How to File a Life Insurance Claim A Step by Step Guide

A clear guide on the process of filing a life insurance claim and what documents are typically required.

How to File a Life Insurance Claim A Step by Step Guide

Losing a loved one is an incredibly difficult experience, filled with grief and emotional challenges. During such a sensitive time, dealing with administrative tasks like filing a life insurance claim can feel overwhelming. However, understanding the process beforehand can significantly ease the burden. This comprehensive guide will walk you through every step of filing a life insurance claim, ensuring you have all the necessary information and support to navigate this crucial process. We'll cover everything from initial notification to receiving the payout, including common pitfalls to avoid and specific considerations for different types of policies and beneficiaries. Our goal is to empower you with the knowledge to secure the financial protection your loved one intended for you.

Understanding the Life Insurance Claim Process What to Expect

The life insurance claim process, while seemingly complex, generally follows a structured path. Knowing what to expect can help you prepare and reduce stress. Typically, it begins with notifying the insurance company of the policyholder's death, followed by submitting required documentation, and finally, the review and payout of the claim. The timeline for this process can vary depending on the insurer, the completeness of your documentation, and the complexity of the claim. Some claims are straightforward and can be processed within a few weeks, while others, especially those requiring further investigation, might take several months. It's important to remember that insurance companies are legally obligated to pay out valid claims, but they also have a right to investigate to prevent fraud. Patience and thoroughness on your part will be key to a smooth process.

Gathering Essential Documents for Your Life Insurance Claim

Before you even contact the insurance company, gathering the necessary documents is paramount. This step is often the most time-consuming but also the most critical for a swift claim resolution. Here's a detailed list of what you'll typically need:

The Life Insurance Policy Document Policy Number and Details

This is the cornerstone of your claim. Locate the original policy document if possible. It contains vital information such as the policy number, the name of the insured, the beneficiary information, and the coverage amount. If you cannot find the physical document, don't panic. The policy number is the most important piece of information. You might find it on old premium statements, in the deceased's financial records, or by contacting the insurance agent who sold the policy. Even without the policy number, the insurance company can usually locate the policy with the deceased's full name and date of birth, but having the policy number will expedite the process significantly.

Certified Death Certificate Proof of Death and Cause

A certified copy of the death certificate is an absolute requirement. This document officially confirms the death of the policyholder and provides crucial details such as the date, time, location, and cause of death. You will typically need multiple certified copies, as various institutions (banks, government agencies, etc.) will require them. You can obtain certified copies from the vital records office in the state or county where the death occurred. It's advisable to order at least 5-10 certified copies, as they are often needed for other estate-related matters.

Beneficiary Identification Proof of Identity and Relationship

As the beneficiary, you will need to prove your identity and your relationship to the deceased. This usually involves providing a government-issued photo ID (like a driver's license or passport) and sometimes documents that establish your relationship, such as a marriage certificate for a spouse or a birth certificate for a child. If there are multiple beneficiaries, each will need to provide their identification. Ensure that the name on your identification matches the name listed as the beneficiary on the policy. If there has been a name change (e.g., due to marriage), you may need to provide supporting legal documents.

Claim Form Completing the Insurer's Specific Requirements

Once you notify the insurance company, they will provide you with a claim form. This form will ask for details about the deceased, the policy, and the beneficiary. Fill it out completely and accurately. Do not leave any sections blank. If a question doesn't apply, write 'N/A' (not applicable). Any missing information can cause delays. If you have questions while filling out the form, contact the insurance company's claims department for clarification. Some insurers now offer online claim submission, which can be a more efficient option.

Additional Documents Medical Records and Police Reports

In certain circumstances, the insurance company may request additional documents. For instance, if the death occurred within the contestability period (usually the first two years of the policy), they might request medical records to verify the information provided during the application process. If the death was accidental or involved suspicious circumstances, police reports or autopsy reports might be required. It's important to cooperate with these requests to avoid delays. If you are unsure why a document is being requested, ask the claims representative for clarification.

Notifying the Life Insurance Company Initiating Your Claim

Once you have gathered the essential documents, the next step is to notify the insurance company. This can typically be done in a few ways:

Contacting the Insurer Directly Phone or Online Portal

The most common method is to call the insurance company's customer service or claims department. Have the policy number ready. They will guide you through the initial steps and explain their specific claims process. Many insurers also have online portals where you can initiate a claim, which can be convenient and allow you to upload documents digitally. Be prepared to provide the deceased's full name, date of birth, date of death, and the policy number.

Working with an Insurance Agent or Broker Assistance and Guidance

If the policy was purchased through an insurance agent or broker, they can be an invaluable resource. They often have direct lines to the claims department and can help you complete the necessary paperwork, answer your questions, and advocate on your behalf. They understand the nuances of the policy and the insurer's procedures, which can significantly streamline the process.

Sending Written Notification Certified Mail for Documentation

While not always required, sending a written notification via certified mail (with a return receipt requested) can provide a documented record of when you initiated the claim. This can be useful for your records and in case of any disputes. Include the policy number, the deceased's name, and your contact information in the letter.

Submitting Your Life Insurance Claim Forms and Documents

After notifying the insurer and receiving the claim forms, the next step is to submit all the required documentation. Accuracy and completeness are crucial here.

Completing the Claim Form Accurately and Completely

As mentioned earlier, fill out the claim form meticulously. Double-check all dates, names, and policy numbers. Any discrepancies or missing information can lead to delays or even rejection of the claim. If you're unsure about a question, it's better to call the claims department for clarification than to guess.

Attaching All Required Documents Certified Copies and Originals

Ensure you attach all the documents requested by the insurer. For the death certificate, always send certified copies, not originals, unless specifically requested otherwise (which is rare). Keep original documents for your records. Make copies of everything you submit for your own files. This includes the claim form itself, the death certificate, and any other supporting documents.

Methods of Submission Mail Fax or Online Portal

Most insurance companies offer multiple ways to submit your claim. Mail is a traditional option, but consider using certified mail for important documents. Faxing can be quicker, but ensure you get a confirmation of receipt. Online portals are increasingly popular, offering a secure and often faster way to upload documents and track your claim's progress. Choose the method that you are most comfortable with and that provides you with a record of submission.

The Life Insurance Claim Review Process What Happens Next

Once your claim is submitted, the insurance company will begin its review process. This involves verifying the information provided and ensuring the claim is valid according to the policy terms.

Verification of Information Policy Details and Beneficiary Status

The insurer will verify the policy's active status, the coverage amount, and the designated beneficiaries. They will cross-reference the information on the death certificate with their records. They will also confirm that the person filing the claim is indeed the rightful beneficiary or has the legal authority to do so.

Investigation of Death Cause and Circumstances

In some cases, especially if the death occurred within the contestability period (typically the first two years of the policy), the insurer may conduct a more thorough investigation into the cause and circumstances of death. This is to ensure that no material misrepresentations were made on the policy application. For example, if the policyholder died from a condition they failed to disclose during the application, the insurer might deny the claim. They may also investigate if the death was due to suicide within the exclusion period (also usually the first two years), as most policies have a suicide clause that prevents payout in such cases.

Communication from the Insurer Updates and Requests

During the review process, the insurance company should keep you informed of the claim's status. They may contact you for additional information or clarification. Respond promptly to any requests to avoid delays. If you haven't heard from them within a reasonable timeframe (e.g., 2-3 weeks), don't hesitate to follow up. Keep a record of all communications, including dates, names of representatives, and summaries of conversations.

Receiving Your Life Insurance Payout Payment Options and Tax Implications

Once the claim is approved, the insurance company will process the payout. You'll typically have several options for how to receive the funds.

Lump Sum Payment Immediate Access to Funds

The most common payout option is a lump sum, where the entire death benefit is paid out at once. This provides immediate access to the funds, allowing beneficiaries to use the money as needed for expenses, investments, or debt repayment. For most beneficiaries, a lump sum payout from a life insurance policy is generally not subject to federal income tax. However, any interest earned on the payout while it's held by the insurer might be taxable. It's always wise to consult with a financial advisor or tax professional regarding your specific situation.

Annuity or Installment Payments Structured Income Over Time

Some insurers offer the option to receive the death benefit as an annuity or in installments over a specified period. This can be beneficial for beneficiaries who prefer a steady stream of income rather than a large lump sum. However, choosing this option means the funds remain with the insurance company, and you might earn interest on the unpaid balance. This interest would typically be taxable. Carefully consider your financial needs and consult with a financial advisor before opting for an annuity.

Retained Asset Account Interest Bearing Account

Another option some insurers provide is a retained asset account. This is essentially an interest-bearing checking account set up by the insurance company in the beneficiary's name. The death benefit is deposited into this account, and the beneficiary can write checks against it. While it offers convenience and earns interest, it's important to understand the terms and conditions, including interest rates and any fees. The interest earned on these accounts is taxable.

Tax Implications of Life Insurance Payouts Federal and State

As mentioned, generally, the death benefit itself is not subject to federal income tax. However, there are exceptions and nuances. For example, if the policy was transferred for value, or if the payout includes interest, those portions might be taxable. State income tax laws vary, so it's essential to check your state's regulations. Furthermore, if the policy is part of a large estate, it might be subject to estate taxes, though this typically applies to very high net worth individuals. Consulting a tax professional is highly recommended to understand your specific tax obligations.

Common Reasons for Life Insurance Claim Delays or Denials

While most life insurance claims are paid out without issue, delays and denials can occur. Understanding the common reasons can help you avoid them.

Incomplete or Inaccurate Information on Claim Form

This is one of the most frequent causes of delays. Any missing fields, incorrect dates, or mismatched names can halt the process. Always double-check your claim form before submission.

Missing or Incorrect Documentation Death Certificate Policy

Failure to provide all required documents, or submitting uncertified copies when certified ones are needed, will inevitably lead to delays. Ensure you have all the necessary paperwork in order.

Contestability Period Misrepresentation on Application

If the policyholder dies within the first two years of the policy (the contestability period), the insurer has the right to investigate the application for any material misrepresentations. If they find that the policyholder withheld crucial health information, the claim could be denied. For example, if someone applied for a policy stating they were a non-smoker but died of a smoking-related illness within the contestability period, the claim might be denied.

Suicide Clause Death by Suicide Within Exclusion Period

Most life insurance policies include a suicide clause, which states that if the policyholder dies by suicide within a specified period (usually the first two years), the death benefit will not be paid out. In such cases, the insurer typically only returns the premiums paid. After the exclusion period, the death benefit is usually paid even in the case of suicide.

Exclusions in the Policy Hazardous Activities War

Life insurance policies often have exclusions for certain causes of death, such as death resulting from hazardous activities (e.g., skydiving, car racing) if not disclosed and covered by a rider, or death due to acts of war. Review the policy document carefully to understand any specific exclusions.

Beneficiary Disputes Multiple Beneficiaries or Unclear Designations

If there are multiple beneficiaries with conflicting claims, or if the beneficiary designation is unclear or outdated, the payout can be significantly delayed as the insurer tries to determine the rightful recipient. It's crucial for policyholders to keep their beneficiary designations up to date.

What to Do if Your Life Insurance Claim is Denied or Delayed

If your claim is denied or significantly delayed, don't give up. You have options to appeal the decision.

Review the Denial Letter Understand the Reason

The insurance company is legally required to provide a reason for denial in writing. Carefully read this letter to understand why your claim was denied. This will be the basis for your appeal.

Gather Additional Evidence Medical Records Legal Documents

Depending on the reason for denial, you may need to gather additional evidence to support your claim. This could include more detailed medical records, legal documents, or witness statements. For example, if the denial was due to a pre-existing condition, you might need to provide medical records proving the condition was disclosed or that it wasn't a factor in the death.

File an Internal Appeal with the Insurance Company

Most insurance companies have an internal appeals process. Submit a formal appeal, clearly stating why you believe the denial was incorrect and providing any new evidence. Be polite but firm in your communication. Keep copies of all correspondence.

Contact Your State's Department of Insurance Consumer Protection

If the internal appeal is unsuccessful, you can file a complaint with your state's Department of Insurance. This government agency regulates insurance companies and can investigate your complaint. They act as a consumer advocate and can sometimes mediate disputes. This is a powerful step and often prompts insurers to re-evaluate their decision.

Seek Legal Counsel Life Insurance Attorney

If all else fails, consider consulting with a life insurance attorney. They specialize in these types of cases and can advise you on your legal options, including filing a lawsuit against the insurance company. An attorney can help you understand the complexities of insurance law and represent your interests effectively.

Specific Scenarios and Considerations for Life Insurance Claims

Certain situations can add layers of complexity to the claims process. Here are a few common ones:

Multiple Beneficiaries and Payout Distribution

If there are multiple beneficiaries, the policy will typically specify how the death benefit is to be divided (e.g., 50% to spouse, 25% to child A, 25% to child B). Each beneficiary will need to file their own claim form and provide their identification. If the policyholder did not specify percentages, the payout might be divided equally among primary beneficiaries. If a primary beneficiary predeceases the policyholder and no contingent beneficiary is named, the payout might go to the remaining primary beneficiaries or the estate.

Minor Beneficiaries Guardianship and Trust Accounts

If a beneficiary is a minor, they cannot legally receive the death benefit directly. The funds will typically be held in a trust or paid to a court-appointed guardian until the minor reaches the age of majority. Policyholders can set up a trust for minor beneficiaries to ensure the funds are managed responsibly. If no trust is established, the court will appoint a guardian, which can be a lengthy and costly process.

Contingent Beneficiaries When Primary Beneficiary is Deceased

A contingent beneficiary is designated to receive the death benefit if the primary beneficiary is deceased. It's crucial for policyholders to name contingent beneficiaries to avoid the death benefit going to their estate, which can lead to probate delays and potential taxes. If both primary and contingent beneficiaries are deceased, the death benefit will typically go to the policyholder's estate.

Estate as Beneficiary Probate and Delays

If the policyholder names their estate as the beneficiary, or if there are no living beneficiaries, the death benefit will become part of the deceased's estate. This means the funds will go through the probate process, which can be lengthy and costly, and the funds will be subject to the deceased's creditors before being distributed to heirs. This is generally not the most efficient way to transfer wealth.

Accelerated Death Benefits for Terminal Illness

Some life insurance policies offer an accelerated death benefit rider, which allows the policyholder to access a portion of their death benefit while still alive if they are diagnosed with a terminal illness. This can help cover medical expenses or improve quality of life during a difficult time. The amount received will reduce the final death benefit paid to beneficiaries.

Recommended Products and Scenarios for Life Insurance Claims

While the claims process is largely standardized, the type of policy and insurer can influence the experience. Here, we'll look at some general recommendations and scenarios.

Term Life Insurance Claims Simplicity and Speed

Term life insurance policies are generally the most straightforward when it comes to claims. Since there's no cash value component, the process focuses primarily on verifying the death and beneficiary. Companies like Haven Life (backed by MassMutual) and Ladder Life are known for their streamlined online application and claims processes, often offering quick approvals and efficient payouts. For a 35-year-old non-smoker seeking a $500,000 20-year term policy, premiums could range from $25-$40 per month. Their digital-first approach often translates to faster claim processing, assuming all documentation is in order. These are excellent choices for individuals who prioritize simplicity and efficiency in both purchasing and claiming.

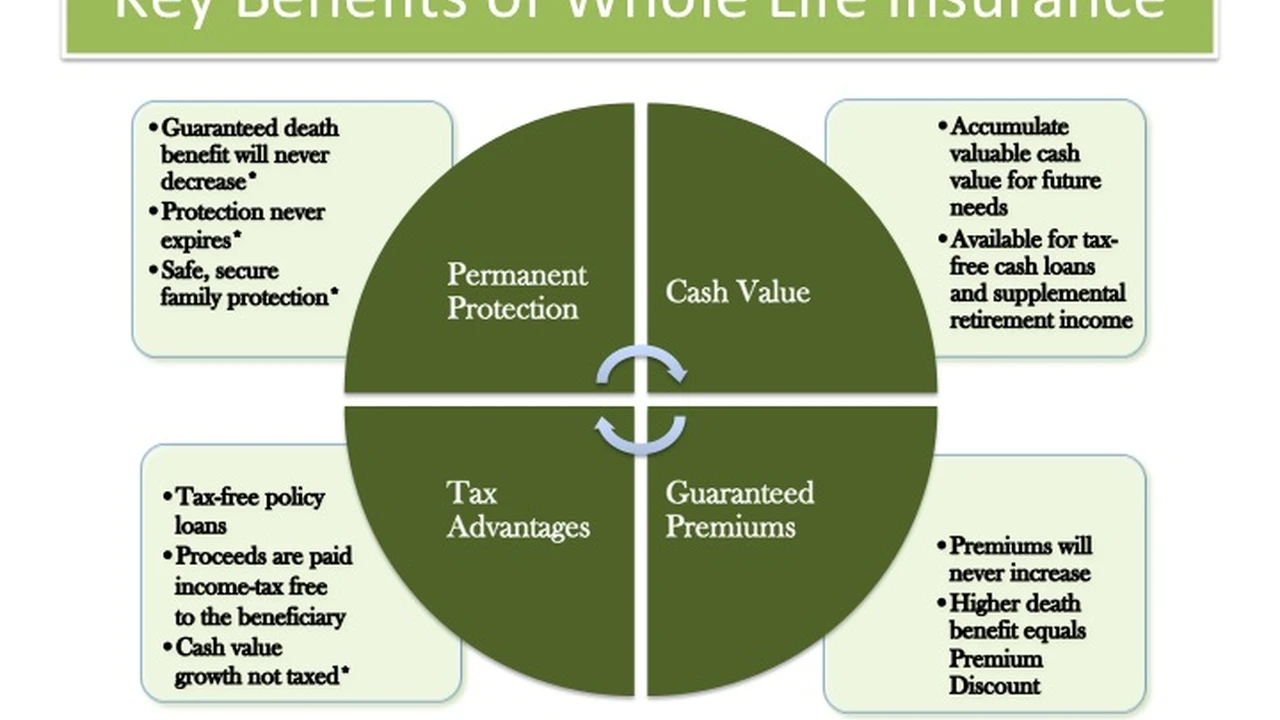

Whole Life Insurance Claims Cash Value and Complexity

Whole life insurance claims are similar to term life in terms of death benefit payout, but the presence of a cash value component can add a layer of complexity if the policyholder had taken out loans against it. Companies like Northwestern Mutual and MassMutual are prominent providers of whole life insurance, known for their financial strength and customer service. While their claims processes are robust, they might involve more detailed checks regarding policy loans or dividends. For a 35-year-old non-smoker seeking a $250,000 whole life policy, premiums could be significantly higher, perhaps $200-$350 per month, reflecting the cash value growth and lifelong coverage. The claims department will need to reconcile any outstanding loans against the cash value before the death benefit is paid out, which can slightly extend the timeline.

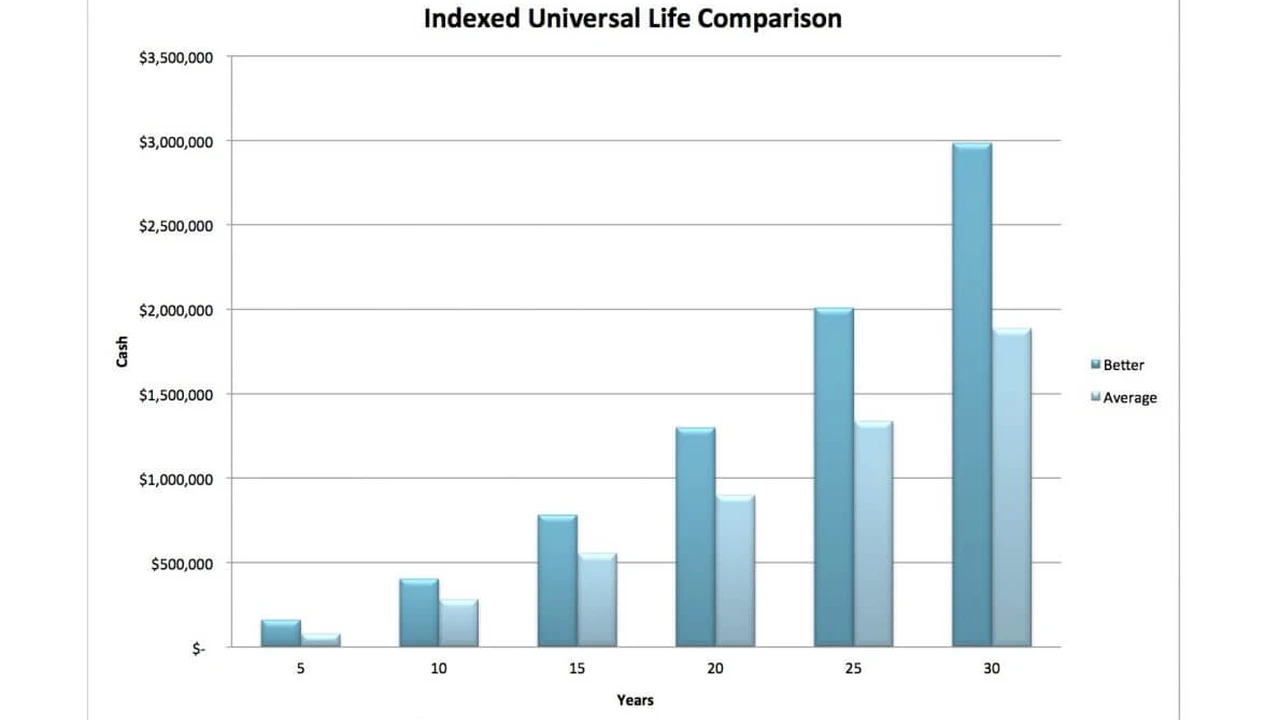

Universal Life Insurance Claims Flexibility and Variability

Universal life (UL) policies, especially Indexed Universal Life (IUL) or Variable Universal Life (VUL), can introduce more variables into the claims process due to their flexible premiums and investment components. The death benefit might fluctuate based on market performance (for VUL) or index performance (for IUL), and policy loans or withdrawals can also impact the final payout. Insurers like Pacific Life and Transamerica offer a range of UL products. Their claims departments are well-versed in these complexities, but beneficiaries might need to understand how the policy's cash value and investment performance affected the final death benefit. For a 35-year-old non-smoker seeking a $500,000 IUL policy, premiums could start around $100-$150 per month, but the actual cost and cash value growth are highly variable. The claims process will involve a thorough accounting of the policy's financial performance and any transactions made by the policyholder.

No Medical Exam Life Insurance Claims Simplified Process

Policies like guaranteed issue or simplified issue life insurance, which require no medical exam, often have a more streamlined claims process because the initial underwriting was less stringent. However, they might have higher premiums or lower coverage amounts. Companies like Mutual of Omaha and Gerber Life are well-known for these types of policies, often marketed towards seniors or those with health issues. For a 65-year-old seeking a $25,000 guaranteed issue policy, premiums could be $50-$100 per month. The claims process for these policies is typically very quick, as the insurer has already accepted a higher risk upfront. The main focus will be on verifying the death and beneficiary, with less emphasis on medical history, unless the death occurs within a very short waiting period (e.g., 2 years) where only premiums might be returned.

Group Life Insurance Claims Employer Provided Benefits

Group life insurance, often provided by employers, usually has a very straightforward claims process. The employer's HR department or benefits administrator typically assists the beneficiary in initiating the claim with the group insurer (e.g., MetLife, Prudential). The process involves confirming employment, death, and beneficiary designation. These claims are generally processed quickly due to the standardized nature of group policies. The coverage amount is often a multiple of the employee's salary, and premiums are usually paid by the employer or shared with the employee.

Accidental Death and Dismemberment AD&D Claims Specific Triggers

AD&D policies are distinct from traditional life insurance as they only pay out for deaths or dismemberment caused by an accident. The claims process for AD&D requires clear proof that the death was indeed accidental, often necessitating police reports, autopsy reports, and detailed medical records. Companies like Aflac and Chubb offer AD&D coverage. The payout is typically a lump sum, and premiums are generally lower than traditional life insurance due to the specific nature of the coverage. For example, a $100,000 AD&D policy might cost $10-$20 per month. The claims department will rigorously review the circumstances of death to ensure it falls within the policy's definition of an accident.

Final Thoughts on Navigating Life Insurance Claims

While the process of filing a life insurance claim can seem daunting during a time of loss, being prepared and understanding the steps involved can make a significant difference. Remember to gather all necessary documents, communicate clearly and promptly with the insurance company, and don't hesitate to seek assistance from an agent, a financial advisor, or legal counsel if needed. Life insurance is designed to provide financial security when it's needed most, and by following these guidelines, you can ensure that your loved one's legacy provides the protection they intended.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)