Final Expense Life Insurance Covering Funeral Costs

Learn about final expense life insurance and how it helps cover funeral and end-of-life expenses.

Learn about final expense life insurance and how it helps cover funeral and end-of-life expenses.

Final Expense Life Insurance Covering Funeral Costs

Let's face it, talking about end-of-life expenses isn't exactly a fun dinner conversation. But it's a really important one, especially if you want to spare your loved ones a significant financial burden during an already difficult time. That's where final expense life insurance comes in. It's a specific type of whole life insurance designed to cover those immediate costs that arise after someone passes away, primarily funeral and burial expenses, but also things like medical bills, probate fees, and other outstanding debts. Think of it as a financial safety net, ensuring that your family can focus on grieving rather than scrambling to pay for a funeral.

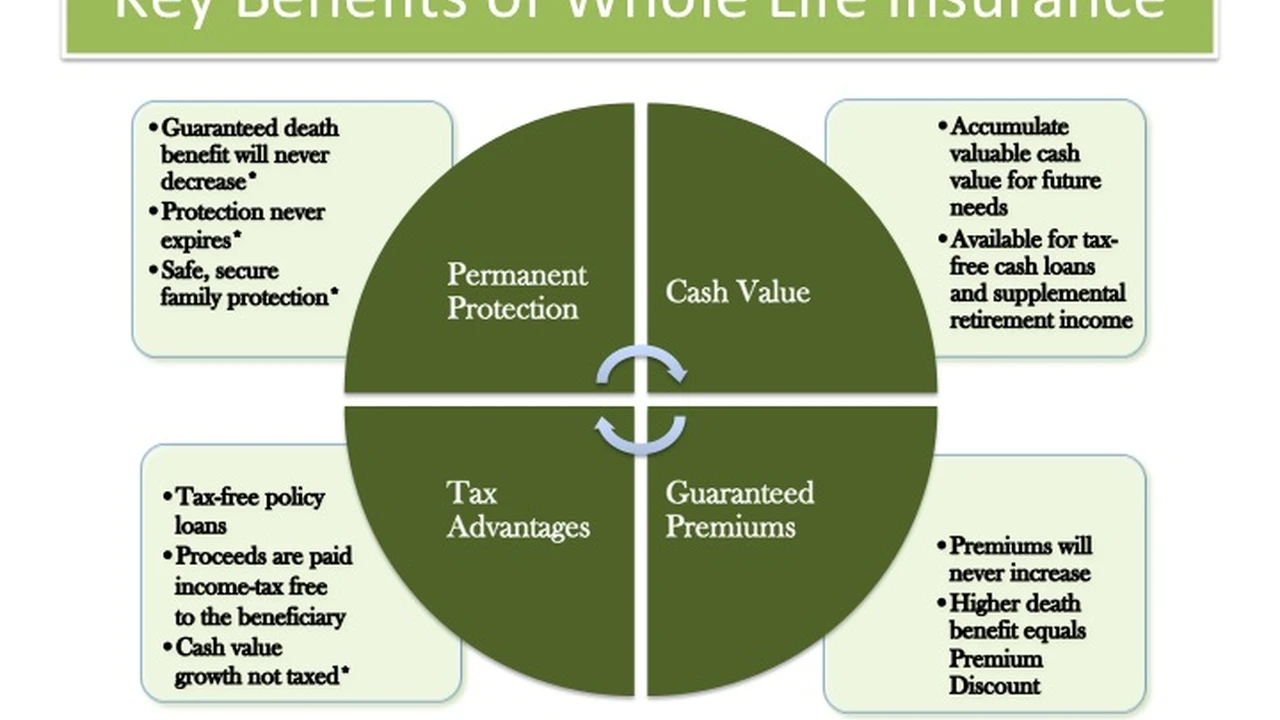

Many people confuse final expense insurance with traditional life insurance, but there are some key differences. While both provide a death benefit, final expense policies are typically for smaller amounts, usually ranging from $5,000 to $50,000. They're also often easier to qualify for, with simplified underwriting and sometimes no medical exam required. This makes them particularly appealing to seniors or those with health issues who might struggle to get approved for a larger, more comprehensive policy. The premiums are usually fixed, meaning they won't increase over time, and the policy builds cash value, which you can access later if needed. It’s a straightforward product designed for a very specific, yet universal, need.

Understanding Final Expense Insurance What It Is and How It Works

So, what exactly is final expense insurance? At its core, it's a type of whole life insurance policy with a smaller death benefit. Unlike term life insurance, which covers you for a specific period, final expense insurance provides coverage for your entire life, as long as premiums are paid. The primary purpose, as the name suggests, is to cover the costs associated with your passing. This can include funeral arrangements, cremation, burial plots, headstones, embalming, and even things like memorial services and transportation of remains. Beyond that, the death benefit can also be used for any outstanding medical bills, credit card debt, or other personal loans that might be left behind.

The way it works is pretty simple. You apply for a policy, typically answering a few health questions, and if approved, you pay a regular premium. When you pass away, the insurance company pays a tax-free death benefit directly to your designated beneficiary. This beneficiary can be a family member, a friend, or even a funeral home. The key here is that the payout is usually quick, often within days or weeks of a claim being filed, which is crucial for covering immediate expenses. There's no waiting period for the death benefit to be paid out for accidental deaths, but for natural causes, some policies might have a graded death benefit period, usually two to three years. During this period, if you pass away from natural causes, your beneficiaries might only receive a refund of premiums paid plus interest, rather than the full death benefit. This is a common feature for guaranteed issue policies, which we'll discuss more later.

Who Needs Final Expense Life Insurance Protecting Your Loved Ones

You might be wondering if final expense insurance is right for you. It's particularly well-suited for a few specific groups of people. Firstly, seniors who want to ensure their funeral costs won't burden their children or other family members. As we age, health issues can make it difficult to qualify for traditional life insurance, but final expense policies often have more lenient underwriting. Secondly, individuals with pre-existing health conditions who have been denied traditional life insurance. Many final expense policies offer simplified issue or guaranteed issue options, meaning you can get coverage even with significant health challenges.

Thirdly, anyone who wants to leave a small, specific legacy to cover end-of-life costs without over-insuring themselves. If you already have a larger life insurance policy for income replacement or wealth transfer, a final expense policy can act as a dedicated fund for funeral expenses, keeping those funds separate and easily accessible. Finally, people who simply want peace of mind. Knowing that your final arrangements are financially covered can be a huge relief, both for you and for your family. It's about taking control of your legacy and ensuring your wishes are respected without adding financial stress to an already emotional time.

Comparing Final Expense Insurance Options Simplified Issue vs Guaranteed Issue

When you're looking at final expense insurance, you'll primarily encounter two main types: simplified issue and guaranteed issue. Understanding the difference is crucial for choosing the right policy for your situation.

Simplified Issue Final Expense Insurance Easy Approval

Simplified issue policies are the most common type of final expense insurance. They typically require you to answer a short series of health questions on the application, usually around 5-10 questions. There's no medical exam involved, which speeds up the approval process significantly. The questions are usually straightforward, asking about major health conditions like cancer, heart attack, stroke, or organ transplants within a certain timeframe. If you can answer 'no' to all or most of these questions, you're likely to be approved. The premiums for simplified issue policies are generally lower than guaranteed issue policies because the insurer has a better understanding of your health risk. Most simplified issue policies offer immediate full coverage, meaning the full death benefit is paid out from day one, regardless of the cause of death (unless it's suicide within the first two years, which is standard for most life insurance).

Guaranteed Issue Final Expense Insurance No Health Questions

Guaranteed issue final expense insurance is exactly what it sounds like: guaranteed approval. There are no health questions asked, and no medical exam required. If you apply and meet the age requirements (usually between 50 and 85), you will be approved for coverage. This makes it an excellent option for individuals with serious health conditions who wouldn't qualify for any other type of life insurance. However, this convenience comes with a trade-off. Guaranteed issue policies almost always have a graded death benefit period, typically two or three years. If you pass away from natural causes during this period, your beneficiaries will usually receive a refund of the premiums paid, plus a small amount of interest (e.g., 10%). If you pass away from an accident during this period, the full death benefit is paid. After the graded period, the full death benefit is paid for any cause of death. Premiums for guaranteed issue policies are also generally higher than simplified issue policies due to the increased risk the insurer takes on.

Key Features and Benefits of Final Expense Policies Cash Value and Fixed Premiums

Beyond covering funeral costs, final expense policies offer several attractive features and benefits that make them a valuable financial tool.

Fixed Premiums for Predictable Costs

One of the most appealing aspects of final expense insurance is its fixed premiums. Once you purchase the policy, your premium payments will never increase, regardless of your age or health changes. This provides incredible peace of mind, allowing you to budget effectively and avoid unexpected cost hikes as you get older. This is a significant advantage over some other types of insurance where premiums can fluctuate.

Cash Value Accumulation A Living Benefit

Like all whole life insurance policies, final expense insurance builds cash value over time. This cash value grows on a tax-deferred basis and can be accessed during your lifetime. You can typically borrow against the cash value or withdraw from it. Policy loans are usually tax-free and don't require a credit check, making them a flexible option for unexpected expenses. However, any outstanding loan balance or withdrawal will reduce the death benefit paid to your beneficiaries. The cash value component adds a 'living benefit' to the policy, meaning it can serve as a financial resource for you while you're still alive, not just for your beneficiaries after you pass.

No Medical Exam Life Insurance Simplified Underwriting

As mentioned, a major benefit of most final expense policies is the simplified underwriting process. Many policies require no medical exam, which means no needles, no urine samples, and no waiting for lab results. This makes the application process much faster and less intrusive. For simplified issue policies, you'll answer a few health questions, and for guaranteed issue, there are no health questions at all. This accessibility is a huge plus for seniors or those with health conditions who might find traditional underwriting processes daunting or prohibitive.

Top Final Expense Insurance Providers and Their Offerings

When it comes to choosing a final expense insurance provider, there are several reputable companies that stand out. Each has its own strengths, so it's worth comparing them based on your specific needs, health status, and budget. Here are a few prominent players in the US market, along with their typical offerings and target scenarios:

Mutual of Omaha Living Promise Final Expense

Mutual of Omaha is a very well-known and highly-rated insurer in the final expense market. Their 'Living Promise' product is a simplified issue whole life policy. They offer two plans: the Level Benefit Plan and the Graded Benefit Plan.

- Level Benefit Plan: This is for healthier individuals. You answer a few health questions, and if approved, you get immediate full coverage. Death benefits typically range from $2,000 to $40,000. This is ideal for someone who is generally in good health but wants the ease of no medical exam.

- Graded Benefit Plan: This is for those with more significant health issues. It also involves health questions, but the criteria are more lenient. However, it comes with a graded death benefit. If death occurs from natural causes in the first two years, beneficiaries receive 110% of premiums paid. After two years, the full death benefit is paid. Accidental death is covered immediately. Death benefits range from $2,000 to $20,000.

Use Case: Mutual of Omaha is great for individuals looking for a balance of affordability and relatively easy qualification. Their Level Benefit Plan is competitive for those in decent health, while the Graded Benefit Plan provides an option for those with more serious conditions who still want some level of immediate coverage for accidents.

Foresters Financial PlanRight Final Expense

Foresters Financial is another strong contender, known for its competitive rates and community-focused approach. Their 'PlanRight' final expense product also offers different tiers based on health.

- Level Plan: Similar to Mutual of Omaha's Level Benefit, this plan offers immediate full coverage for healthier applicants who pass a few health questions. Death benefits can go up to $35,000.

- Modified Plan: For those with certain health conditions that might exclude them from the Level Plan. It has a graded death benefit for the first two years (10% interest on premiums paid for natural death), with full coverage after that.

- Guaranteed Plan: This is their guaranteed issue option, with no health questions or medical exam. It has a two-year graded death benefit (10% interest on premiums paid for natural death). Death benefits typically range from $2,000 to $15,000.

Use Case: Foresters is often praised for its competitive pricing, especially for its Level Plan. Their Guaranteed Plan is a solid choice for those who absolutely cannot qualify for anything else due to severe health issues, offering a safety net for funeral costs.

AIG Guaranteed Issue Whole Life

AIG is a major global insurer, and their guaranteed issue whole life product is a popular choice for those who need guaranteed acceptance.

- Guaranteed Issue: As the name suggests, this is a guaranteed issue policy. No health questions, no medical exam. It's available for ages 50-80.

- Graded Death Benefit: It comes with a two-year graded death benefit. If death occurs from natural causes within the first two years, beneficiaries receive 110% of premiums paid. After two years, the full death benefit is paid. Accidental death is covered immediately.

- Death Benefits: Typically range from $5,000 to $25,000.

Use Case: AIG's guaranteed issue policy is ideal for individuals with significant health problems, or those who simply want the absolute certainty of approval without any medical scrutiny. It's a straightforward solution for covering final expenses when other options are limited.

Gerber Life Grow-Up Plan and Guaranteed Acceptance Whole Life

Gerber Life is well-known for its children's life insurance, but they also offer final expense options for adults.

- Guaranteed Acceptance Whole Life: This is their adult final expense product, available for ages 50-80. It's a guaranteed issue policy with no health questions or medical exam.

- Graded Death Benefit: Similar to AIG, it has a two-year graded death benefit. If death occurs from natural causes within the first two years, beneficiaries receive 110% of premiums paid. Full death benefit after two years, and immediate coverage for accidental death.

- Death Benefits: Typically range from $5,000 to $25,000.

Use Case: Gerber Life's guaranteed acceptance policy is another strong option for those needing guaranteed approval due to health issues. It's a reliable choice from a well-established brand, offering peace of mind for end-of-life costs.

Colonial Penn Guaranteed Acceptance Whole Life

Colonial Penn is famous for its TV commercials and guaranteed acceptance policies, often marketed directly to seniors.

- Guaranteed Acceptance: This is their flagship product, offering guaranteed approval for ages 50-85. No health questions or medical exam.

- Graded Death Benefit: It includes a two-year graded death benefit. If death occurs from natural causes within the first two years, beneficiaries receive all premiums paid plus 7% interest. Full death benefit after two years, and immediate coverage for accidental death.

- Death Benefits: They often market their policies in 'units,' with each unit providing a certain amount of coverage based on age and gender. This can sometimes make direct comparisons a bit tricky, but it allows for flexible coverage amounts.

Use Case: Colonial Penn is a go-to for many seniors who prioritize guaranteed acceptance and a simple application process above all else. While their 'unit' system can be a bit confusing, it offers a clear path to coverage for those who might otherwise be denied.

Understanding Final Expense Insurance Costs Premiums and Factors

The cost of final expense insurance, like any insurance, isn't one-size-fits-all. Several factors influence your premiums. Understanding these can help you get a better estimate and find the most affordable option.

Age and Gender Impact on Final Expense Premiums

Your age is arguably the biggest factor. The older you are when you apply, the higher your premiums will generally be. This is because the insurer is taking on a shorter period of risk. It's always more affordable to get coverage when you're younger, even for final expense. Gender also plays a role, as women typically have a longer life expectancy than men, which can sometimes result in slightly lower premiums for women.

Health Status and Underwriting Simplified vs Guaranteed Issue Costs

Your health status directly impacts the type of policy you qualify for and, consequently, the premium. If you're in relatively good health and can qualify for a simplified issue policy, your premiums will be lower because the insurer perceives less risk. If you have significant health issues and need a guaranteed issue policy, your premiums will be higher due to the increased risk the insurer is taking on by not asking health questions. The graded death benefit in guaranteed issue policies is also a way for insurers to manage this higher risk.

Coverage Amount and Riders Customizing Your Final Expense Policy

Naturally, the amount of coverage you choose will affect your premium. A $20,000 policy will cost more than a $10,000 policy. It's important to accurately estimate your potential final expenses to avoid being under-insured or over-insured. Additionally, some policies offer riders, which are add-ons that provide extra benefits. Common riders might include an accidental death benefit rider (which pays an additional sum if death is due to an accident) or a children's rider (which provides a small amount of coverage for your children). While riders can enhance your coverage, they will also increase your premium.

Example Premium Ranges (Illustrative, for a $10,000 policy)

To give you a rough idea, here are some illustrative monthly premium ranges for a $10,000 final expense policy. Please remember these are estimates and actual quotes will vary significantly based on the insurer, your exact age, health, and location.

- For a 60-year-old female, non-smoker, good health (Simplified Issue): $30 - $50 per month

- For a 60-year-old male, non-smoker, good health (Simplified Issue): $40 - $65 per month

- For a 70-year-old female, non-smoker, average health (Simplified Issue): $50 - $80 per month

- For a 70-year-old male, non-smoker, average health (Simplified Issue): $65 - $100 per month

- For an 80-year-old female, any health (Guaranteed Issue): $80 - $120 per month

- For an 80-year-old male, any health (Guaranteed Issue): $100 - $150+ per month

As you can see, premiums increase with age and if you need a guaranteed issue policy. It's always best to get personalized quotes from multiple providers to find the best rate for your specific situation.

How to Choose the Best Final Expense Policy for Your Needs

Selecting the right final expense policy involves a few key steps. It's not just about the cheapest premium; it's about finding the best fit for your health, budget, and peace of mind.

Assess Your Health and Eligibility Simplified or Guaranteed

The first step is to honestly assess your health. Do you have any major health conditions like cancer, heart disease, or kidney failure? Have you had a stroke or heart attack recently? If you're in relatively good health, you'll likely qualify for a simplified issue policy, which offers lower premiums and immediate full coverage. If your health is more challenging, a guaranteed issue policy might be your only option, but it still provides valuable coverage. Don't try to hide health issues, as this can lead to policy cancellation or denial of claims.

Determine Your Coverage Amount Funeral Costs and More

Next, estimate how much coverage you actually need. Research average funeral costs in your area (they can vary significantly). Consider cremation vs. traditional burial, memorial services, burial plots, headstones, and any other specific wishes you have. Don't forget to factor in potential outstanding debts like medical bills, credit card balances, or personal loans that you don't want to leave to your family. A common range for final expense policies is $10,000 to $25,000, but you can go higher or lower depending on your needs.

Compare Quotes from Multiple Providers Finding the Best Value

This is a crucial step. Don't just go with the first quote you get. Work with an independent insurance agent or use online comparison tools to get quotes from several different companies. Premiums can vary significantly between insurers for the exact same coverage. Look not only at the premium but also at the company's financial strength ratings (from agencies like A.M. Best, S&P, Moody's) and their customer service reputation. A financially strong company is more likely to be around to pay claims when the time comes.

Understand the Graded Death Benefit If Applicable

If you're considering a guaranteed issue policy, make sure you fully understand the graded death benefit period. Know exactly how long it is (usually two or three years) and what your beneficiaries will receive if you pass away from natural causes during that time. This transparency is important so there are no surprises later on.

Consider Riders and Additional Benefits Customizing Your Policy

Think about whether any riders would be beneficial for your situation. An accidental death benefit rider can provide extra protection, especially if you're concerned about that specific risk. A children's rider can be a cost-effective way to get a small amount of coverage for your grandchildren or minor children. While riders add to the cost, they can provide valuable extra protection and peace of mind.

The Application Process for Final Expense Insurance What to Expect

Applying for final expense insurance is generally a straightforward process, especially compared to traditional life insurance. Here's a typical breakdown of what you can expect:

Initial Consultation and Needs Assessment

You'll usually start by speaking with an insurance agent or using an online platform. They'll ask you about your age, health, and how much coverage you're looking for. This helps them determine which type of final expense policy (simplified issue or guaranteed issue) you're most likely to qualify for and what coverage amount makes sense for your estimated final expenses.

Completing the Application Form Health Questions and Personal Details

For a simplified issue policy, you'll fill out an application that includes basic personal information (name, address, date of birth, beneficiary details) and a short series of health questions. These questions are usually 'yes/no' and focus on major health conditions or recent medical events. For a guaranteed issue policy, you'll only provide personal details, as there are no health questions.

Underwriting Process Simplified and Fast

Once your application is submitted, the insurer will review it. For simplified issue policies, they might do a quick check of prescription drug databases (to see what medications you've been prescribed) and the Medical Information Bureau (MIB), which is a database that shares health information among life insurance companies. This process is usually very fast, often resulting in an approval decision within minutes or a few days. For guaranteed issue policies, approval is almost immediate as there's no health review.

Policy Issuance and First Premium Payment

If approved, the insurer will issue your policy. You'll then need to make your first premium payment to put the policy in force. You'll receive your policy documents, which you should review carefully to ensure all details are correct and you understand the terms and conditions, especially regarding any graded death benefit period.

Final Expense Insurance in Southeast Asia Market Insights

While the core concept of final expense insurance remains the same globally, the market in Southeast Asia has its own nuances. The demand for such products is growing as populations age and awareness of financial planning increases. However, product names and specific features might differ.

Cultural Considerations and Funeral Traditions

Funeral traditions in Southeast Asia are incredibly diverse and often involve significant cultural and religious ceremonies, which can be costly. For example, in countries like Vietnam or the Philippines, multi-day wakes and elaborate rituals are common. In Singapore and Malaysia, while traditions vary, there's a strong emphasis on providing a dignified farewell. Final expense insurance can be particularly valuable here, as it helps families uphold these important traditions without financial strain.

Availability and Product Names in Key Markets

In many Southeast Asian countries, dedicated 'final expense' products might not be explicitly marketed under that name. Instead, they are often offered as small whole life insurance policies or 'burial plans' by local and international insurers. For example:

- Singapore and Malaysia: Major insurers like Prudential, AIA, Great Eastern, and Manulife offer various whole life plans that can serve as final expense coverage. They might have simplified underwriting options for smaller face amounts.

- Philippines: Companies like Sun Life, Pru Life UK, and AXA offer whole life insurance products that can be tailored for final expenses. Some local providers might have specific 'memorial plans' or 'funeral plans.'

- Vietnam: The life insurance market is growing, with companies like Prudential Vietnam, Manulife Vietnam, and FWD offering whole life and endowment plans that can be used for end-of-life costs.

It's important to consult with local insurance agents in these countries to understand the specific products available and how they align with final expense needs, as regulatory environments and product structures can differ from the US market.

Comparing Local Offerings and International Providers

When looking for final expense solutions in Southeast Asia, consider both local insurers and international providers with a presence in the region. Local insurers often have a deeper understanding of cultural nuances and local regulations, while international providers might offer a broader range of products or more robust digital platforms. Always compare policy terms, premium structures, cash value growth, and the claims process. Look for policies with clear, fixed premiums and a straightforward payout mechanism to ensure your beneficiaries can access funds quickly when needed.

Common Misconceptions About Final Expense Insurance Debunked

There are a few common misunderstandings about final expense insurance that are worth clarifying to help you make an informed decision.

It's Only for the Elderly Not True

While final expense insurance is very popular among seniors, it's not exclusively for them. Anyone who wants to pre-plan and cover their funeral costs can benefit. Younger individuals with health conditions who struggle to get traditional life insurance might also find it a viable option. The younger you are when you purchase it, the lower your premiums will be, making it more affordable in the long run.

It's Too Expensive for What It Is Not Always

Some people perceive final expense insurance as expensive for the relatively small death benefit. However, when you consider the ease of qualification, fixed premiums, and the peace of mind it provides, it can be a very cost-effective solution for a specific need. The alternative is often leaving your family to cover potentially thousands of dollars in immediate expenses, which can be far more costly in terms of emotional and financial stress.

It's a Scam or Not Real Insurance Absolutely Not

Final expense insurance is a legitimate and regulated form of whole life insurance. It's offered by reputable insurance companies and provides a real death benefit. Like any financial product, it's important to buy from a financially stable and well-regarded insurer and to understand the policy terms, especially any graded death benefit. But it is definitely not a scam.

My Family Will Just Pay for It Why Bother

While your family might be willing to pay for your funeral, do you really want to burden them with that financial stress during their time of grief? Funeral costs can easily run into the tens of thousands of dollars. Final expense insurance ensures that those funds are readily available, allowing your family to focus on remembering you rather than worrying about bills. It's a thoughtful act of love and planning.

The Importance of Planning Your Final Arrangements

Beyond just the financial aspect, planning your final arrangements is a profound act of care for your loved ones. Final expense insurance is a key component of this planning, but it's also about communicating your wishes.

Reducing Emotional and Financial Burden on Family

When someone passes away, their family is often overwhelmed with grief. Having to make immediate financial decisions and arrangements can add immense stress. By having a final expense policy in place, you remove a significant financial burden. Your family won't have to dip into savings, take out loans, or even start a crowdfunding campaign to cover costs. The death benefit is paid directly to them, providing immediate liquidity for expenses.

Ensuring Your Wishes Are Respected

Part of planning your final arrangements is also making your wishes known. Do you prefer cremation or burial? What kind of service do you envision? What music or readings are important to you? While final expense insurance covers the costs, having a written plan (like a funeral pre-arrangement or a letter of instruction) ensures that your family can honor your preferences without guesswork. The insurance provides the funds to make those wishes a reality.

Peace of Mind for You and Your Loved Ones

Ultimately, final expense insurance offers invaluable peace of mind. For you, it's the comfort of knowing that you've taken care of this important detail and that your passing won't create financial hardship for those you leave behind. For your loved ones, it's the relief of knowing that they can grieve without the added stress of immediate financial concerns. It's a small investment that yields a huge return in terms of emotional and financial security for your family.

So, if you're thinking about how to best protect your family from the inevitable costs that come with passing away, final expense life insurance is definitely worth exploring. It's a simple, accessible, and effective way to ensure your final wishes are honored and your loved ones are cared for during a difficult time.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)