Comparing Term Life Insurance Quotes Online

A guide to effectively comparing term life insurance quotes online to find the most competitive rates and coverage.

Comparing Term Life Insurance Quotes Online

Why Comparing Term Life Insurance Quotes Online Matters for Your Financial Future

Hey there! So, you're thinking about getting term life insurance, huh? That's a smart move! It's one of the most straightforward and affordable ways to protect your loved ones financially if something unexpected happens to you. But here's the thing: not all term life insurance policies are created equal, and neither are their prices. That's where comparing term life insurance quotes online becomes super important. It's not just about finding the cheapest option; it's about finding the best value for your specific needs, ensuring your family gets the coverage they deserve without breaking your bank. Think of it like shopping for a new car – you wouldn't just buy the first one you see, right? You'd compare models, features, and prices to get the best deal. The same goes for life insurance, but with even higher stakes because it's about your family's security.

In today's digital age, getting quotes online has made this process incredibly easy and transparent. You no longer have to sit through lengthy meetings with multiple agents. With just a few clicks, you can get a clear picture of what's out there. This guide is going to walk you through everything you need to know about comparing term life insurance quotes online, from understanding what affects your rates to picking the right policy and even some specific product recommendations for both the US and Southeast Asian markets. Let's dive in!

Understanding Term Life Insurance What You Need to Know Before Getting Quotes

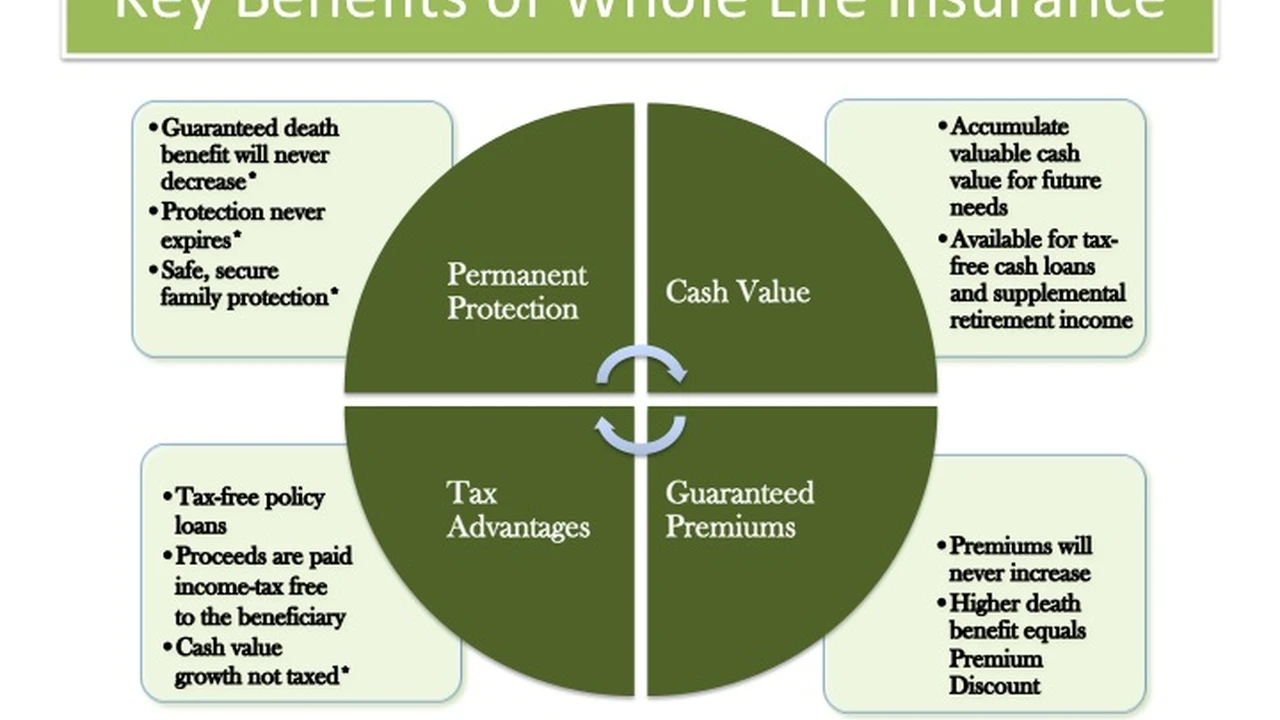

Before you start punching in your details to get quotes, it's crucial to have a solid grasp of what term life insurance actually is. In a nutshell, term life insurance provides coverage for a specific period, or 'term' – usually 10, 20, or 30 years. If you pass away within that term, your beneficiaries receive a tax-free death benefit. If you outlive the term, the policy simply expires, and there's no payout. It's pure protection, without any cash value component like whole life insurance. This simplicity is often why it's more affordable.

Key Factors Influencing Your Term Life Insurance Premiums and Quotes

When you get an online quote, you'll notice that the premiums can vary significantly. This isn't random; several factors play a huge role in determining how much you'll pay. Understanding these can help you get more accurate quotes and even take steps to lower your costs:

- Age: This is probably the biggest factor. The younger and healthier you are, the lower your premiums will be. Life insurance companies see younger individuals as less risky.

- Health and Medical History: Your current health status, any pre-existing conditions (like diabetes or heart disease), and your family's medical history will all be scrutinized. Be honest here; insurers will find out during the underwriting process.

- Lifestyle Choices: Do you smoke? Do you engage in risky hobbies like skydiving or rock climbing? These can significantly increase your premiums because they indicate a higher risk.

- Gender: Generally, women tend to live longer than men, so they often pay slightly lower premiums for the same coverage.

- Coverage Amount (Death Benefit): The more coverage you want (e.g., $500,000 vs. $1,000,000), the higher your premiums will be.

- Term Length: A longer term (e.g., 30 years) will typically cost more than a shorter term (e.g., 10 years) because the insurer is taking on risk for a longer period.

- Riders and Add-ons: If you add extra features like a waiver of premium rider or an accelerated death benefit rider, your premiums will increase.

- Insurance Company: Different companies have different underwriting guidelines and pricing structures, which is precisely why comparing quotes is so important!

How to Get Accurate Term Life Insurance Quotes Online A Step by Step Guide

Ready to start comparing? Great! Here's how to get the most accurate and useful quotes online:

Step 1 Determine Your Coverage Needs and Term Length for Optimal Protection

Before you even visit a quote comparison website, figure out how much coverage you actually need and for how long. A common rule of thumb is to aim for 5-10 times your annual income, but a more thorough approach involves considering:

- Your Debts: Mortgage, car loans, credit card debt, student loans.

- Future Expenses: College tuition for children, retirement for your spouse.

- Income Replacement: How many years of your income would your family need to replace?

- Final Expenses: Funeral costs, medical bills.

For term length, consider how long you'll have financial dependents or significant debts. If you have young children, a 20 or 30-year term might make sense. If your mortgage will be paid off in 15 years and your kids will be independent, a 15 or 20-year term could be sufficient.

Step 2 Gather Your Personal and Health Information for Precise Quotes

When you use an online quote tool, you'll be asked for information like your date of birth, gender, height, weight, smoking status, and general health. Have this information handy. The more accurate you are, the more accurate your quotes will be. Don't try to 'game' the system by omitting details; insurers will uncover them during underwriting, and it could lead to your policy being denied or premiums increasing significantly.

Step 3 Utilize Reputable Online Comparison Tools and Broker Websites

There are many excellent online platforms that allow you to compare quotes from multiple insurers simultaneously. These aggregators are fantastic because they save you the hassle of visiting each insurer's website individually. Some popular ones in the US include:

- Policygenius: Known for its user-friendly interface and comprehensive comparisons.

- SelectQuote: A long-standing broker that provides quotes from many top carriers.

- Quotacy: Offers a streamlined application process and personalized guidance.

- Ladder Life: A fully digital option for quick, flexible term life insurance.

For Southeast Asian markets, you might look at platforms like:

- CompareAsiaGroup (now part of SingSaver/Moneymax): Offers comparisons across various financial products, including life insurance, in countries like Singapore, Hong Kong, and the Philippines.

- Local Insurer Websites: Many major insurers in countries like Singapore (e.g., AIA, Prudential, Great Eastern), Malaysia (e.g., Etiqa, FWD), and Thailand (e.g., Muang Thai Life, Bangkok Life) have their own online quote tools.

Step 4 Review and Compare Quotes Beyond Just the Price Tag

Once you get your quotes, don't just pick the cheapest one. While price is important, it's not the only factor. Look at:

- The Insurer's Financial Strength: Check ratings from agencies like A.M. Best, Standard & Poor's, or Moody's. A strong rating means the company is financially stable and likely to pay claims.

- Customer Service and Reputation: Read reviews. How do customers rate their claims process? Their overall experience?

- Policy Features and Riders: Does the policy offer convertibility to whole life? Are there any useful riders you might want, like an accelerated death benefit for critical illness?

- Underwriting Process: Some companies are more lenient than others for certain health conditions. If you have a pre-existing condition, some insurers might offer better rates than others.

Specific Product Recommendations and Use Cases for US and Southeast Asian Markets

Let's get into some concrete examples. Keep in mind that specific product availability and pricing can change, and these are general recommendations. Always get personalized quotes!

Top Term Life Insurance Products for US Consumers and Their Scenarios

For the US market, competition is fierce, leading to many excellent options. Here are a few highly-rated providers and their typical use cases:

1. Haven Life (Backed by MassMutual) Ideal for Digital-Savvy Individuals Seeking Speed and Simplicity

- Product: Haven Term

- Use Case: Perfect for healthy individuals aged 18-64 who want a quick, fully online application process. Many applicants can get an instant decision without a medical exam for coverage up to $1 million (or even higher with a medical exam). It's great for young families or professionals who need coverage fast.

- Key Features: Streamlined digital experience, competitive rates for healthy applicants, policies issued by MassMutual (a highly-rated insurer).

- Pricing Example (Illustrative, actual rates vary): A healthy 35-year-old non-smoking male might pay around $25-$35 per month for a $500,000, 20-year term policy.

2. Protective Life Insurance Excellent for Competitive Rates and Broad Underwriting

- Product: Protective Classic Choice Term

- Use Case: Known for offering some of the most competitive rates, especially for those in good health. They also have a reputation for being more flexible with certain health conditions compared to some other carriers, making them a good option if you have a minor health issue. Great for families looking for maximum coverage at a lower cost.

- Key Features: Very competitive pricing, strong financial ratings, offers a wide range of term lengths (10-40 years), convertible to permanent coverage.

- Pricing Example (Illustrative): A healthy 40-year-old non-smoking female could potentially find a $750,000, 30-year term policy for $40-$55 per month.

3. Pacific Life Insurance Strong for Higher Coverage Amounts and Financial Stability

- Product: Pacific Term

- Use Case: A solid choice for individuals needing higher coverage amounts (e.g., $1 million or more) and those who value a financially strong, reputable company. They are often competitive for individuals with excellent health.

- Key Features: Excellent financial strength ratings, flexible term options, good for larger policies, often has favorable underwriting for preferred health classes.

- Pricing Example (Illustrative): A healthy 45-year-old non-smoking male might see quotes for a $1,000,000, 20-year term policy in the range of $70-$90 per month.

4. Banner Life Insurance (Legal & General America) Known for Longer Terms and Value

- Product: OPTerm

- Use Case: Banner is frequently cited for its competitive rates, especially for longer term lengths (up to 40 years). If you're looking to lock in coverage for a significant portion of your working life or until your children are well into adulthood, Banner is often a strong contender.

- Key Features: Very competitive pricing across various health classes, especially for longer terms, strong financial backing, convertible to permanent insurance.

- Pricing Example (Illustrative): A healthy 38-year-old non-smoking female could potentially get a $600,000, 30-year term policy for $30-$45 per month.

Leading Term Life Insurance Products for Southeast Asian Markets and Their Applications

The Southeast Asian market is diverse, with different regulations and product offerings in each country. However, major international players and strong local insurers dominate. Here are some general examples:

1. AIA (Across Multiple SEA Countries) A Regional Giant with Comprehensive Offerings

- Product: AIA Term Life (names may vary by country, e.g., AIA Secure Term in Singapore, AIA A-LifeLink in Malaysia)

- Use Case: AIA is a dominant player across Southeast Asia. Their term life products are suitable for individuals and families seeking reliable coverage from a well-established insurer. They often offer various riders for critical illness, disability, and accidental death, which are popular in the region. Good for those who prefer a large, stable company with a wide agent network.

- Key Features: Strong brand recognition, extensive agent network, customizable with various riders, often offers convertibility options.

- Pricing Example (Illustrative for Singapore): A healthy 35-year-old non-smoking male might pay S$30-S$50 per month for S$500,000, 20-year term coverage, potentially with basic critical illness riders.

2. Prudential (Across Multiple SEA Countries) Another Major Player with Flexible Plans

- Product: Prudential PRUTerm (names may vary, e.g., PruTerm Multiplier in Malaysia, PruTerm Protect in Singapore)

- Use Case: Similar to AIA, Prudential has a significant presence and offers robust term life solutions. Their products are often flexible, allowing policyholders to adjust coverage and add riders to suit evolving needs. Ideal for those who want a reputable insurer with a good range of customization options.

- Key Features: Strong financial standing, flexible plans, wide range of optional riders (e.g., early critical illness, total and permanent disability), often offers guaranteed renewability.

- Pricing Example (Illustrative for Malaysia): A healthy 40-year-old non-smoking female could expect to pay MYR 80-MYR 120 per month for MYR 750,000, 25-year term coverage.

3. FWD Insurance (Emerging Digital Player in SEA) Innovative and Digitally Focused

- Product: FWD Term Life (e.g., FWD Term Life Plus in Singapore, FWD Term Life in Thailand)

- Use Case: FWD is a newer, more digitally-focused insurer gaining traction in Southeast Asia. They often offer competitive online-first products, making them attractive to younger, tech-savvy consumers who prefer a straightforward, online application process. Good for those looking for value and convenience.

- Key Features: User-friendly online platforms, often competitive pricing, quick application process, sometimes offers unique benefits like free health screenings or wellness programs.

- Pricing Example (Illustrative for Thailand): A healthy 30-year-old non-smoking male might find a THB 10,000,000 (approx. USD 270,000), 20-year term policy for THB 500-THB 800 per month.

4. Great Eastern Life (Singapore, Malaysia, Indonesia) A Strong Local Heritage Insurer

- Product: Great Eastern Term Assurance (e.g., GREAT Term in Singapore, Great Eastern Term Life in Malaysia)

- Use Case: Great Eastern is one of the oldest and largest insurers in Singapore and Malaysia, with a strong regional presence. Their term life products are well-regarded for their reliability and comprehensive coverage. Suitable for those who value a long-standing local insurer with a solid track record.

- Key Features: Established reputation, wide range of riders, often offers guaranteed insurability options, strong financial ratings within the region.

- Pricing Example (Illustrative for Indonesia): A healthy 42-year-old non-smoking female could look at IDR 500,000-IDR 800,000 per month for IDR 1,000,000,000 (approx. USD 65,000), 15-year term coverage.

Common Pitfalls to Avoid When Comparing Term Life Insurance Quotes Online

While comparing quotes online is super convenient, there are a few traps you'll want to steer clear of:

1. Only Focusing on the Lowest Premium Ignoring Coverage Details

It's tempting to just go for the cheapest option, but remember, the lowest price might mean less coverage, a shorter term than you need, or a company with poor customer service. Always ensure the policy meets your actual needs before committing.

2. Providing Inaccurate Information Leading to Quote Discrepancies

As mentioned, be honest about your health, lifestyle, and medical history. If you get a quote based on inaccurate information, your actual premium after underwriting could be much higher, or worse, your policy could be denied or claims disputed.

3. Not Understanding the Underwriting Process and Its Impact on Final Rates

An online quote is an estimate. The final premium is determined after the underwriting process, which might involve a medical exam, review of your medical records, and a deeper look into your lifestyle. Be prepared for your final rate to be slightly different from the initial quote, especially if you have any health issues.

4. Overlooking the Insurer's Financial Strength and Customer Reviews

A life insurance policy is a long-term commitment. You want to be sure the company will be around and able to pay claims decades down the line. Always check financial ratings and read customer reviews about their claims process and overall service.

5. Neglecting to Review Policy Riders and Conversion Options

Riders can significantly enhance your policy, offering benefits like accelerated death benefits or waiver of premium. Also, consider if the policy is convertible to permanent insurance. This can be a valuable option if your needs change later on.

Maximizing Your Savings and Getting the Best Term Life Insurance Deal

Want to pay less for your term life insurance? Here are some tips:

1. Apply When You Are Young and Healthy Locking in Lower Rates

This is the golden rule of life insurance. The younger and healthier you are when you apply, the lower your premiums will be, and they'll stay level for the entire term.

2. Improve Your Health and Lifestyle Before Applying Potentially Lowering Premiums

If you're a smoker, quitting can dramatically reduce your premiums after a certain period (usually 12 months). Losing weight, managing chronic conditions, and adopting a healthier lifestyle can also lead to better health classifications and lower rates.

3. Consider a Shorter Term if Your Financial Obligations Are Temporary

If your primary financial obligations (like a mortgage or raising children) will end in 15-20 years, a shorter term policy can be significantly cheaper than a 30-year term.

4. Work with an Independent Broker for Personalized Guidance and Access to More Options

While online comparison tools are great, an independent broker can offer personalized advice, help you navigate complex health situations, and often has access to a wider range of insurers and exclusive rates that might not be available directly online.

5. Re-evaluate Your Coverage Periodically Ensuring It Still Meets Your Needs

Your life changes, and so do your insurance needs. Review your policy every few years, especially after major life events like marriage, having children, buying a home, or a significant salary increase. You might need more or less coverage, or a different type of policy altogether.

The Future of Online Term Life Insurance Quotes and Applications

The landscape of life insurance is constantly evolving, especially with technological advancements. We're seeing more:

- No Medical Exam Options: More insurers are offering policies with no medical exam, especially for younger, healthier applicants and lower coverage amounts, speeding up the application process significantly.

- AI and Data Analytics: Insurers are using AI and vast amounts of data to refine their underwriting processes, potentially leading to more personalized and accurate pricing.

- Wearable Tech Integration: Some innovative insurers are exploring ways to integrate data from wearable devices (with your consent, of course) to offer dynamic pricing or wellness incentives.

- Simplified Language and Transparency: The industry is moving towards making policies easier to understand, with clearer terms and conditions, especially for online products.

Comparing term life insurance quotes online is a powerful tool in your financial planning arsenal. It empowers you to make informed decisions, find competitive rates, and ultimately secure the financial future of your loved ones. By understanding the factors that influence your premiums, utilizing reputable comparison tools, and avoiding common pitfalls, you can confidently navigate the market and choose the best policy for your unique circumstances. Remember, it's not just about getting a policy; it's about getting the right policy at the right price. Happy comparing!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)