Comparing Burial Insurance vs Final Expense Insurance

Understand the differences between burial insurance and final expense insurance to choose the right coverage for end-of-life costs.

Comparing Burial Insurance vs Final Expense Insurance

Navigating the world of life insurance can be a bit like trying to find your way through a maze. There are so many terms, so many options, and sometimes it feels like everyone is speaking a different language. Two terms that often get used interchangeably, but actually have distinct differences, are 'burial insurance' and 'final expense insurance.' If you're looking to cover end-of-life costs, it's super important to understand what each one offers so you can pick the right fit for your needs and your family's peace of mind.

Let's break it down, shall we? We'll dive deep into what each type of insurance is, how they work, who they're best for, and even look at some specific product recommendations and pricing examples. Our goal here is to make sure you walk away feeling confident and clear about your choices.

What is Burial Insurance Understanding the Basics

So, what exactly is burial insurance? At its core, burial insurance is a type of whole life insurance designed specifically to cover funeral and burial costs. It's often referred to as 'funeral insurance' or 'pre-need funeral insurance.' The key thing to remember is that it's a smaller, more focused policy compared to traditional life insurance. The death benefit is typically lower, usually ranging from a few thousand dollars up to around $25,000 or $30,000. This amount is intended to cover things like the funeral service, cremation, embalming, casket, urn, plot, headstone, and other related expenses.

One of the biggest advantages of burial insurance is its simplicity. It's usually very easy to qualify for, even if you have health issues. Many policies are 'guaranteed issue,' meaning there are no medical exams or health questions. This makes it a fantastic option for seniors or those with pre-existing conditions who might struggle to get approved for other types of life insurance.

The premiums for burial insurance are typically fixed, meaning they won't increase over time, and the coverage lasts for your entire life, as long as you keep paying those premiums. It also builds a small cash value over time, which you can borrow against if needed, though that's not its primary purpose.

What is Final Expense Insurance Comprehensive End of Life Coverage

Now, let's talk about final expense insurance. This is where things can get a little confusing because, in many ways, final expense insurance is very similar to burial insurance. In fact, burial insurance is often considered a subset or a specific type of final expense insurance. The main difference is that final expense insurance is a broader term that encompasses all end-of-life costs, not just the funeral itself.

While funeral costs are a significant part of final expenses, there are often other financial obligations that arise after someone passes away. These can include medical bills not covered by health insurance, outstanding credit card debt, legal fees for estate settlement, or even just a small amount to help surviving family members with immediate living expenses during a difficult time. Final expense policies typically offer a slightly higher death benefit than what's strictly needed for a funeral, often up to $50,000, to cover these additional costs.

Like burial insurance, final expense policies are usually whole life insurance, meaning they offer lifelong coverage and fixed premiums. They are also designed to be easy to qualify for, with many offering simplified underwriting (a few health questions, but no medical exam) or guaranteed issue options. The goal is to provide a straightforward and accessible way for people, especially seniors, to ensure their loved ones aren't burdened with unexpected costs.

Key Differences and Similarities Burial vs Final Expense

Let's put them side-by-side to really highlight the distinctions and commonalities:

Similarities Between Burial and Final Expense Insurance

- Type of Policy: Both are typically whole life insurance policies. This means they offer lifelong coverage and build cash value.

- Purpose: Both are designed to cover end-of-life expenses, providing financial relief to your loved ones.

- Ease of Qualification: Both are generally easier to qualify for than traditional term or whole life insurance, often with simplified underwriting or guaranteed issue options. This makes them ideal for seniors or those with health issues.

- Fixed Premiums: Premiums for both types of policies are usually fixed and will not increase over time.

- Guaranteed Death Benefit: As long as premiums are paid, the death benefit is guaranteed to be paid out to your beneficiaries.

Differences Between Burial and Final Expense Insurance

- Scope of Coverage: This is the primary differentiator. Burial insurance is specifically focused on funeral and burial costs. Final expense insurance has a broader scope, covering funeral costs PLUS other outstanding debts, medical bills, or immediate financial needs of the family.

- Death Benefit Amount: Because of the broader scope, final expense policies often have slightly higher death benefit limits (e.g., up to $50,000) compared to burial insurance (e.g., up to $25,000-$30,000).

- Marketing Terminology: 'Burial insurance' is a more specific term often used when the primary concern is just the funeral. 'Final expense insurance' is a more encompassing term that covers a wider range of post-mortem costs.

Think of it this way: all burial insurance is a type of final expense insurance, but not all final expense insurance is strictly burial insurance. Final expense is the umbrella term, and burial insurance is a specific type under that umbrella, focused solely on funeral arrangements.

Who Needs Burial or Final Expense Insurance Ideal Scenarios

These types of policies aren't for everyone, but they are incredibly valuable for specific groups of people. Let's explore who benefits most:

Seniors and Older Adults Securing Peace of Mind

This is probably the largest demographic for both burial and final expense insurance. As we age, health issues can make it difficult or impossible to qualify for traditional life insurance policies with large death benefits. Burial and final expense policies offer an accessible solution, ensuring that their passing doesn't create a financial burden for their children or other loved ones. Many seniors want to take care of these costs themselves, and these policies provide that assurance.

Individuals with Health Issues Guaranteed Coverage Options

If you have pre-existing medical conditions like heart disease, diabetes, or cancer, you might have been declined for other life insurance. The simplified underwriting or guaranteed issue options of burial and final expense insurance mean that your health status won't prevent you from getting coverage. This is a huge relief for many who thought they had no options.

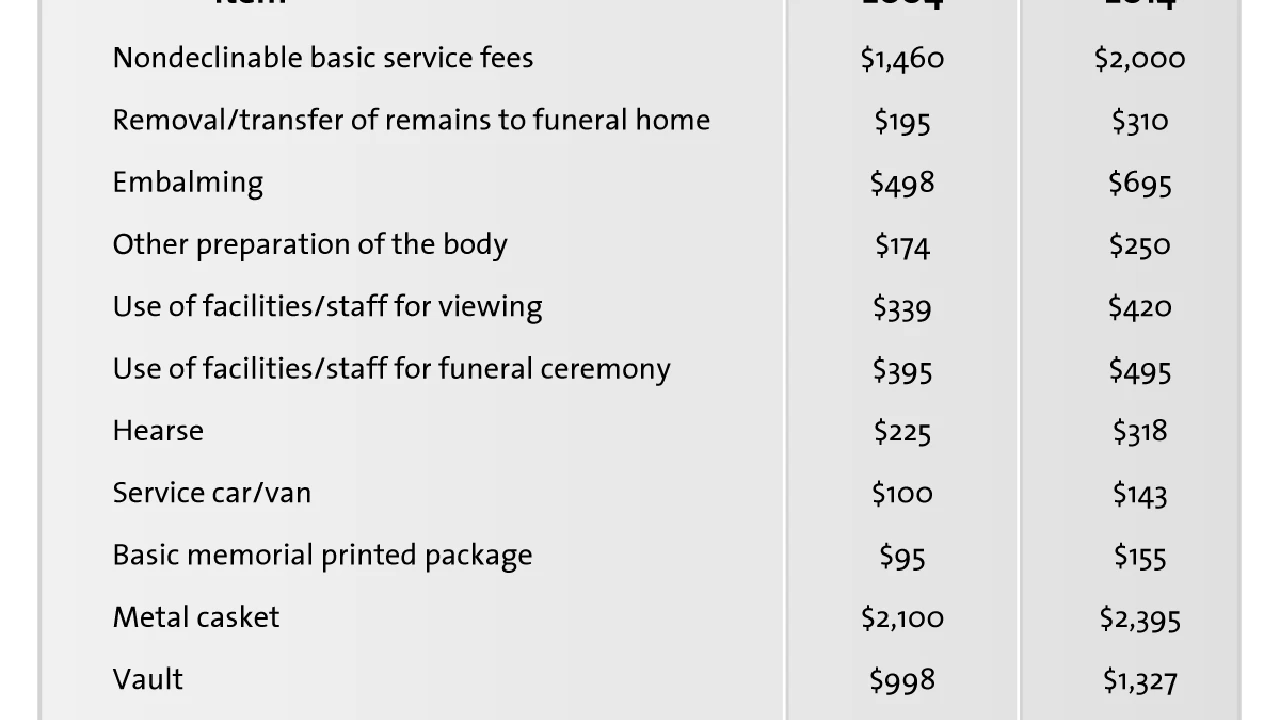

Those with Limited Savings Avoiding Financial Burden

Not everyone has a large savings account set aside specifically for funeral costs. With the average funeral costing between $7,000 and $10,000 (and often more), this can be a significant unexpected expense for a family. Burial or final expense insurance ensures that these costs are covered, preventing loved ones from having to dip into their own savings, go into debt, or even crowdfund for funeral expenses.

Anyone Who Wants to Plan Ahead and Reduce Stress

Even if you're relatively healthy and have some savings, the emotional toll of losing a loved one is immense. Having a policy in place that specifically covers final expenses can significantly reduce the stress on your family during an already difficult time. They won't have to worry about finding the money or making tough financial decisions while grieving.

Choosing the Right Policy Factors to Consider

Okay, so you've decided that one of these policies is right for you. How do you go about choosing the best one? Here are some key factors to keep in mind:

Death Benefit Amount How Much Coverage Do You Need

This is probably the most crucial decision. Get quotes from local funeral homes to understand the average cost of a funeral in your area. Then, consider if you want to cover additional expenses beyond the funeral, such as medical bills, credit card debt, or a small inheritance. If you only need to cover the funeral, a burial insurance policy with a lower death benefit might suffice. If you want broader coverage, a final expense policy with a higher death benefit would be more appropriate.

Underwriting Process Simplified vs Guaranteed Issue

- Simplified Issue: This involves answering a few health questions, but no medical exam. Approval is usually quick, and premiums are generally lower than guaranteed issue. If you're in decent health for your age, this is often the best route.

- Guaranteed Issue: No health questions, no medical exam, guaranteed approval. This is for those who can't qualify for anything else due to significant health issues. The downside is higher premiums and often a 'graded death benefit,' meaning if you pass away within the first two or three years, your beneficiaries might only receive a refund of premiums paid plus interest, rather than the full death benefit.

Premium Affordability and Budgeting

Since these policies are whole life, you'll be paying premiums for the rest of your life. Make sure the monthly or annual premium fits comfortably within your budget. You don't want to lapse on payments, as that would mean losing your coverage.

Cash Value Growth While Not the Primary Goal

While not the main reason to buy these policies, they do build cash value. Some policies might offer slightly better cash value growth than others. If this is a secondary consideration for you, it's worth comparing.

Riders and Additional Benefits Customizing Your Coverage

Some policies offer riders that can enhance your coverage. Common riders include:

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit if you're diagnosed with a terminal illness.

- Accidental Death Benefit Rider: Pays an additional death benefit if your death is due to an accident.

- Child Rider: Provides a small amount of coverage for your children.

Recommended Products and Providers for Burial and Final Expense Insurance

When it comes to specific products, many reputable insurance companies offer burial and final expense options. Here are a few well-known providers and what they typically offer. Remember, specific policy details and availability can vary by state and individual circumstances, so always get personalized quotes.

Gerber Life Grow-Up Plan and Guaranteed Acceptance Life Insurance

Gerber Life is often associated with child life insurance, but they also offer final expense options. Their Guaranteed Acceptance Life Insurance is a popular choice for seniors aged 50-80 (or 50-75 in some states) who want guaranteed approval. It's a whole life policy with a graded death benefit for the first two years. Coverage amounts typically range from $5,000 to $25,000. This is a good option for those with significant health issues who can't qualify for simplified issue policies.

Example Scenario: A 70-year-old with a history of heart conditions might find Gerber Life's Guaranteed Acceptance policy to be one of their few options for coverage. A $10,000 policy might cost around $70-$90 per month, depending on age and gender.

Mutual of Omaha Living Promise Whole Life Insurance

Mutual of Omaha is a highly respected name in the insurance industry and offers excellent final expense options. Their Living Promise Whole Life Insurance comes in two main forms:

- Level Benefit Plan: This is a simplified issue policy for those in reasonably good health. It offers immediate full death benefits and coverage amounts from $2,000 to $40,000. Premiums are very competitive for those who qualify.

- Graded Benefit Plan: For those with more serious health conditions, this plan offers coverage from $2,000 to $20,000 with a graded death benefit for the first two years.

Mutual of Omaha is known for its strong financial ratings and good customer service. They are a solid choice if you're looking for a reliable provider.

Example Scenario: A 65-year-old in good health might qualify for Mutual of Omaha's Level Benefit Plan with a $20,000 death benefit for around $50-$70 per month, offering immediate full coverage.

Foresters Financial PlanRight Whole Life Insurance

Foresters Financial offers a range of final expense products under their PlanRight Whole Life Insurance umbrella. They have three levels of coverage, catering to different health statuses:

- Level Plan: For the healthiest applicants, offering immediate full death benefits and competitive premiums.

- Modified Plan: For those with some health issues, it typically has a graded death benefit for the first two years.

- Guaranteed Plan: For those with significant health concerns, offering guaranteed acceptance with a graded death benefit.

Foresters is a fraternal benefit society, which means they often offer additional member benefits like scholarships and community grants, which can be a nice bonus.

Example Scenario: A 75-year-old with a few minor health issues might qualify for Foresters' Modified Plan with a $15,000 death benefit for approximately $90-$110 per month. This would provide coverage after the graded period.

AIG Guaranteed Issue Whole Life Insurance

AIG is another major player that offers a Guaranteed Issue Whole Life Insurance policy. This policy is available for individuals aged 50-80 and requires no medical exam or health questions. It's a whole life policy with a graded death benefit for the first two years. Coverage amounts typically range from $5,000 to $25,000. AIG is a large, well-established company, offering stability and a wide range of financial products.

Example Scenario: An 80-year-old with multiple chronic conditions might find AIG's Guaranteed Issue policy to be their only viable option. A $10,000 policy could cost around $120-$150 per month, providing essential coverage for final expenses.

Colonial Penn Guaranteed Acceptance Whole Life Insurance

Colonial Penn is well-known for its guaranteed acceptance life insurance, often advertised on TV. Their Guaranteed Acceptance Whole Life Insurance is available for ages 50-85 and offers coverage in 'units.' Each unit provides a certain amount of death benefit, which varies by age and gender. It's a guaranteed issue policy with a graded death benefit for the first two years.

Example Scenario: A 68-year-old looking for a small amount of coverage, say $5,000, might purchase a few units from Colonial Penn. The cost per unit can vary significantly, but it's designed to be accessible for those who need guaranteed approval.

Understanding Pricing and Cost Factors for Final Expense Insurance

The cost of burial or final expense insurance isn't one-size-fits-all. Several factors influence your premiums:

Age The Older You Are the Higher the Cost

This is the biggest factor. The older you are when you apply, the higher your premiums will be because the insurance company has less time to collect premiums before paying out a claim. It's generally advisable to get coverage sooner rather than later if you know you'll need it.

Gender Women Often Pay Less

Statistically, women tend to live longer than men. Because of this, women typically pay lower premiums for life insurance, including final expense policies, compared to men of the same age.

Health Status Simplified vs Guaranteed Issue Premiums

Your health plays a significant role. If you qualify for a simplified issue policy (meaning you answer a few health questions and are deemed relatively healthy), your premiums will be lower than if you opt for a guaranteed issue policy (no health questions, but higher risk for the insurer).

Coverage Amount The More You Need the More You Pay

This one is straightforward. A policy with a $20,000 death benefit will cost more than a policy with a $10,000 death benefit, assuming all other factors are equal.

Smoking Status Smokers Pay More

If you smoke, you'll almost certainly pay higher premiums. Smoking is a major health risk, and insurers price that risk into your policy.

State of Residence Regulations and Market Differences

Insurance regulations and market competition can vary by state, which can slightly impact premium rates.

General Pricing Examples (Illustrative, not actual quotes):

- 60-year-old female, non-smoker, good health, $10,000 coverage (simplified issue): $30-$45 per month

- 60-year-old male, non-smoker, good health, $10,000 coverage (simplified issue): $40-$55 per month

- 75-year-old female, non-smoker, average health, $15,000 coverage (simplified issue): $60-$80 per month

- 75-year-old male, non-smoker, average health, $15,000 coverage (simplified issue): $80-$100 per month

- 80-year-old female, smoker, poor health, $10,000 coverage (guaranteed issue): $100-$130 per month

- 80-year-old male, smoker, poor health, $10,000 coverage (guaranteed issue): $130-$160 per month

These are just estimates. Always get multiple quotes from different providers to find the best rate for your specific situation.

The Application Process What to Expect

Applying for burial or final expense insurance is typically much simpler than applying for traditional life insurance. Here's a general idea of what you can expect:

Step 1 Contact an Agent or Broker

You can work with an independent insurance agent who can shop around with multiple carriers for you, or you can contact a specific insurance company directly. An agent can be particularly helpful in navigating the different underwriting requirements and finding the best fit for your health status.

Step 2 Provide Basic Information

You'll need to provide your personal details, including your name, address, date of birth, and social security number.

Step 3 Answer Health Questions (for Simplified Issue)

If you're applying for a simplified issue policy, you'll answer a short series of 'yes/no' health questions. These typically cover major health conditions like cancer, heart attack, stroke, organ transplant, or current hospitalization. There's no medical exam involved.

Step 4 Choose Your Coverage Amount and Beneficiaries

Decide on the death benefit amount you need and designate your beneficiaries (the people who will receive the payout). You can name multiple beneficiaries and specify percentages.

Step 5 Review and Sign the Application

Carefully review all the information on your application before signing. Make sure everything is accurate.

Step 6 First Premium Payment and Policy Issuance

Once approved, you'll make your first premium payment, and your policy will be issued. This process can often happen within a few days, sometimes even instantly for guaranteed issue policies.

Common Misconceptions About Burial and Final Expense Insurance

Let's clear up some common misunderstandings:

Myth 1 It's Only for the Very Old or Very Sick

While these policies are excellent for seniors and those with health issues, anyone who wants to ensure their final expenses are covered can benefit. If you have limited savings or just want to plan ahead, it's a viable option regardless of age (within the typical age limits, usually 50-85).

Myth 2 It's a Bad Investment

These policies are not designed as investments in the traditional sense. Their primary purpose is to provide a guaranteed death benefit to cover specific costs. While they do build cash value, it's usually minimal compared to other financial products. Their value lies in the peace of mind and financial protection they offer, not in wealth accumulation.

Myth 3 My Family Will Automatically Know What to Do

Even if you have a policy, your family might not know it exists or how to access the benefits. It's crucial to communicate your plans, tell your beneficiaries about the policy, and keep policy documents in an accessible place. Consider creating a 'final wishes' document that outlines your preferences and where to find important papers.

Myth 4 It's Too Expensive

While premiums increase with age and health status, many people find these policies surprisingly affordable, especially when compared to the potential burden of unexpected funeral costs. The cost is often manageable, particularly for smaller death benefits.

Alternatives to Burial and Final Expense Insurance Other Options

While burial and final expense insurance are great tools, they're not the only way to cover end-of-life costs. Here are some alternatives:

Pre-Need Funeral Plans Direct Arrangements with Funeral Homes

You can make arrangements directly with a funeral home and pre-pay for your funeral services. This locks in today's prices and ensures your wishes are followed. However, the money is typically held in a trust by the funeral home, and it can be difficult to transfer if you move or change your mind. Also, if the funeral home goes out of business, your funds could be at risk.

Savings Accounts or CDs Self-Funding Your Final Expenses

You can simply save money in a dedicated savings account or Certificate of Deposit (CD) to cover your final expenses. This offers maximum flexibility and control over your money. The downside is that if you pass away before you've saved enough, your family will still face a financial shortfall. Also, it requires discipline to save consistently.

Traditional Life Insurance Policies Broader Coverage

If you're younger and in good health, a traditional term life or whole life insurance policy might be a better fit. These policies typically offer much larger death benefits, which can cover not only final expenses but also provide income replacement, mortgage payoff, and other significant financial support for your family. However, they are harder to qualify for as you age or if you have health issues.

Making the Right Decision for Your Future

Deciding between burial insurance and final expense insurance, or even choosing an alternative, comes down to your specific needs, health, and financial situation. If your primary concern is simply covering the cost of your funeral, a burial insurance policy might be all you need. If you want to ensure that your loved ones are also protected from other lingering debts and immediate financial pressures, a broader final expense policy would be more suitable.

The most important thing is to take action. Don't leave your family to deal with the financial stress of your passing. By understanding your options and planning ahead, you can provide invaluable peace of mind for both yourself and those you care about most. Talk to a qualified insurance professional, get personalized quotes, and make an informed decision that secures your legacy and protects your loved ones from financial hardship.

Remember, this isn't just about money; it's about love and responsibility. It's about ensuring that your final wishes are honored and that your family can grieve without the added burden of unexpected costs. So, take the time, do your research, and choose the path that feels right for you and your family's future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)