Comparing Accidental Death and Dismemberment Insurance

Review accidental death and dismemberment insurance, its coverage, and how it differs from traditional life insurance.

Comparing Accidental Death and Dismemberment Insurance

Hey there! Let's talk about something a bit different in the world of insurance: Accidental Death and Dismemberment, or AD&D for short. You might have heard of it, maybe even have it through your job, but do you really know what it covers and how it stacks up against your regular life insurance? It's a common question, and understanding the nuances can save you a lot of headaches and ensure you're properly protected. We're going to dive deep into AD&D, explore its coverage, look at some real-world scenarios, compare it to traditional life insurance, and even check out some specific products and their costs. So, buckle up!

What is Accidental Death and Dismemberment Insurance Understanding AD&D Coverage

First things first, what exactly is AD&D insurance? At its core, AD&D is a type of insurance that pays out a benefit if you die or suffer a severe injury as a direct result of an accident. The 'death' part is pretty straightforward – if an accident causes your demise, your beneficiaries get a payout. The 'dismemberment' part refers to losing a limb, sight, hearing, or speech due to an accident. It's important to stress the word 'accident' here because that's the key differentiator. This isn't like your standard life insurance that covers death from almost any cause (barring a few exclusions like suicide within a certain period).

Think of AD&D as a specialized safety net. It's designed to provide financial relief during some of life's most unexpected and devastating events. While it might sound a bit grim, having this coverage can be incredibly helpful for you and your family if an accident turns your world upside down.

Common Accidental Events Covered by AD&D Policies

So, what kind of accidents are we talking about? Generally, AD&D policies cover a wide range of incidents. Here are some common examples:

- Car accidents: This is probably the most common scenario. If you're involved in a car crash that results in death or a covered injury, AD&D would typically kick in.

- Falls: Serious falls that lead to death or dismemberment are often covered.

- Drowning: Accidental drowning is usually included.

- Fires: Injuries or death sustained in a fire.

- Workplace accidents: Many workplace incidents, especially those involving machinery or hazardous environments, can be covered.

- Homicide: If you're a victim of homicide, it's generally considered an accidental death for AD&D purposes.

- Exposure to elements: Death or injury due to accidental exposure to extreme weather conditions.

It's crucial to remember that the accident must be the direct and sole cause of the death or injury. If there's an underlying health condition that contributed, it might complicate the claim.

Specific Dismemberment Benefits and Payout Structures

The 'dismemberment' aspect of AD&D is where things get a bit more specific. Policies typically define what constitutes 'dismemberment' and assign a percentage of the policy's face value for each type of loss. Here's a general idea of how it works:

- Loss of one hand or one foot: Often 50% of the principal sum.

- Loss of sight in one eye: Also commonly 50% of the principal sum.

- Loss of two limbs (e.g., both hands, both feet, or one hand and one foot): Usually 100% of the principal sum.

- Loss of sight in both eyes: Typically 100% of the principal sum.

- Loss of speech and hearing: Often 100% of the principal sum.

- Loss of thumb and index finger of the same hand: Sometimes a smaller percentage, like 25%.

Some policies also include benefits for paralysis (quadriplegia, paraplegia, hemiplegia) or severe burns. The exact percentages and covered losses will vary significantly between policies and providers, so always read the fine print!

AD&D vs Traditional Life Insurance Key Differences and Overlap

This is where many people get confused. Is AD&D just another type of life insurance? Not quite. While both provide a payout upon death, their scope is vastly different. Let's break down the core distinctions:

Coverage Scope and Exclusions Understanding What Each Policy Covers

Traditional Life Insurance (Term or Whole Life):

- Broad Coverage: Covers death from almost any cause, including illness, natural causes, and accidents.

- Exclusions: Typically excludes suicide within the first two years of the policy, death resulting from illegal activities, or sometimes death during acts of war.

- Cash Value (for Whole Life): Whole life policies build cash value over time, which you can borrow against or withdraw. Term life does not.

- Underwriting: Requires a medical exam and extensive health questions for most policies.

Accidental Death and Dismemberment (AD&D) Insurance:

- Narrow Coverage: Only covers death or specific injuries that are a direct result of an accident.

- Exclusions: This is a big one. AD&D policies have many more exclusions. Common ones include death or injury due to illness, natural causes, suicide, drug overdose, war, dangerous sports (like skydiving or car racing), driving under the influence, or medical malpractice. If you die from a heart attack, AD&D won't pay out. If you die in a car crash, it likely will.

- No Cash Value: AD&D policies do not build cash value. They are purely protection policies.

- Underwriting: Often requires no medical exam or very few health questions, making it easier and quicker to obtain.

So, the biggest takeaway here is that traditional life insurance is much broader in its coverage, while AD&D is highly specialized. AD&D is not a substitute for comprehensive life insurance.

Cost Comparison and Affordability of AD&D and Life Insurance

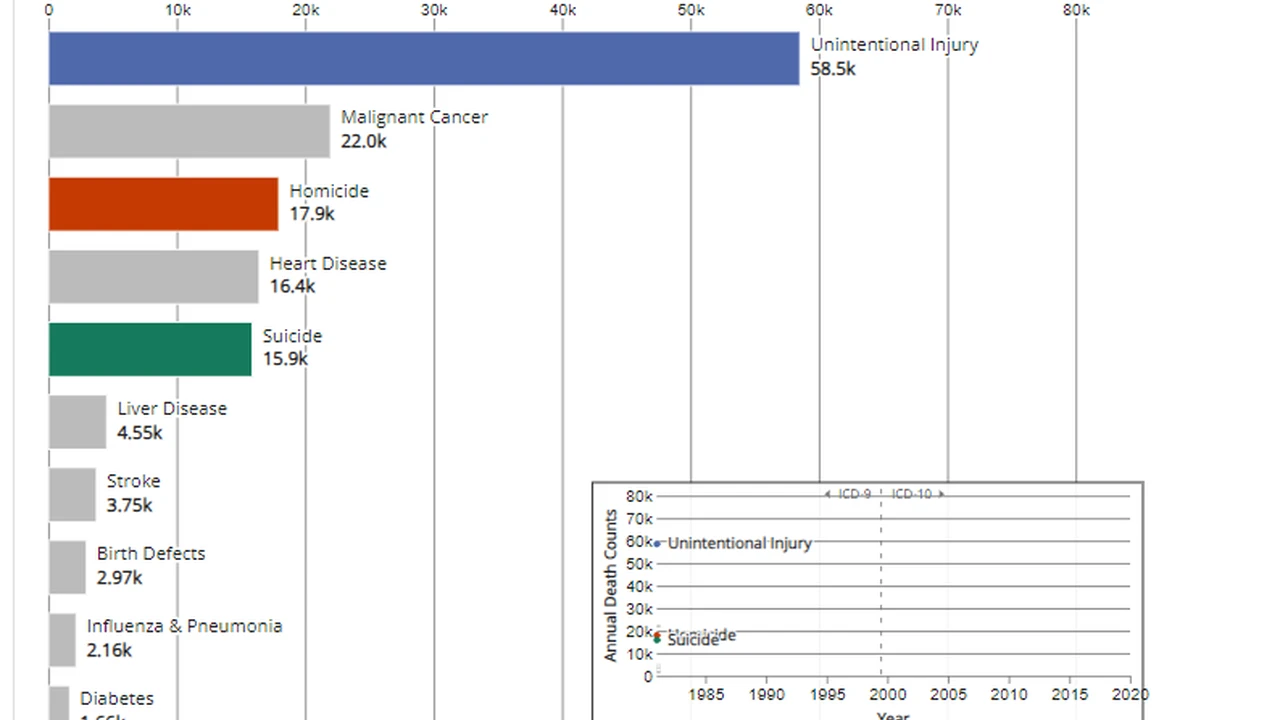

Generally, AD&D insurance is significantly cheaper than traditional life insurance for the same coverage amount. Why? Because the risk to the insurer is much lower. The probability of dying from an accident is statistically lower than dying from any cause (illness, old age, etc.).

For example, a healthy 30-year-old might pay $20-$30 per month for a $500,000 term life policy. The same person might pay only $5-$10 per month for a $500,000 AD&D policy. This affordability makes AD&D an attractive option for some, especially as a supplement.

When to Consider AD&D Insurance Complementing Your Existing Coverage

Given its specialized nature, AD&D is usually best viewed as a supplement to your existing life insurance, not a replacement. Here are scenarios where AD&D can be a smart addition:

- High-Risk Occupations: If your job involves significant physical risk (e.g., construction worker, pilot, truck driver), AD&D can provide extra protection against workplace accidents.

- Dangerous Hobbies: If you engage in hobbies like rock climbing, motorcycling, or competitive sports, AD&D can offer peace of mind. (Just be sure your specific hobby isn't an exclusion in the policy!)

- Budget Constraints: If you can't afford a large traditional life insurance policy but want some form of death benefit, AD&D can be a cost-effective way to get some coverage, especially if you're worried about accidental death.

- Travel: Many travel insurance policies include AD&D components, which can be useful for unexpected incidents while abroad.

- Group Benefits: Many employers offer AD&D as a low-cost or free benefit. It's a great perk to take advantage of.

- Supplementing Existing Life Insurance: If you already have a life insurance policy but want an extra layer of protection specifically for accidents, AD&D can boost your total coverage.

Top AD&D Insurance Products and Providers A Detailed Review

Alright, let's get into some specifics. While I can't give you real-time quotes, I can highlight some reputable providers and common types of AD&D products you'll encounter in the US and Southeast Asia. Remember, prices and terms can vary wildly based on your age, location, and the specific policy features.

Leading AD&D Providers in the US Market Product Features and Pricing

In the US, many major insurance companies offer AD&D, often as a standalone policy or as a rider to other insurance products. Here are a few prominent names:

1. Mutual of Omaha Accidental Death Insurance

- Product Overview: Mutual of Omaha is well-known for its straightforward accidental death policies. They often offer guaranteed acceptance for certain age groups, meaning no medical questions.

- Key Features:

- Coverage amounts typically range from $50,000 to $500,000 or more.

- Often includes benefits for specific injuries like loss of limbs or sight.

- May offer additional benefits for common carrier accidents (e.g., plane, train, bus).

- No medical exam required, making it easy to get.

- Typical Use Case: Ideal for individuals who want simple, affordable accidental death coverage without the hassle of medical underwriting, or as a supplement to existing life insurance. Good for those with health issues that make traditional life insurance expensive.

- Pricing Example (Illustrative): A 40-year-old might pay around $10-$15 per month for $100,000 in coverage. This is highly variable.

2. Aflac Accidental Injury Insurance

- Product Overview: Aflac specializes in supplemental insurance, and their accidental injury policy is designed to pay cash benefits directly to you (not just for death or dismemberment) for a wide range of accidental injuries. While not strictly AD&D, it's often purchased alongside or instead of traditional AD&D for broader accident coverage.

- Key Features:

- Pays benefits for things like emergency room visits, X-rays, physical therapy, and even follow-up doctor visits due to an accident.

- Includes accidental death and dismemberment benefits.

- Benefits are paid directly to the policyholder, regardless of other insurance.

- Often available through employer benefits programs.

- Typical Use Case: Excellent for individuals or families who want comprehensive protection against the financial impact of various accidental injuries, not just the most severe ones. It helps cover out-of-pocket costs that health insurance might not.

- Pricing Example (Illustrative): A family plan could range from $30-$60 per month, depending on the level of benefits.

3. USAA Accidental Death and Dismemberment Insurance (for Military Members and Families)

- Product Overview: USAA is a top choice for military members and their families, offering competitive rates and tailored benefits.

- Key Features:

- Coverage up to $1,000,000.

- Includes benefits for specific losses like sight, hearing, speech, and paralysis.

- Often includes a 'seat belt benefit' or 'air bag benefit' for car accidents.

- No health questions or medical exams.

- Typical Use Case: Highly recommended for active military, veterans, and their families who want robust accidental coverage with military-specific benefits.

- Pricing Example (Illustrative): A 35-year-old military member might pay around $7-$12 per month for $250,000 in coverage.

AD&D Options in Southeast Asia Market Specific Products and Regulations

The Southeast Asian market for AD&D is also robust, with many local and international insurers offering products. Regulations and product features can vary significantly by country (e.g., Singapore, Malaysia, Thailand, Indonesia, Philippines).

1. AIA Accidental Death and Disability Plan (e.g., Singapore, Malaysia)

- Product Overview: AIA is a major player across Asia, and they offer various accidental plans. Their AD&D plans often come with comprehensive features.

- Key Features:

- High coverage limits available.

- May include benefits for medical expenses due to accidents, temporary total disability, and permanent partial disability.

- Often includes worldwide coverage, which is great for frequent travelers.

- Some plans offer a 'double indemnity' clause for specific types of accidents (e.g., public transport accidents).

- Typical Use Case: Suitable for individuals and families seeking comprehensive accident protection, especially those who travel frequently or have active lifestyles.

- Pricing Example (Illustrative for Singapore): A 30-year-old might pay SGD 15-30 per month for SGD 200,000 in coverage, depending on the plan's features.

2. Prudential PRUAccident (e.g., Thailand, Indonesia)

- Product Overview: Prudential also has a strong presence in Southeast Asia, offering accident insurance that often combines AD&D with other accident-related benefits.

- Key Features:

- Covers accidental death and dismemberment.

- Often includes daily hospital income benefits due to accidents.

- May cover medical expenses for accidental injuries.

- Some plans offer a lump sum for specific critical illnesses caused by accidents.

- Typical Use Case: Good for individuals looking for a broader accident plan that covers not just death/dismemberment but also the immediate financial impact of accidental injuries and hospitalization.

- Pricing Example (Illustrative for Thailand): A 35-year-old might pay THB 300-600 per month for a plan with THB 1,000,000 accidental death coverage and additional medical benefits.

3. Great Eastern Accidental Protection Plans (e.g., Malaysia, Singapore)

- Product Overview: Great Eastern is another well-established insurer in the region, providing various accident protection plans.

- Key Features:

- Flexible plans with different levels of coverage for accidental death and dismemberment.

- Often includes benefits for medical expenses, traditional Chinese medicine (TCM) treatments, and physiotherapy due to accidents.

- Some plans offer weekly income benefits if you're temporarily disabled due to an accident.

- May include child education benefits or funeral expenses.

- Typical Use Case: Excellent for families who want comprehensive accident coverage that extends beyond just death and dismemberment, covering a wider range of recovery and support needs.

- Pricing Example (Illustrative for Malaysia): A 45-year-old might pay MYR 50-100 per month for a plan with MYR 500,000 accidental death coverage and various medical/disability benefits.

When looking at policies in Southeast Asia, always check the specific country's regulations regarding insurance, as they can impact policy terms, tax implications, and claims processes.

Understanding AD&D Exclusions and Limitations What Is Not Covered

This is super important. Knowing what an AD&D policy doesn't cover is just as vital as knowing what it does. The exclusions list can be quite extensive, and overlooking it can lead to nasty surprises when you need to make a claim.

Common Exclusions in AD&D Policies Avoiding Claim Denials

Here are the most common exclusions you'll find in almost any AD&D policy:

- Illness or Disease: If you die from cancer, a heart attack, stroke, or any other illness, AD&D will not pay out. This is the biggest difference from traditional life insurance.

- Natural Causes: Death due to old age or natural deterioration of the body is not covered.

- Suicide or Self-Inflicted Injury: Any death or injury resulting from intentional self-harm is excluded.

- Drug or Alcohol Intoxication: If the accident occurs while you are under the influence of drugs or alcohol, the claim will likely be denied.

- War or Act of War: Death or injury sustained during wartime or military operations.

- Participation in Illegal Activities: If the accident happens while you're committing a felony or other illegal act.

- Dangerous Sports or Activities: Many policies exclude death or injury from high-risk activities like skydiving, bungee jumping, professional racing, scuba diving, or mountaineering, especially if you're not a professional. Some policies might offer riders to cover these, but they'll cost extra.

- Medical or Surgical Treatment: Death or injury resulting from medical procedures, unless it's a direct result of an accident that necessitated the treatment.

- Mental or Nervous Disorders: These are typically not covered.

- Driving Under the Influence (DUI/DWI): Accidents occurring while driving intoxicated are almost always excluded.

- Aviation (Non-Commercial): If you're flying a private plane or as a passenger on a non-commercial flight, it might be excluded unless specified.

Always, always read the policy document carefully to understand its specific exclusions. If you have a particular concern or engage in a specific activity, clarify with the insurer before purchasing.

Understanding the Definition of 'Accident' in Insurance Terms

The definition of 'accident' is paramount for AD&D. Insurers typically define an accident as an unforeseen, unintended, and external event that directly and independently causes the injury or death. This means:

- Unforeseen: It wasn't expected.

- Unintended: You didn't mean for it to happen.

- External: It came from outside your body (not an internal illness).

- Direct and Independent Cause: The accident itself must be the sole cause of the injury or death, without any contributing factors from pre-existing conditions or illnesses. This last point is often where claims get complicated. For example, if someone with a severe heart condition has a minor fall, and the fall triggers a fatal heart attack, the insurer might argue the heart condition was a contributing factor, potentially denying the claim.

This strict definition is why AD&D is so much more limited than traditional life insurance.

Practical Scenarios and Use Cases When AD&D Makes Sense

Let's look at some real-world situations where AD&D can be a valuable part of your financial safety net.

Supplementing Employer Provided Benefits Maximizing Your Coverage

Many employers offer a basic AD&D policy as part of their benefits package, often at no cost to the employee or for a very low premium. This is a fantastic perk! Even if it's a small amount, it's free money if the worst happens. You might also have the option to purchase additional AD&D coverage through your employer at group rates, which are usually cheaper than individual policies.

Scenario: Sarah works in an office but commutes daily in heavy traffic. Her employer provides a $50,000 AD&D policy. Sarah also has a $500,000 term life policy. If Sarah were to die in a car accident, her family would receive $500,000 from her term life policy AND $50,000 from her employer's AD&D policy, totaling $550,000. This extra layer of protection for a common risk (car accidents) is a great bonus.

Affordable Coverage for High Risk Individuals and Occupations

For individuals in high-risk professions or those with dangerous hobbies, traditional life insurance can be very expensive or even difficult to obtain. AD&D can fill a crucial gap.

Scenario: Mark is a commercial deep-sea diver. His traditional life insurance premiums are sky-high due to his occupation. He purchases a $250,000 AD&D policy specifically to cover accidental death or dismemberment related to his work. While it doesn't cover illness, it provides significant protection against the most likely risks of his job at a much more affordable rate than an equivalent traditional life policy.

Travel Insurance and AD&D Benefits Protecting You Abroad

Many travel insurance policies include an AD&D component. This is particularly useful when traveling to unfamiliar places or engaging in activities you wouldn't normally do at home.

Scenario: Emily is going on an adventure trip to Thailand, which includes zip-lining and white-water rafting. Her travel insurance policy includes $100,000 in AD&D coverage. If she were to suffer a severe injury or accidental death during one of these activities (and it's not excluded by the policy), her travel insurance's AD&D component would provide a payout, supplementing her regular life insurance.

AD&D as a Rider to Other Policies Enhancing Existing Protection

Sometimes, you can add an AD&D rider to your existing life insurance policy. This is often a cost-effective way to boost your accidental death coverage without buying a separate policy.

Scenario: David has a $1,000,000 whole life insurance policy. He decides to add an AD&D rider for an additional $250,000. If David dies from an illness, his beneficiaries receive $1,000,000. If he dies in a covered accident, they receive $1,250,000 ($1,000,000 from the base policy + $250,000 from the AD&D rider). This provides an extra layer of protection for accidental death, which can be a significant concern for many.

Making an Informed Decision Is AD&D Right for You

So, after all this, should you get AD&D insurance? It really depends on your individual circumstances, existing coverage, and financial goals.

Assessing Your Personal Risk Factors and Lifestyle Choices

Consider your daily life. Do you have a long, risky commute? Does your job involve physical hazards? Do you participate in extreme sports? If the answer to any of these is yes, then the likelihood of an accidental injury or death might be higher for you, making AD&D a more attractive option.

Reviewing Your Current Insurance Portfolio Gaps and Overlaps

Look at what you already have. Do you have sufficient traditional life insurance? If not, prioritize getting that first. AD&D should generally be considered a secondary or supplementary form of protection. If you have a robust life insurance policy, AD&D can be a nice-to-have extra, especially if it's offered cheaply through your employer.

The Importance of Reading the Fine Print Policy Terms and Conditions

I can't stress this enough: read the policy document! Understand the definition of 'accident,' the specific dismemberment benefits, and especially the exclusions. Don't assume anything. If you have questions, ask the insurer or a qualified insurance agent. A policy is only good if it covers what you think it covers.

Ultimately, AD&D insurance is a niche product. It's not a replacement for comprehensive life insurance, but it can be a valuable and affordable addition to your financial protection strategy, especially if you face specific accidental risks or want to boost your coverage for unexpected events. It's about building a robust safety net, piece by piece, to ensure you and your loved ones are prepared for whatever life throws your way.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)