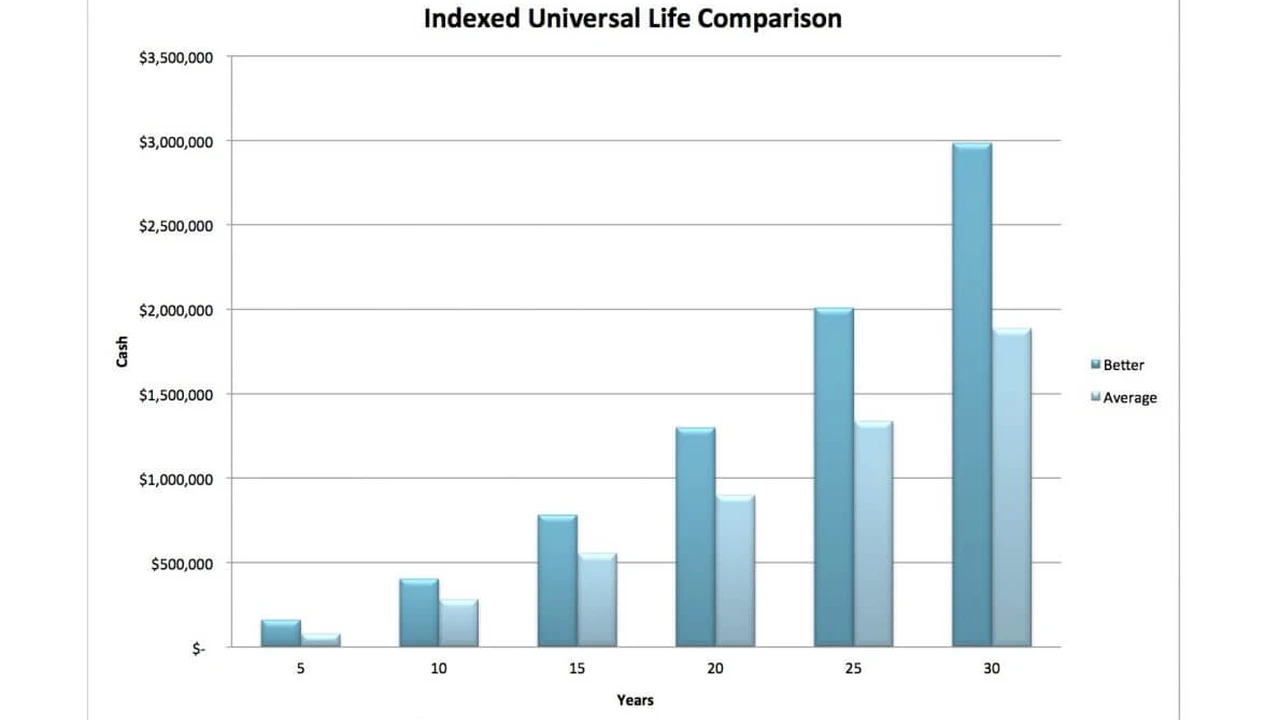

Comparing Universal Life Insurance Cash Value Growth

Review how the cash value component of different universal life insurance policies grows over time.

Review how the cash value component of different universal life insurance policies grows over time. Understanding how the cash value in your universal life (UL) insurance policy accumulates is crucial for making informed financial decisions. Unlike term life insurance, which offers pure death benefit protection for a specific period, universal life policies come with a savings component that can grow over time, tax-deferred. This cash value can be a powerful financial tool, offering flexibility and access to funds during your lifetime. But not all UL policies are created equal when it comes to cash value growth. Let's dive deep into the mechanics, compare different types, and look at some real-world examples.

Universal Life Insurance Cash Value Growth Comparison

Understanding Universal Life Insurance Cash Value Growth Mechanics

At its core, universal life insurance is a permanent life insurance policy that offers a death benefit and a cash value component. A portion of your premium payments goes towards covering the cost of insurance (COI), administrative fees, and other charges, while the remainder is allocated to the cash value. This cash value then grows based on an interest rate, which can vary depending on the type of UL policy you have. The beauty of this growth is that it's typically tax-deferred, meaning you don't pay taxes on the gains until you withdraw them or surrender the policy.

How Premiums and Charges Affect Cash Value Accumulation

It's important to understand that not every dollar you pay in premiums directly contributes to your cash value. The initial years of a UL policy often see a larger portion of premiums going towards administrative costs and the cost of insurance. As you get older, the cost of insurance naturally increases. However, with a UL policy, the cash value can help offset these rising costs, or you can adjust your premium payments to maintain coverage. The flexibility of UL policies allows you to increase or decrease your premium payments (within certain limits) and even skip payments if your cash value is sufficient to cover the policy's charges.

The Power of Tax Deferred Growth in Universal Life Policies

One of the most attractive features of universal life insurance is the tax-deferred growth of its cash value. This means your money grows without being subject to annual income taxes, allowing it to compound more rapidly over time. This tax advantage can be significant, especially over several decades. When you eventually access the cash value through loans or withdrawals, the tax implications can be favorable, particularly if structured correctly. Policy loans, for instance, are generally tax-free as long as the policy remains in force.

Types of Universal Life Insurance and Their Cash Value Growth

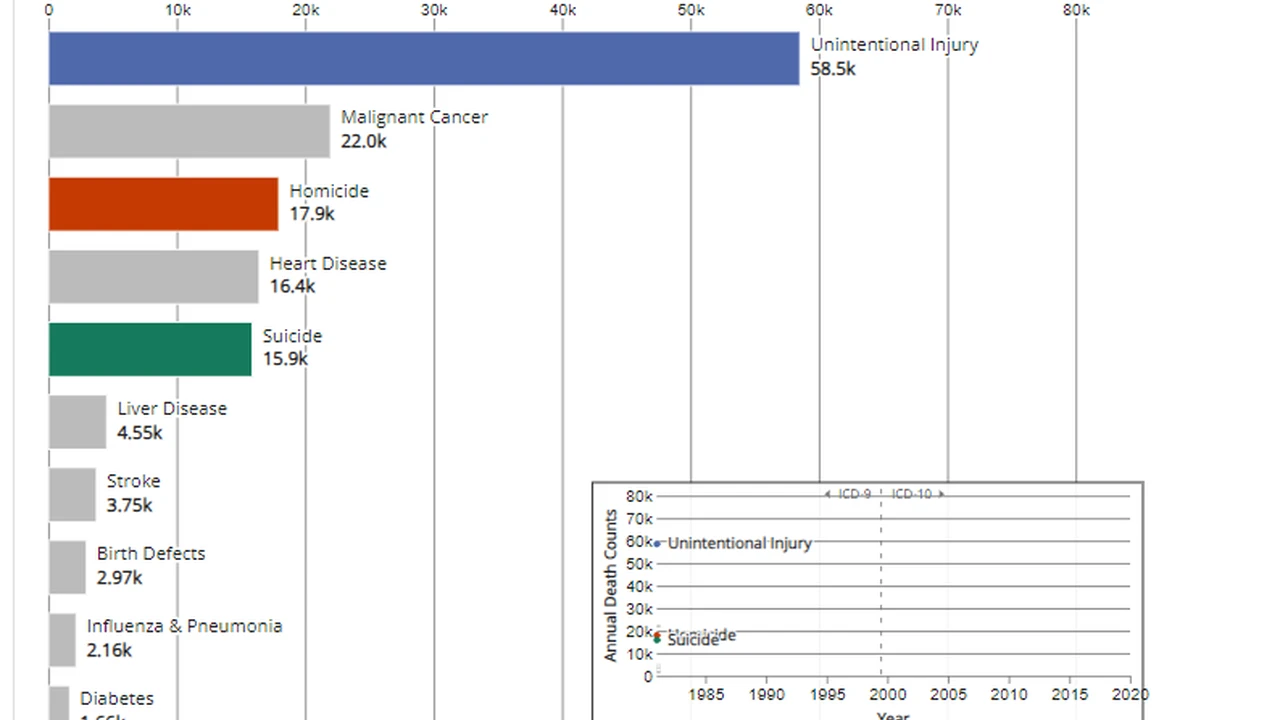

The way cash value grows differs significantly across the various types of universal life insurance. Understanding these distinctions is key to choosing the policy that best aligns with your financial goals and risk tolerance.

Guaranteed Universal Life GUL Cash Value Growth

Guaranteed Universal Life (GUL) insurance is primarily designed for its guaranteed death benefit, often extending to a specific age, like 90, 100, or even 121. While it does have a cash value component, its growth is typically minimal and not the primary focus. The interest rate credited to the cash value in a GUL policy is usually a fixed, conservative rate, often just enough to keep the policy in force. The main advantage of GUL is its predictability and guaranteed coverage, not robust cash value accumulation. It's ideal for those who prioritize a guaranteed death benefit over cash value growth.

Indexed Universal Life IUL Cash Value Growth Potential

Indexed Universal Life (IUL) insurance offers a unique approach to cash value growth. Instead of a fixed interest rate, the cash value growth is linked to the performance of a specific market index, such as the S&P 500, without directly investing in the stock market. This linkage provides the potential for higher returns than traditional UL policies, while also offering protection against market downturns through a guaranteed minimum interest rate (floor). However, IUL policies also come with caps on potential gains, meaning you won't participate in all of the index's upside. This blend of potential growth and downside protection makes IUL attractive to those seeking a balance between risk and reward.

Variable Universal Life VUL Cash Value Investment Options

Variable Universal Life (VUL) insurance takes cash value growth to another level by allowing policyholders to invest their cash value in a variety of sub-accounts, similar to mutual funds. This means the cash value growth is directly tied to the performance of these underlying investments. VUL offers the highest potential for cash value growth, but also carries the highest risk, as the cash value can decrease if the investments perform poorly. It's suited for individuals who are comfortable with investment risk and want more control over their cash value's growth potential. It's crucial to understand the investment options, fees, and risks associated with VUL policies.

Comparing Specific Universal Life Insurance Products and Their Cash Value Growth

Let's look at some hypothetical examples of how different universal life policies might perform in terms of cash value growth. Keep in mind that actual results will vary based on individual circumstances, policy specifics, and market conditions.

Product Comparison 1 Indexed Universal Life Policy A

Product Name: "GrowthGuard IUL" (Hypothetical) Provider: A major US insurer Target Market: Individuals aged 30-55 seeking long-term cash value growth with market upside potential and downside protection. Key Features:

- Cash value growth linked to S&P 500 (or similar index).

- Participation Rate: 100% (meaning you participate in 100% of the index's gains, up to the cap).

- Cap Rate: 10% (maximum annual interest credited).

- Floor Rate: 0% (guaranteed minimum interest rate, protecting against losses).

- Loan Feature: Access to cash value via policy loans, typically at a fixed or variable interest rate.

- Premium Flexibility: Adjustable premiums within certain limits.

- Year 10: ~$60,000 - $75,000

- Year 20: ~$180,000 - $220,000

- Year 30: ~$400,000 - $500,000

Product Comparison 2 Variable Universal Life Policy B

Product Name: "WealthBuilder VUL" (Hypothetical) Provider: A leading investment-focused insurer Target Market: High-net-worth individuals or those comfortable with investment risk, seeking aggressive cash value growth and investment control. Key Features:

- Cash value invested in various sub-accounts (e.g., equity funds, bond funds, balanced funds).

- No cap on potential gains, but also no floor (cash value can decrease).

- Wide range of investment options managed by professional fund managers.

- Premium Flexibility: Highly flexible, allowing for lump-sum contributions or adjustable payments.

- Loan Feature: Access to cash value via policy loans, interest rates vary.

- Year 10: ~$100,000 - $150,000 (can be lower or higher)

- Year 20: ~$350,000 - $600,000 (can be lower or higher)

- Year 30: ~$800,000 - $1,500,000+ (can be lower or higher)

Product Comparison 3 Guaranteed Universal Life Policy C

Product Name: "SecureLegacy GUL" (Hypothetical) Provider: A well-established insurer known for stability Target Market: Individuals prioritizing a guaranteed death benefit for estate planning or final expenses, with minimal interest in cash value growth. Key Features:

- Guaranteed death benefit to age 100, 110, or even 121.

- Fixed, low interest rate credited to cash value (e.g., 1-2%).

- Predictable premiums, often level for life.

- Minimal cash value accumulation, primarily used to keep the policy in force.

- Loan Feature: Available, but cash value is typically low.

- Year 10: ~$20,000 - $25,000

- Year 20: ~$45,000 - $55,000

- Year 30: ~$70,000 - $85,000

Factors Influencing Universal Life Cash Value Growth

Several factors play a significant role in how quickly and substantially your universal life policy's cash value grows. Understanding these can help you optimize your policy for better returns.

Premium Payment Structure and Frequency

The amount and frequency of your premium payments directly impact cash value growth. Higher premiums, especially in the early years, mean more money is allocated to the cash value component, allowing it to grow faster. Consistent payments also ensure that the policy remains adequately funded, preventing the cash value from being depleted by policy charges.

Cost of Insurance COI and Administrative Fees

The cost of insurance (COI) and various administrative fees are deducted from your premium payments before money is allocated to the cash value. These costs can significantly impact growth, especially in the initial years. COI typically increases with age, so a policy designed to minimize these costs can lead to better cash value accumulation over the long term. Always review the policy illustration to understand these charges.

Interest Crediting Rates and Market Performance

For traditional UL policies, the interest rate credited to the cash value is crucial. For IUL, the cap and floor rates, along with the performance of the linked index, determine growth. For VUL, the performance of the chosen sub-accounts is paramount. Higher crediting rates or strong market performance (for IUL/VUL) will lead to faster cash value growth. It's important to understand how these rates are determined and if they are guaranteed or subject to change.

Policy Loans and Withdrawals Impact on Cash Value

Accessing your cash value through loans or withdrawals will naturally reduce its balance and, consequently, its future growth potential. While these features offer flexibility, it's important to use them judiciously. Policy loans accrue interest, and if not repaid, can reduce the death benefit or even cause the policy to lapse. Withdrawals directly reduce the cash value and death benefit. Always consult with a financial advisor before taking loans or withdrawals from your policy.

Optimizing Universal Life Cash Value for Your Financial Goals

To make the most of your universal life policy's cash value, consider these strategies and scenarios.

Using Cash Value for Retirement Income Supplementation

Many people use the cash value of their UL policy as a supplemental income stream during retirement. By taking tax-free policy loans, you can access your accumulated wealth without incurring immediate tax liabilities. This can be particularly attractive for those who have maximized other retirement accounts or are looking for an additional source of tax-efficient income.

Leveraging Cash Value for Major Life Expenses

The accessible cash value can also be a valuable resource for unexpected expenses or planned major purchases, such as a down payment on a home, funding a child's education, or starting a business. The ability to borrow against your policy without a credit check and with flexible repayment terms can be a significant advantage compared to traditional loans.

Estate Planning and Wealth Transfer with Universal Life

While cash value growth is a living benefit, the death benefit of a UL policy remains a cornerstone of estate planning. A well-funded UL policy can provide a tax-free inheritance to beneficiaries, cover estate taxes, or fund charitable bequests. The cash value can also be used to pay premiums in later years, ensuring the death benefit remains intact for your heirs.

Choosing the Right Universal Life Policy for Cash Value Growth

Selecting the best universal life policy for cash value growth depends heavily on your individual financial situation, risk tolerance, and long-term objectives.

Assessing Your Risk Tolerance and Investment Comfort

If you're comfortable with market fluctuations and want the highest potential for growth, a Variable Universal Life (VUL) policy might be suitable. If you prefer a balance of growth potential and downside protection, Indexed Universal Life (IUL) could be a good fit. If your priority is a guaranteed death benefit with minimal interest in cash value growth, Guaranteed Universal Life (GUL) is likely the better choice.

Reviewing Policy Illustrations and Projections Carefully

Always request and thoroughly review policy illustrations from your insurance agent. These illustrations provide projections of cash value growth under various scenarios (e.g., guaranteed rates, current rates, higher rates). Understand that these are projections, not guarantees, especially for IUL and VUL policies. Pay close attention to the fees and charges outlined in the illustration.

Working with a Qualified Financial Advisor for Personalized Advice

Universal life insurance can be complex. Working with an experienced and qualified financial advisor is highly recommended. They can help you assess your needs, compare different policies from various providers, explain the intricacies of cash value growth, and ensure the policy aligns with your overall financial plan. They can also help you understand the tax implications and potential risks involved.

Understanding how the cash value component of different universal life insurance policies grows over time is essential for anyone considering this type of coverage. Whether you prioritize guaranteed coverage, market-linked growth, or direct investment control, there's a universal life policy designed to meet diverse financial needs. By carefully comparing options, understanding the underlying mechanics, and seeking expert advice, you can harness the power of universal life insurance to build a secure financial future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)