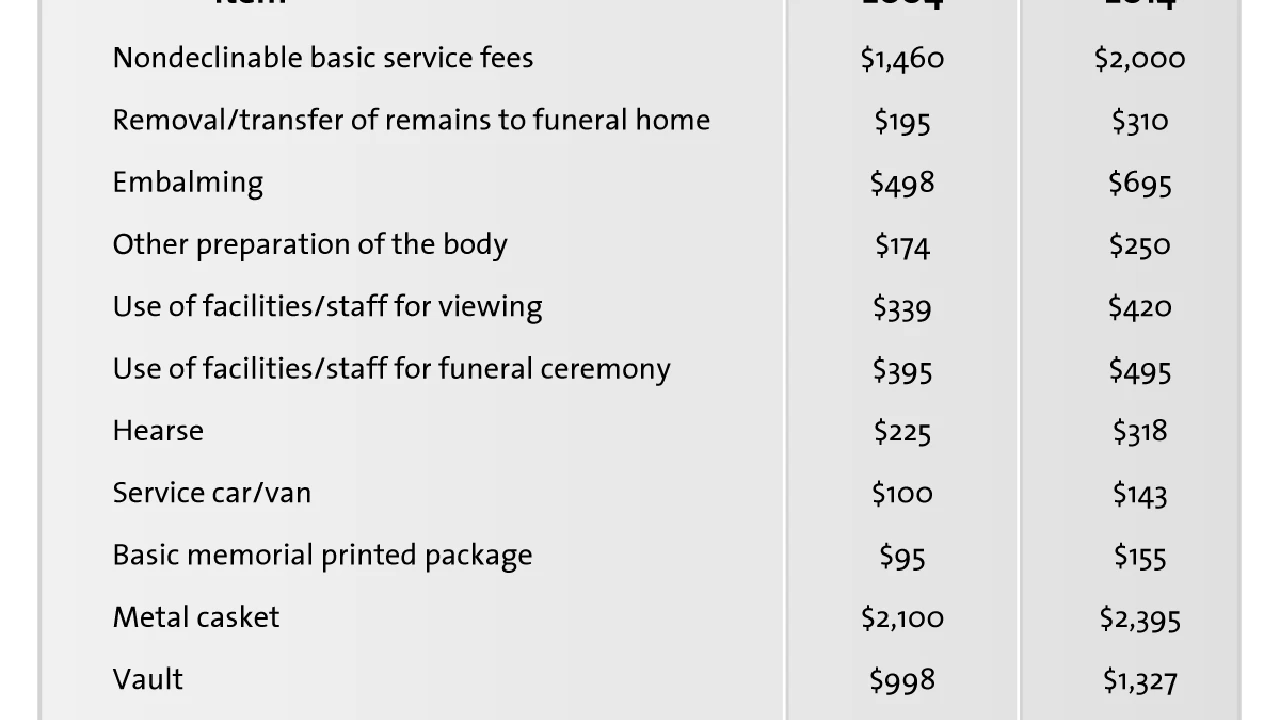

Final Expenses Covering Funeral and Burial Costs

Unfortunately, death comes with its own set of expenses. Funeral and burial costs can range from $7,000 to $12,000 or even more. While some people opt for a separate final expense policy, it's wise to factor these costs into your term life insurance calculation to ensure your family isn't left with an unexpected bill during a difficult time.

Emergency Fund Providing a Financial Buffer

An emergency fund is crucial for any family. If your family were to lose your income, having a dedicated emergency fund within your life insurance payout could provide a vital buffer for unexpected expenses or a period of adjustment. Consider adding 3-6 months of living expenses to your total.

Childcare Costs Supporting Your Family's Daily Needs

If you have young children and one parent stays home, or if both parents work and rely on childcare, these costs can be substantial. If the income-earning parent passes away, the surviving parent might need to continue working and pay for childcare, or even reduce their work hours, impacting their income. Factor in potential childcare costs for several years.

Inflation Adjusting for Future Purchasing Power

The cost of living tends to increase over time due to inflation. A dollar today won't buy as much in 10 or 20 years. While it's hard to predict exact inflation rates, it's a good idea to consider adding a small buffer to your coverage to account for the erosion of purchasing power over the term of your policy.

Existing Assets and Savings Reducing Your Coverage Needs

On the flip side, if you have significant savings, investments, or other assets that your family could access, these can reduce your overall life insurance needs. For example, if you have a substantial retirement account that your spouse could draw from, you might not need as much income replacement from your life insurance policy. Be realistic about what assets are truly liquid and accessible to your family without penalty.

Spouse's Income and Future Earning Potential

If your spouse has their own income or strong earning potential, this can also influence your life insurance needs. If they could comfortably support the family on their own, or quickly increase their income, you might need less coverage. However, if they would struggle to maintain the household without your income, then higher coverage is essential.

Choosing the Right Term Length Matching Your Life Stages

Once you've figured out how much coverage you need, the next big decision is the term length. Term life insurance, as the name suggests, covers you for a specific period. Common term lengths are 10, 15, 20, 25, or 30 years. The ideal term length usually aligns with your major financial obligations and the period your dependents will rely on your income.

- Young Families with Young Children: A 20 or 30-year term might be appropriate to cover your children until they're grown and financially independent, and potentially cover your mortgage.

- Mid-Career Professionals with Older Children: A 10 or 15-year term might suffice if your children are nearing college age or your mortgage is almost paid off.

- Nearing Retirement: If your major financial obligations are winding down, you might opt for a shorter term or even consider no longer needing term life insurance if your assets are sufficient.

Think about when your mortgage will be paid off, when your children will finish college, and when you plan to retire. Your term length should ideally cover these critical periods.

Comparing Term Life Insurance Products and Providers in the US and Southeast Asia

Now that you have a good idea of your coverage amount and term length, it's time to look at actual products. The market for term life insurance is competitive, both in the US and Southeast Asia, which is great news for you! It means you have options. Here's a general overview of what to look for and some examples of providers, keeping in mind that specific product availability and features can vary greatly by region and individual circumstances.

Key Features to Compare Across Term Life Policies

- Premium Rates: This is often the first thing people look at. Get quotes from multiple providers.

- Financial Strength of the Insurer: Look for companies with high ratings from agencies like A.M. Best, Standard & Poor's, or Moody's. This indicates their ability to pay claims.

- Convertibility: Can you convert your term policy to a permanent policy (like whole life or universal life) without a new medical exam? This can be a valuable feature if your needs change.

- Renewability: Can you renew your term policy at the end of the term, even if the premiums will likely increase significantly?

- Riders: These are add-ons that can customize your policy. Common riders include:

- Waiver of Premium Rider: Waives premiums if you become disabled.

- Accelerated Death Benefit Rider (Living Benefits): Allows you to access a portion of your death benefit early if you're diagnosed with a terminal illness.

- Child Rider: Provides a small amount of coverage for your children.

- Customer Service and Claims Process: Look for companies with a good reputation for customer service and an efficient claims process.

Recommended Products and Providers in the US Market

The US market is mature and offers a wide range of term life insurance products. Here are a few highly-rated providers known for competitive rates and strong financial standing. Remember, prices vary based on age, health, and coverage amount, so always get personalized quotes.

1. Haven Life (Backed by MassMutual)

- Product Type: Online-focused term life insurance.

- Use Case: Ideal for tech-savvy individuals who want a quick, streamlined application process, often without a medical exam for eligible applicants (up to certain coverage limits). Great for young to middle-aged professionals.

- Comparison: Known for its user-friendly digital experience and competitive pricing, especially for healthy individuals. Offers a 'Haven Term' policy.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking $500,000 in coverage for a 20-year term, premiums could range from $25-$40 per month. (Note: This is a general estimate and can vary significantly.)

2. Protective Life

- Product Type: Traditional term life insurance with various term lengths.

- Use Case: Good for individuals looking for a balance of affordability and strong financial backing. They offer competitive rates for a wide range of health classes.

- Comparison: Often cited for having some of the lowest rates in the industry, particularly for longer terms. Their 'Custom Choice UL' (Universal Life) also offers a term-like structure with more flexibility.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking $500,000 in coverage for a 20-year term, premiums could range from $20-$35 per month. (Note: This is a general estimate and can vary significantly.)

3. Banner Life (Legal & General America)

- Product Type: Term life insurance with competitive rates and strong financial ratings.

- Use Case: Excellent for those seeking long-term coverage (up to 40 years) and competitive pricing. They are often very competitive for individuals with minor health issues.

- Comparison: Known for offering some of the longest term lengths available and generally competitive pricing across various health ratings. Their 'OPTerm' policy is a popular choice.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking $500,000 in coverage for a 20-year term, premiums could range from $22-$38 per month. (Note: This is a general estimate and can vary significantly.)

4. Pacific Life

- Product Type: Offers a range of term life products, including those with living benefits.

- Use Case: Good for individuals who want the option of accessing their death benefit early if they face a critical, chronic, or terminal illness.

- Comparison: While not always the absolute cheapest, Pacific Life is highly regarded for its financial strength and the inclusion of valuable riders, particularly living benefits, which can be crucial for comprehensive protection.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking $500,000 in coverage for a 20-year term, premiums could range from $28-$45 per month, potentially higher due to included riders. (Note: This is a general estimate and can vary significantly.)

Recommended Products and Providers in Southeast Asia Market

The Southeast Asian market is diverse, with each country having its own regulations and dominant insurers. However, many global players also have a strong presence. Here are some general examples and considerations.

1. AIA (Across Multiple SEA Countries like Singapore, Malaysia, Thailand, Vietnam)

- Product Type: Offers various term life plans, often with options for critical illness riders.

- Use Case: A strong regional player, good for individuals seeking comprehensive coverage that can be tailored with health-related riders. Popular for families and professionals.

- Comparison: AIA is one of the largest pan-Asian life insurers, known for its extensive agent network and a wide array of products. They often integrate wellness programs (like AIA Vitality) that can offer premium discounts.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking S$500,000 (Singapore Dollars) in coverage for a 20-year term, premiums could range from S$40-S$70 per month. (Note: This is a general estimate and can vary significantly by country and specific product.)

2. Prudential (Across Multiple SEA Countries like Singapore, Malaysia, Indonesia)

- Product Type: Diverse term life offerings, including those with investment-linked options.

- Use Case: Suitable for individuals who want flexibility and potentially the option to combine protection with some investment growth, or those who prefer a well-established global brand.

- Comparison: Another major player with a strong presence. Prudential often offers more customizable plans, including those that can be converted to investment-linked policies later.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking RM500,000 (Malaysian Ringgit) in coverage for a 20-year term, premiums could range from RM80-RM150 per month. (Note: This is a general estimate and can vary significantly by country and specific product.)

3. Great Eastern Life (Singapore, Malaysia, Indonesia, Brunei)

- Product Type: Wide range of term life plans, often with strong focus on protection and critical illness.

- Use Case: A good choice for those seeking robust protection-focused term plans from a well-regarded local/regional insurer.

- Comparison: Great Eastern is a prominent and trusted insurer in the region, known for its stable financial performance and comprehensive product suite. They often have competitive offerings for pure protection.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking S$500,000 (Singapore Dollars) in coverage for a 20-year term, premiums could range from S$35-S$65 per month. (Note: This is a general estimate and can vary significantly by country and specific product.)

4. FWD Insurance (Thailand, Vietnam, Singapore, Hong Kong)

- Product Type: Modern, digitally-focused term life products.

- Use Case: Appeals to younger, digitally-savvy customers who prefer online interactions and straightforward products.

- Comparison: FWD is a newer, more agile player in the region, often leveraging technology for a simpler customer experience. They tend to offer competitive rates for basic term coverage.

- Estimated Pricing: For a healthy 35-year-old non-smoker seeking 10,000,000 VND (Vietnamese Dong) in coverage for a 20-year term, premiums could range from 200,000-400,000 VND per month. (Note: This is a general estimate and can vary significantly by country and specific product.)

Important Note on Pricing: The estimated pricing provided is for illustrative purposes only. Actual premiums will depend on a multitude of factors including your exact age, gender, health status (including medical history, height/weight, smoking status), occupation, hobbies, the specific insurer, and the exact features and riders chosen. It is absolutely essential to get personalized quotes from multiple providers to find the best rates for your individual situation.

The Application Process What to Expect When Applying for Term Life Insurance

Once you've calculated your needs and identified potential providers, the next step is the application process. It typically involves a few key stages:

Filling Out the Application Providing Personal and Health Information

You'll complete an application form, either online or with an agent. This will ask for basic personal information, your medical history, family medical history, lifestyle habits (smoking, drinking), occupation, and hobbies. Be honest and thorough; any misrepresentation could jeopardize future claims.

The Medical Exam Understanding Underwriting Requirements

For most traditional term life policies, especially for higher coverage amounts, a medical exam is required. This is usually a free service arranged by the insurer and conducted by a paramedical professional at your home or office. It typically involves:

- Taking your height and weight.

- Measuring blood pressure and pulse.

- Collecting blood and urine samples.

- Asking additional health questions.

Some policies, particularly those with lower coverage amounts or from online providers, might offer 'no medical exam' options, relying instead on health questionnaires and database checks. These can be faster but sometimes come with higher premiums or lower coverage limits.

Underwriting The Insurer's Assessment of Your Risk

After your application and medical exam (if required), the insurer's underwriting department will review all the information. They assess your risk level to determine if they will offer you coverage and at what premium rate. Factors like your health, age, lifestyle, and family history all play a role. This process can take a few days to several weeks, depending on the complexity of your case.

Receiving Your Policy and Making Payments

If approved, you'll receive your policy documents. Review them carefully to ensure all details are correct and that the coverage meets your expectations. You'll then start making regular premium payments, usually monthly or annually. It's crucial to pay your premiums on time to keep your policy in force.

Regularly Reviewing Your Term Life Insurance Needs Adapting to Life Changes

Life isn't static, and neither should your life insurance policy be. Your needs will change over time. It's a good idea to review your policy every few years, or whenever a significant life event occurs, such as:

- Marriage or Divorce: Your beneficiaries and financial obligations will change.

- Birth of a Child: New dependents mean increased financial responsibilities.

- Buying a New Home: A larger mortgage means you might need more coverage.

- Significant Salary Increase or Decrease: Your income replacement needs might shift.

- Children Becoming Financially Independent: You might be able to reduce your coverage.

- Paying Off Major Debts: Less debt means less coverage needed.

- Starting a Business: You might need key person insurance or more personal coverage.

Don't just set it and forget it. A quick review can ensure your policy remains aligned with your current life situation and financial goals.

Common Misconceptions About Term Life Insurance Debunking the Myths

Let's clear up a few common misunderstandings about term life insurance:

- "It's too expensive": While premiums vary, term life insurance is generally the most affordable type of life insurance, especially for younger, healthier individuals. The cost of not having it can be far greater.

- "I'm young and healthy, I don't need it": This is precisely when it's most affordable! And life is unpredictable. Getting coverage early locks in lower rates.

- "My employer provides enough coverage": Group life insurance through an employer is a great benefit, but it's often not enough. It's usually a multiple of your salary (e.g., 1-2x), which rarely covers all your family's needs. Plus, it's tied to your job.

- "I'll just invest the money instead": While investing is crucial, life insurance serves a different purpose. It provides immediate financial protection that investments might not be able to replicate in the event of an untimely death. It's about protection, not just growth.

Calculating your term life insurance needs might seem daunting at first, but by breaking it down into manageable steps, you can arrive at a figure that provides genuine peace of mind. Remember the DIME method, consider additional factors, choose an appropriate term length, and compare reputable providers. Your family's financial future is worth the effort. Take the time to get it right, and you'll be glad you did.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)