How to Choose the Best Universal Life Insurance Policy

A guide to life insurance options available for foreign nationals residing in the United States.

Life Insurance for Foreign Nationals in the US Navigating Your Options

Hey there! If you're a foreign national living in the United States, you might be wondering about life insurance. It's a super important topic, especially when you're building a life in a new country. Whether you're here on a work visa, a green card, or even just for an extended stay, protecting your loved ones financially is probably high on your priority list. But let's be real, navigating the US insurance landscape can feel a bit like trying to solve a Rubik's Cube blindfolded, especially with all the specific rules for non-citizens. Don't sweat it, though! This comprehensive guide is designed to break down everything you need to know about life insurance for foreign nationals in the US, from eligibility to specific product recommendations and how to get the best rates. We're talking about making sure your family is secure, no matter what.

Understanding Eligibility for Foreign Nationals Life Insurance Requirements

First things first: can you even get life insurance as a foreign national in the US? The short answer is usually yes, but it's not always as straightforward as it is for US citizens. Insurers look at a few key factors to determine your eligibility and the type of policy you can get. The biggest one is your residency status and how long you plan to stay in the US. Generally, the more permanent your ties to the US, the easier it will be to secure a policy.

Residency Status and Its Impact on Life Insurance

- Green Card Holders (Permanent Residents): If you have a green card, you're in a pretty good position. Most insurance companies treat green card holders very similarly to US citizens. You'll likely have access to the full range of life insurance products, including term, whole, and universal life policies, with competitive rates. The main thing they'll check is your physical presence in the US.

- Visa Holders (Non-Permanent Residents): This is where it gets a bit more nuanced. The type of visa you hold and its duration play a huge role.

- H-1B, L-1, O-1 Visas (Work Visas): If you're on a long-term work visa, especially one that's renewable or has a clear path to permanent residency, many insurers will consider you. They'll often require you to have been in the US for a certain period (e.g., 6 months to 2 years) and demonstrate an intent to stay. Some might even require you to have a US bank account and a US mailing address.

- F-1 Visas (Student Visas): For students, it can be tougher. Some companies might offer limited coverage, especially if you're planning to return to your home country after graduation. However, if you're pursuing a PhD or have a clear career path in the US, some insurers might be more flexible.

- E-2, TN Visas (Treaty Investor/NAFTA Professional): These visas often imply a longer-term stay, making it easier to qualify for policies, similar to H-1B holders.

- B-1/B-2 Visas (Tourist/Business Visas): Generally, it's very difficult, if not impossible, to get life insurance on a short-term tourist or business visa, as insurers require a more permanent connection to the US.

- Asylum Seekers and Refugees: Eligibility can vary greatly. Once asylum or refugee status is granted, and you have a more stable residency, options become more available.

Physical Presence and Intent to Stay Life Insurance Underwriting

Beyond your visa type, insurers want to see that you have a genuine connection to the US. This often means:

- Physical Presence: You need to be physically present in the US when you apply and often for a certain period leading up to the application. Some companies have a minimum stay requirement (e.g., 6 months, 1 year, or 2 years).

- Intent to Stay: This is a big one. Insurers want to know you're not just passing through. They'll look for things like a US mailing address, a US bank account, a US driver's license, employment in the US, and even property ownership. If you have family (spouse, children) also residing in the US, that strengthens your case.

- Tax Residency: Being a US tax resident is often a positive indicator for insurers.

Types of Life Insurance for Foreign Nationals Exploring Your Options

Once you've cleared the eligibility hurdles, you'll find that the types of life insurance available to foreign nationals are largely the same as for US citizens. The main difference might be the specific companies willing to offer them and potentially some limitations based on your residency status.

Term Life Insurance for Non-Citizens Affordable Protection

Term life insurance is often the most accessible and affordable option for foreign nationals, especially those on work visas. It provides coverage for a specific period (the 'term'), typically 10, 20, or 30 years. If you pass away during that term, your beneficiaries receive a death benefit. If you outlive the term, the policy expires, and there's no payout.

Why Term Life Insurance is Popular for Foreign Nationals:

- Affordability: Generally much cheaper than permanent policies.

- Simplicity: Easy to understand and straightforward.

- Matches Temporary Needs: If you're on a long-term work visa but aren't sure if you'll stay in the US permanently, a 10 or 20-year term can cover your needs while you're here.

Use Cases for Term Life Insurance:

- Young Professionals on H-1B: To cover mortgage, student loans, or provide for a young family while working in the US.

- Families with Dependents: Ensuring financial stability for children and a spouse if the primary earner passes away.

- Covering Specific Debts: Like a car loan or a portion of a mortgage.

Whole Life Insurance for Foreign Nationals Permanent Coverage

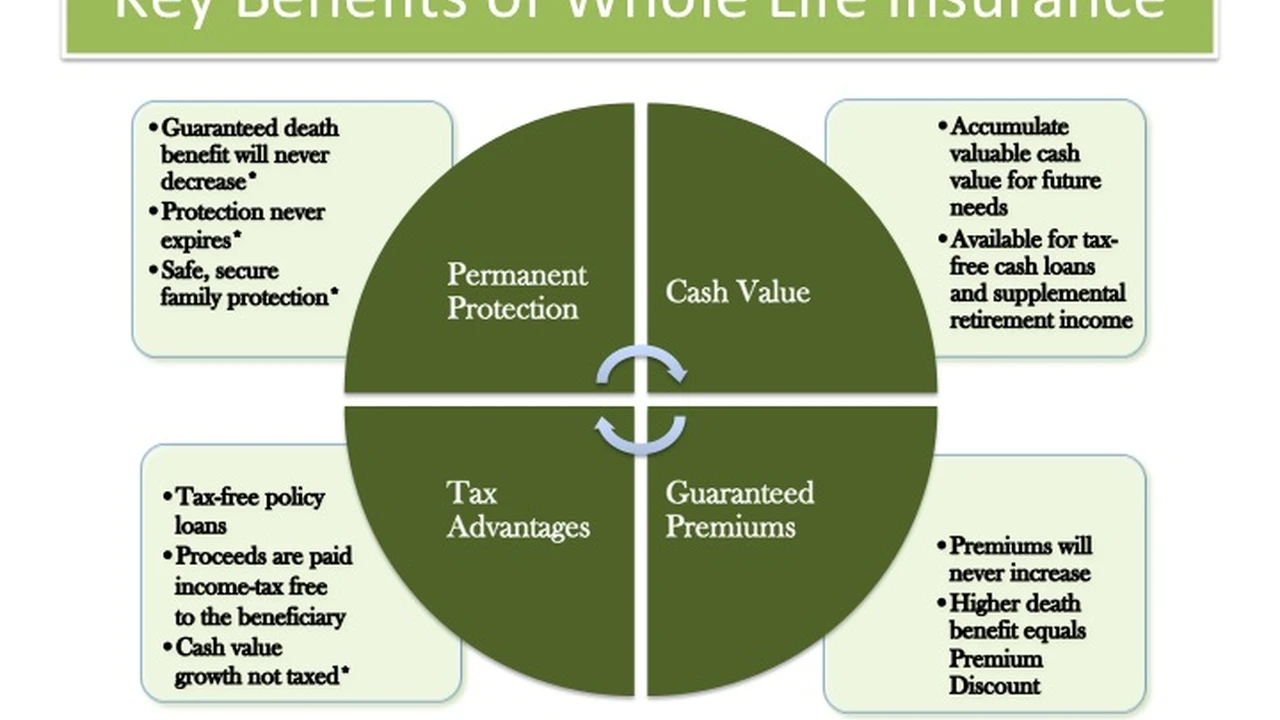

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as premiums are paid. It also builds cash value over time, which you can borrow against or withdraw from. This option is typically more suitable for green card holders or those with very strong, permanent ties to the US.

Benefits of Whole Life Insurance for Foreign Nationals:

- Lifelong Coverage: Provides peace of mind that your family will receive a death benefit whenever you pass away.

- Cash Value Growth: The cash value grows on a tax-deferred basis and can be a source of funds later in life.

- Guaranteed Premiums: Premiums typically remain level for your entire life.

Use Cases for Whole Life Insurance:

- Green Card Holders: Who plan to reside permanently in the US and want lifelong protection.

- Estate Planning: To leave a legacy or cover estate taxes.

- Wealth Accumulation: Using the cash value component as part of a broader financial strategy.

Universal Life Insurance for Non-Citizens Flexible Permanent Options

Universal life (UL) insurance is another form of permanent life insurance, but it offers more flexibility than whole life. You can often adjust your premium payments and death benefit over time. Like whole life, it also has a cash value component.

Types of Universal Life Insurance:

- Guaranteed Universal Life (GUL): Offers a guaranteed death benefit and fixed premiums, similar to whole life, but often at a lower cost. The cash value growth is minimal.

- Indexed Universal Life (IUL): The cash value growth is tied to a stock market index (like the S&P 500) but with a floor (minimum return) and a cap (maximum return), offering potential for higher growth without direct market risk.

- Variable Universal Life (VUL): The cash value is invested in sub-accounts chosen by the policyholder, similar to mutual funds. This offers the highest growth potential but also the highest risk, as you can lose money.

Why Universal Life Insurance Might Be a Fit:

- Flexibility: Adaptable to changing financial situations.

- Cash Value Potential: IUL and VUL can offer significant cash value growth.

Use Cases for Universal Life Insurance:

- Green Card Holders Seeking Flexibility: Who want permanent coverage but with more control over premiums and death benefits.

- High Net Worth Individuals: For estate planning and tax-advantaged wealth accumulation.

Top Life Insurance Providers for Foreign Nationals Recommended Companies and Products

Not all insurance companies are equally friendly to foreign nationals. Some have stricter underwriting guidelines or simply don't offer policies to non-citizens. However, several reputable carriers are known for being more accommodating. It's always best to work with an independent agent who specializes in this area, as they can shop around for you.

Recommended Insurers and Their Offerings for Non-Citizens

Here are a few companies that often have favorable policies for foreign nationals, along with examples of products they might offer. Please note: eligibility and specific product availability can change, and it's crucial to get personalized quotes.

1. Prudential Financial

- Why they're good: Prudential is often cited as one of the most foreign-national-friendly insurers. They have a long history and are generally flexible with various visa types, especially H-1B and L-1, provided you have a strong US connection.

- Recommended Products:

- PruTerm WorkLife IV: A solid term life insurance option. It's convertible, meaning you can convert it to a permanent policy later if your residency status becomes more permanent. This is great for those on work visas who might eventually get a green card.

- PruLife Universal Protector: A guaranteed universal life policy that offers lifelong coverage with fixed premiums. Good for green card holders seeking permanent, affordable protection.

- Use Case: An H-1B visa holder who has been in the US for 2+ years, has a family, and wants to ensure their mortgage and living expenses are covered for the next 20 years. They might start with PruTerm WorkLife IV and consider converting it if they get a green card.

- Estimated Cost (Example): For a healthy 35-year-old H-1B visa holder seeking a $500,000, 20-year term policy, premiums could range from $30-$50 per month, depending on health and other factors.

2. Transamerica

- Why they're good: Transamerica is another major player that often works with foreign nationals. They have a range of products and can be competitive, especially for those with established US residency.

- Recommended Products:

- Transamerica Trendsetter Super: A popular term life insurance product known for competitive rates and flexible terms.

- Transamerica Financial Foundation IUL: An indexed universal life policy that offers cash value growth tied to market performance, suitable for green card holders looking for both protection and wealth accumulation.

- Use Case: A green card holder in their 40s who wants permanent coverage and the potential for cash value growth to supplement retirement income. They might opt for the Financial Foundation IUL.

- Estimated Cost (Example): For a healthy 45-year-old green card holder seeking a $750,000 IUL policy, premiums could start around $200-$400 per month, varying significantly based on desired cash value growth and death benefit.

3. Pacific Life

- Why they're good: Pacific Life is known for its strong financial ratings and a good selection of permanent life insurance products, including various universal life options. They can be a good choice for foreign nationals with more complex financial planning needs.

- Recommended Products:

- Pacific Life Pacific Estate Protector: A guaranteed universal life policy designed for estate planning, offering guaranteed death benefits.

- Pacific Life Pacific Indexed Accumulator 7: An IUL product focused on cash value accumulation, which can be attractive for high-net-worth individuals.

- Use Case: A high-net-worth L-1 visa holder or green card holder who wants to ensure their US-based assets are protected and passed on efficiently, potentially using an IUL for tax-advantaged growth.

- Estimated Cost (Example): For a healthy 50-year-old green card holder seeking a $1,000,000 IUL policy, premiums could be $500-$1000+ per month, depending on the desired accumulation strategy.

4. AIG (American International Group)

- Why they're good: AIG is a global insurer and can sometimes be more flexible with international clients. They offer a wide range of term and universal life products.

- Recommended Products:

- AIG Select-a-Term: Offers flexible term lengths (10 to 30 years) and competitive pricing.

- AIG Max Accumulator+ II: An IUL product with strong cash value potential.

- Use Case: A foreign national on an E-2 visa who needs a substantial death benefit for a specific period to cover business debts or family needs. AIG's term products could be a good fit.

- Estimated Cost (Example): For a healthy 40-year-old E-2 visa holder seeking a $750,000, 25-year term policy, premiums might be in the range of $50-$80 per month.

Important Considerations for Product Selection and Pricing

- Medical Exam: Most policies will require a medical exam, just like for US citizens. Be prepared for blood tests, urine samples, and a physical.

- Travel History: Your travel history, especially to certain high-risk countries, can impact your rates or even eligibility.

- Home Country Ties: Some insurers might ask about your ties to your home country. If you have significant financial obligations or dependents there, it could influence underwriting.

- Premium Payment: You'll typically need a US bank account for premium payments.

- Beneficiaries: You can usually name beneficiaries who reside outside the US, but it's important to discuss this with your agent to ensure a smooth payout process.

Comparing Life Insurance Options for Foreign Nationals Key Factors

When you're comparing policies, especially as a foreign national, there are a few extra layers to consider beyond just the premium. Let's break down what to look for.

Underwriting Guidelines for Non-Citizens What to Expect

Underwriting is the process where the insurance company assesses your risk. For foreign nationals, this process can be more rigorous. They'll look at:

- Residency Status and Duration: As discussed, this is paramount. The longer and more stable your US residency, the better.

- Visa Type: Some visas are viewed more favorably than others.

- Country of Origin: Unfortunately, some countries are considered higher risk due to political instability, economic sanctions, or higher mortality rates, which can affect eligibility or rates.

- Travel Plans: Frequent travel outside the US, especially to certain regions, can be a red flag.

- Financial Ties to the US: Proof of US employment, property, bank accounts, and tax residency strengthens your application.

- Health and Lifestyle: Standard underwriting factors like age, health, smoking status, and hobbies still apply.

Cost and Affordability Life Insurance Premiums for Non-Citizens

The cost of life insurance for foreign nationals can sometimes be slightly higher than for US citizens, depending on the perceived risk. However, if you have a green card or a long-term, stable visa and good health, you can often get very competitive rates.

Factors Influencing Your Premium:

- Age: Younger applicants generally pay less.

- Health: Excellent health leads to lower premiums.

- Coverage Amount: Higher death benefits mean higher premiums.

- Policy Type: Term is cheapest, followed by GUL, then Whole Life, and IUL/VUL can vary widely.

- Term Length: Longer term policies (e.g., 30 years) are more expensive than shorter ones (e.g., 10 years).

- Riders: Adding extra benefits (like critical illness riders) will increase the cost.

Comparing Specific Product Features and Benefits

Beyond the basic type of policy, delve into the specifics:

- Convertibility (for Term Policies): Can you convert your term policy to a permanent one without a new medical exam? This is a huge benefit if your residency status might change.

- Cash Value Growth (for Permanent Policies): How does the cash value grow? Is it guaranteed, tied to an index, or market-dependent? What are the surrender charges if you cancel early?

- Flexibility: Can you adjust premiums or death benefits? This is a hallmark of Universal Life policies.

- Riders: What additional benefits can you add? Common riders include Waiver of Premium (if you become disabled), Accelerated Death Benefit (access funds if terminally ill), and Long-Term Care riders.

- Company Financial Strength: Always check the financial ratings (A.M. Best, S&P, Moody's) of the insurer. You want a company that will be around to pay claims decades from now.

Practical Steps to Secure Life Insurance as a Foreign National Your Action Plan

Ready to get started? Here’s a step-by-step guide to help you navigate the process.

Gathering Necessary Documentation for Application

Before you even talk to an agent, have these documents ready:

- Passport and Visa: Copies of your current passport and visa.

- Green Card (if applicable): Copy of your green card.

- Proof of US Residency: Utility bills, lease agreements, driver's license, etc.

- Proof of US Employment: Pay stubs, employment verification letter.

- US Bank Account Information: For premium payments.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): Most insurers will require one of these.

- Financial Information: Income, assets, and liabilities.

- Medical History: Be prepared to provide detailed medical history, including any conditions or medications.

Working with an Independent Life Insurance Agent for Non-Citizens

This is perhaps the most crucial step. Don't try to do this alone. An independent agent who specializes in foreign national life insurance will be invaluable.

- Expertise: They know which companies are most favorable to foreign nationals and understand the nuances of underwriting for different visa types.

- Shopping Around: They can get quotes from multiple carriers, saving you time and potentially money.

- Guidance: They can help you understand the complex application process and ensure you submit all necessary documentation correctly.

- Advocacy: If there are any issues during underwriting, a good agent will advocate on your behalf.

The Application and Underwriting Process for Foreign Nationals

Here's what the process typically looks like:

- Initial Consultation: Discuss your needs, residency status, and financial goals with your agent.

- Quotes and Comparison: Your agent will provide quotes from suitable carriers.

- Application Submission: Complete the application form, which can be quite detailed.

- Medical Exam: A paramedical exam will be scheduled at your convenience.

- Underwriting Review: The insurer reviews your application, medical exam results, and all supporting documents. They might request additional information.

- Policy Offer: If approved, you'll receive a policy offer with the final premium.

- Policy Acceptance: You review and accept the policy, and your coverage begins.

Common Challenges and Solutions for Foreign Nationals Seeking Life Insurance

It's not always smooth sailing, but most challenges have solutions.

Addressing Limited Residency or Short Term Visas

If your visa is short-term or you haven't been in the US for long, options might be limited. Focus on:

- Shorter Term Policies: A 10-year term might be more accessible than a 30-year term.

- Companies with Flexible Underwriting: Some insurers are more lenient with minimum residency requirements.

- Group Life Insurance: If your employer offers group life insurance, take advantage of it. It's often guaranteed issue and doesn't depend on your visa status.

Navigating Home Country Ties and International Travel

Insurers want to understand your global footprint. Be transparent about:

- Frequent Travel: If you travel frequently, especially to countries with higher risk profiles, it might affect your rates. Some insurers might add a travel exclusion rider.

- Dependents Abroad: If your beneficiaries are in your home country, ensure you have all their details correct for a smooth claims process.

- Foreign Assets/Income: Be prepared to disclose these if asked, as they can be part of the overall financial picture.

Understanding Tax Implications for Non-Citizens

Life insurance death benefits are generally income tax-free to beneficiaries in the US. However, for foreign nationals, there can be estate tax implications if the death benefit is paid to non-US citizen beneficiaries and the policyholder is considered a non-resident alien for estate tax purposes. This is a complex area, and it's highly recommended to consult with a tax advisor specializing in international taxation.

The Importance of Life Insurance for Foreign Nationals Securing Your Future

Even if you plan to return to your home country eventually, having life insurance while you're in the US is incredibly important. You're building a life here, possibly with a family, a mortgage, and other financial responsibilities. Life insurance provides a safety net, ensuring that if the unexpected happens, your loved ones won't face financial hardship.

Protecting Your Family and Dependents

This is the primary reason for life insurance. If you're the primary earner, your death benefit can replace your income, allowing your family to maintain their lifestyle, pay for education, and cover daily expenses.

Covering Debts and Financial Obligations

Whether it's a mortgage on a US home, student loans, or other personal debts, life insurance can ensure these are paid off, preventing your family from inheriting financial burdens.

Peace of Mind for Your Journey in the US

Living in a new country comes with its own set of challenges. Having life insurance can provide immense peace of mind, knowing that you've taken steps to protect your family's financial future, no matter where life takes you.

So, don't put it off! Start exploring your options today. Work with a knowledgeable independent agent, gather your documents, and take that crucial step towards securing your family's financial well-being in the United States.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)