Borrowing Against Your Whole Life Insurance Policy

Learn how to access the cash value of your whole life insurance policy through policy loans and their implications.

Borrowing Against Your Whole Life Insurance Policy

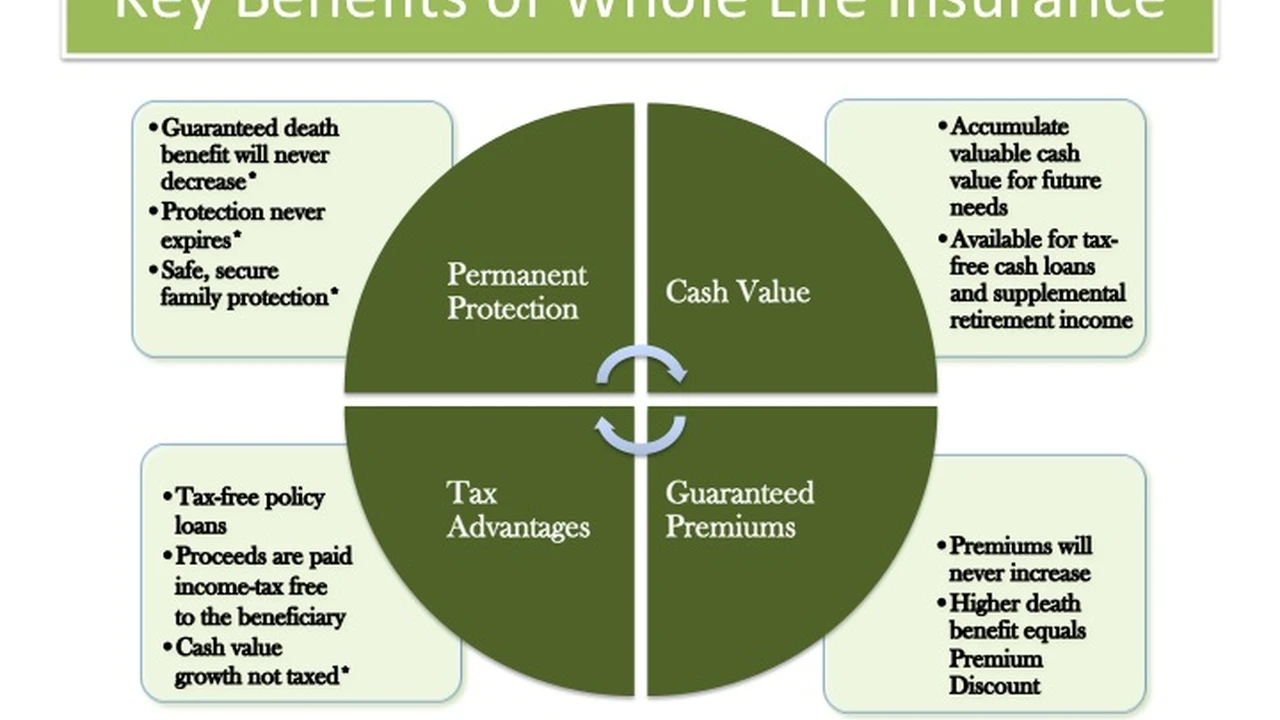

Understanding Whole Life Insurance Cash Value and Its Power

So, you've got a whole life insurance policy, right? That's awesome! It's not just about the death benefit that protects your loved ones when you're gone. One of the coolest, and often underutilized, features of whole life insurance is its cash value component. Think of it like a savings account that grows over time, tax-deferred. This cash value isn't just a number on a statement; it's a living, breathing asset that you can actually tap into while you're still alive. We're talking about policy loans here, and they can be a real game-changer for your personal finances. Unlike a traditional bank loan, borrowing from your whole life policy is a bit different, and in many ways, more flexible. You're essentially borrowing from yourself, using your policy's cash value as collateral. This means no credit checks, no lengthy approval processes, and often, more favorable terms than you'd get from a conventional lender. It's your money, working for you, even when you need to access it for other purposes. This flexibility is a huge draw for many policyholders, offering a financial safety net and a source of funds for various life events, big or small. Let's dive deeper into how this works and why it might be a smart move for you.

How Whole Life Insurance Policy Loans Work A Step by Step Guide

Alright, let's break down the mechanics of a whole life insurance policy loan. It's pretty straightforward once you get the hang of it. First off, you need to have accumulated sufficient cash value in your policy. This usually takes a few years, as the cash value grows steadily over time. Once you have that, you can request a loan from your insurance company. The amount you can borrow is typically a percentage of your policy's cash value, often up to 90% or even 95%. The insurance company doesn't actually take money out of your cash value; instead, they lend you money from their general fund, and your cash value acts as collateral. This is a crucial distinction because your policy continues to earn dividends and grow, even while you have a loan outstanding. That's right, your money keeps working for you! The loan will accrue interest, but here's the kicker: you set your own repayment schedule. There are no strict monthly payments like a bank loan. You can pay it back quickly, slowly, or even not at all during your lifetime. However, any outstanding loan balance and accrued interest will be deducted from the death benefit when the policy pays out. So, while flexible, it's wise to consider the implications for your beneficiaries. The interest rates on policy loans are usually competitive, often lower than personal loans or credit cards, and they are typically fixed. This predictability is another big plus. It's a simple process: you request the loan, the insurer approves it (because your cash value is the guarantee), and the funds are disbursed to you. Easy peasy!

Advantages of Borrowing from Your Whole Life Policy Financial Flexibility and Control

Why would you choose to borrow from your whole life policy instead of going to a bank? There are several compelling advantages that make policy loans a powerful financial tool. First and foremost is the incredible flexibility. As we mentioned, you dictate the repayment terms. Need to skip a payment or two? No problem. Want to pay it all back at once? You can do that too. This level of control is almost unheard of with traditional loans. Secondly, there are no credit checks. Your eligibility for a policy loan is based solely on the cash value you've built up, not your credit score. This can be a lifesaver if you have less-than-perfect credit or simply want to avoid another inquiry on your credit report. Thirdly, the interest rates are often more favorable and stable compared to other lending options. They're typically fixed, so you don't have to worry about fluctuating payments. Plus, the interest you pay often goes back into the insurance company's general fund, which can indirectly benefit participating policyholders through dividends. Another huge advantage is that your policy's cash value continues to grow, even while you have a loan. This means you're not sacrificing future growth for current liquidity. It's like having your cake and eating it too! Finally, the process is usually much faster and less bureaucratic than applying for a bank loan. You can often get the funds you need within a few days, which is perfect for unexpected expenses or time-sensitive opportunities. These advantages make policy loans a go-to option for many savvy financial planners and individuals.

Potential Downsides and Considerations for Whole Life Policy Loans

While policy loans offer fantastic flexibility, it's important to be aware of the potential downsides and considerations. It's not a magic bullet, and understanding the implications is key to making smart financial decisions. The most significant consideration is the impact on your death benefit. Any outstanding loan balance, plus accrued interest, will be deducted from the death benefit paid to your beneficiaries. If you take out a large loan and don't repay it, your loved ones will receive less than the original face amount of the policy. This can defeat one of the primary purposes of life insurance, which is to provide financial security for your family. So, it's crucial to weigh your need for current funds against your desire to leave a substantial legacy. Another point to remember is that while you set the repayment schedule, interest still accrues. If you don't make any payments, the interest will compound, and the loan balance can grow significantly over time. In extreme cases, if the loan balance plus interest exceeds the cash value, the policy could lapse, leading to potential tax consequences. This is rare but a possibility if loans are left unchecked for many years. Also, while the interest rates are often competitive, they are not free. You are still paying for the use of the money. It's essential to compare the policy loan interest rate with other available lending options to ensure it's truly the most cost-effective choice for your specific situation. Finally, while the process is simple, it's always a good idea to communicate with your insurance provider. Understand their specific terms and conditions for policy loans, as they can vary slightly between companies. Being informed helps you avoid any surprises down the road.

When to Consider a Whole Life Insurance Policy Loan Practical Use Cases

So, when does it make sense to tap into your whole life policy's cash value? Policy loans are incredibly versatile and can be used for a wide range of financial needs. One common scenario is for unexpected emergencies. Life throws curveballs, and having access to quick, low-hassle funds can be a lifesaver for things like medical bills, urgent home repairs, or sudden job loss. Instead of racking up high-interest credit card debt or depleting your emergency savings, a policy loan can provide a more favorable alternative. Another popular use is for bridging short-term financial gaps. Maybe you're waiting for a bonus, a tax refund, or a real estate deal to close, but you need funds now. A policy loan can provide that temporary liquidity without disrupting your long-term investments. Many people also use policy loans for educational expenses, such as college tuition or continuing education. It can be a more attractive option than student loans, especially if you can repay it relatively quickly. For entrepreneurs or small business owners, a policy loan can serve as a source of capital for business expansion, inventory purchases, or covering operational costs during lean times. It offers a private and flexible funding option without the scrutiny of traditional lenders. Some individuals even use policy loans for investment opportunities, like a down payment on a property or to seize a market opportunity, especially if they believe the investment's return will outpace the loan interest. Lastly, it can be a great way to consolidate high-interest debt, like credit card balances, by replacing them with a lower-interest policy loan. The key is to have a clear plan for repayment and to understand the implications for your policy and beneficiaries.

Comparing Policy Loans with Other Lending Options Why Whole Life Stands Out

Let's put policy loans side-by-side with some other common lending options to really highlight why whole life insurance can be such a powerful financial tool. When you need cash, you typically think of personal loans, home equity loans (HELOCs), credit cards, or even 401(k) loans. Each has its pros and cons, but policy loans often come out on top for specific situations. Personal loans usually require a credit check, have fixed repayment terms, and interest rates can vary widely based on your credit score. HELOCs use your home as collateral, meaning your home is at risk if you default, and interest rates can be variable. Credit cards are notoriously expensive, with high interest rates that can quickly spiral out of control. And 401(k) loans, while seemingly attractive, can have significant downsides: if you leave your job, you often have to repay the loan quickly, and if you don't, it's treated as an early withdrawal, incurring taxes and penalties. Plus, the money you borrow from your 401(k) is no longer growing in the market. Now, compare that to a whole life policy loan: no credit check, flexible repayment, often fixed and competitive interest rates, and your cash value continues to grow. Your policy isn't at risk of foreclosure like your home, and there are no immediate tax implications unless the policy lapses due to an unpaid loan. The biggest differentiator is the control and the fact that you're borrowing from your own asset, not a third party. This makes policy loans a unique and often superior choice for those who have built up sufficient cash value and understand the mechanics. It's about leveraging your own financial strength without external dependencies.

Specific Whole Life Insurance Products and Their Loan Features

When it comes to whole life insurance, different companies offer slightly different features and terms for their policy loans. While the core concept remains the same, understanding these nuances can help you make an informed decision. Let's look at a few examples of reputable providers and what they bring to the table. Keep in mind that specific product names and features can change, so always verify with the insurer directly.

Northwestern Mutual Whole Life Insurance

Northwestern Mutual is a mutual company, meaning it's owned by its policyholders, and is well-known for its strong dividend performance. Their whole life policies are highly regarded for their stability and consistent cash value growth. When it comes to policy loans, Northwestern Mutual typically offers competitive, fixed interest rates. A key advantage here is their strong dividend history; even with a loan outstanding, your policy continues to be eligible for dividends, which can help offset the cost of the loan or further grow your cash value. They are known for excellent customer service, making the loan application process relatively smooth. Their policies are often seen as a cornerstone for long-term financial planning, and the loan feature is a significant part of that flexibility. For example, if you have a policy with a $100,000 cash value, you might be able to borrow up to $90,000 at a fixed rate, say 5%. The policy continues to earn dividends, and you can repay at your own pace.

MassMutual Whole Life Insurance

MassMutual, another highly-rated mutual company, also offers robust whole life insurance products with attractive loan provisions. Similar to Northwestern Mutual, MassMutual policies are known for their strong cash value accumulation and consistent dividend payments. Their policy loan interest rates are typically competitive and fixed, providing predictability. MassMutual emphasizes the ability to use your policy's cash value as a personal banking system, allowing you to access funds for various needs without disrupting your overall financial plan. They often highlight the non-direct recognition feature, which means that taking a loan does not directly impact the dividends your policy earns. This can be a significant benefit, as your policy's growth potential isn't immediately diminished by borrowing. For instance, a policyholder with a $75,000 cash value could access a loan of up to $67,500, and their policy would still be eligible for the same dividend scale as if no loan were taken.

Guardian Life Insurance Whole Life

Guardian Life is another top-tier mutual company with a strong reputation for its whole life insurance offerings. Their policies are designed for long-term growth and financial security, with a focus on guaranteed cash value increases and competitive dividends. Guardian's policy loan features are similar to other mutual companies, offering flexible access to your cash value at competitive, fixed interest rates. They also often operate on a non-direct recognition basis, ensuring that your policy's dividend eligibility is not negatively affected by taking a loan. Guardian is known for its personalized service and financial strength, which provides peace of mind when leveraging your policy's assets. Imagine needing $50,000 for a home renovation; with a Guardian policy, you could easily access these funds, and your policy's cash value would continue to grow, potentially offsetting some of the loan interest through dividends.

New York Life Whole Life Insurance

New York Life, one of the largest mutual life insurance companies in the US, offers whole life policies that are a cornerstone of many financial plans. Their policies are known for their guarantees, strong cash value growth, and consistent dividend payments. New York Life's policy loan provisions are designed to provide policyholders with flexible access to their cash value. They offer competitive interest rates, and the process for obtaining a loan is typically streamlined. Like other mutuals, their policies are often structured so that taking a loan doesn't directly impact the dividend scale, allowing your policy to continue its growth trajectory. This makes New York Life a strong contender for those looking for a reliable source of funds that doesn't compromise their long-term financial goals. If you have a policy with a $120,000 cash value, you could borrow a substantial portion, say $108,000, for a business opportunity, knowing your policy's underlying value and dividend potential remain strong.

Important Considerations Before Taking a Policy Loan

Before you jump into taking a policy loan, let's just quickly recap some really important things to keep in mind. It's all about being informed, right? First, always remember that any outstanding loan balance and accrued interest will reduce the death benefit your beneficiaries receive. So, if leaving a specific amount to your loved ones is your primary goal, make sure you have a plan to repay the loan. Second, while repayment is flexible, interest does accrue. If you let the interest compound without making payments, the loan balance can grow significantly. In rare cases, this could lead to the policy lapsing if the loan balance exceeds the cash value, which could trigger a taxable event. Third, understand the interest rate. While often competitive, it's still a cost. Compare it to other lending options you might have. Fourth, communicate with your insurance company. They are there to help you understand the specifics of your policy and the loan process. Don't hesitate to ask questions. Finally, have a repayment strategy. Even if it's flexible, having a general idea of how and when you'll repay the loan can help you manage your finances effectively and ensure your policy continues to serve its intended purpose. Policy loans are a fantastic tool, but like any financial instrument, they work best when used thoughtfully and strategically.

Frequently Asked Questions About Whole Life Policy Loans

Can I borrow against my whole life insurance policy immediately after purchasing it?

Generally, no. You need to accumulate sufficient cash value in your policy before you can take a loan. This usually takes a few years, as the cash value grows over time with premium payments and dividends. The exact timeframe depends on your policy's specific terms and how quickly cash value builds up.

What happens if I don't repay my whole life insurance policy loan?

If you don't repay the loan, the outstanding loan balance plus any accrued interest will be deducted from the death benefit when the policy pays out. This means your beneficiaries will receive a reduced amount. In rare cases, if the loan balance grows to exceed the policy's cash value, the policy could lapse, which might have tax implications.

Are policy loan interest payments tax deductible?

Typically, no. For most individual whole life insurance policies, the interest paid on a policy loan is not tax deductible. However, tax laws can be complex and change, so it's always best to consult with a qualified tax advisor for personalized advice.

Does taking a policy loan affect my policy's cash value growth or dividends?

This depends on whether your policy is 'direct recognition' or 'non-direct recognition.' With non-direct recognition policies (common with many mutual companies), taking a loan does not directly impact the dividends your policy earns. Your cash value continues to grow as if no loan was taken. With direct recognition policies, the portion of your cash value used as collateral for the loan might earn a lower dividend rate. Always check your specific policy terms or ask your insurer.

Is there a limit to how much I can borrow from my whole life policy?

Yes, there is a limit. You can typically borrow up to a certain percentage of your policy's accumulated cash value, often ranging from 90% to 95%. The exact percentage will be specified in your policy contract and by your insurance company.

How quickly can I get a policy loan?

One of the advantages of policy loans is their speed. Once you request a loan and it's approved (which is usually quick since your cash value is the collateral), the funds can often be disbursed to you within a few business days, sometimes even faster.

Can I take multiple loans from my whole life policy?

Yes, as long as you have sufficient cash value available, you can typically take multiple loans from your whole life insurance policy. Each loan will accrue interest independently, and the total outstanding loan balance will reduce the death benefit.

What are the tax implications of a policy loan?

Generally, policy loans are not considered taxable income as long as the policy remains in force. However, if the policy lapses with an outstanding loan, the amount of the loan that exceeds the premiums paid could be considered taxable income. It's crucial to consult with a tax professional regarding your specific situation.

Can I use a policy loan to pay my premiums?

Yes, you can use a policy loan to pay your whole life insurance premiums. This can be a useful option if you face a temporary financial hardship and want to keep your policy in force without missing payments. However, remember that the loan will accrue interest and reduce your death benefit.

Is a whole life policy loan better than a bank loan?

It depends on your specific needs and financial situation. Policy loans offer unique advantages like no credit checks, flexible repayment, and continued cash value growth. However, bank loans might offer lower interest rates in some cases, or be necessary if you haven't built up sufficient cash value. It's important to compare all your options.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)