Comparing Life Insurance Quotes Online Best Practices

Tips and strategies for effectively comparing life insurance quotes online to find the best rates and coverage.

Tips and strategies for effectively comparing life insurance quotes online to find the best rates and coverage.

Hey there! So, you're thinking about getting life insurance, and you've decided to take the smart route by looking for quotes online. That's a fantastic first step! The internet has made it incredibly easy to shop around and compare different policies without ever leaving your couch. But with so many options and providers out there, it can feel a bit overwhelming, right? Don't worry, I'm here to walk you through the best practices for comparing life insurance quotes online, ensuring you find the perfect fit for your needs and budget. We'll cover everything from understanding what you need to spotting the best deals and even looking at some specific product examples.

H2 Understanding Your Life Insurance Needs Before You Compare

Before you even start clicking around for quotes, it's super important to have a clear idea of what you actually need. Think of it like going grocery shopping without a list – you'll probably end up with a bunch of stuff you don't need and forget the essentials! So, let's figure out your 'life insurance shopping list'.

H3 How Much Coverage Do You Really Need Life Insurance Coverage Calculator

This is probably the biggest question. There's no one-size-fits-all answer, but a good rule of thumb is to consider your current and future financial obligations. Think about:

- Income Replacement: How many years of your income would your family need to replace if something happened to you? A common recommendation is 7-10 times your annual salary.

- Debts: Do you have a mortgage, car loans, student loans, or credit card debt? You'll want enough coverage to pay these off so your loved ones aren't burdened.

- Future Expenses: Are there college tuition costs for your kids? Wedding expenses? Retirement for your spouse? Factor these in.

- Final Expenses: Funeral costs can be surprisingly high. Make sure there's enough to cover these.

Many online calculators can help you estimate this. Just search for 'life insurance needs calculator' and you'll find plenty of free tools.

H3 What Type of Life Insurance Is Best for You Term Whole Universal Life

There are a few main types, and each has its pros and cons:

- Term Life Insurance: This is the most straightforward and often the most affordable. It covers you for a specific period (e.g., 10, 20, or 30 years). If you pass away during that term, your beneficiaries get a payout. If you outlive the term, the policy expires, and there's no payout. Great for covering specific financial obligations like a mortgage or raising children.

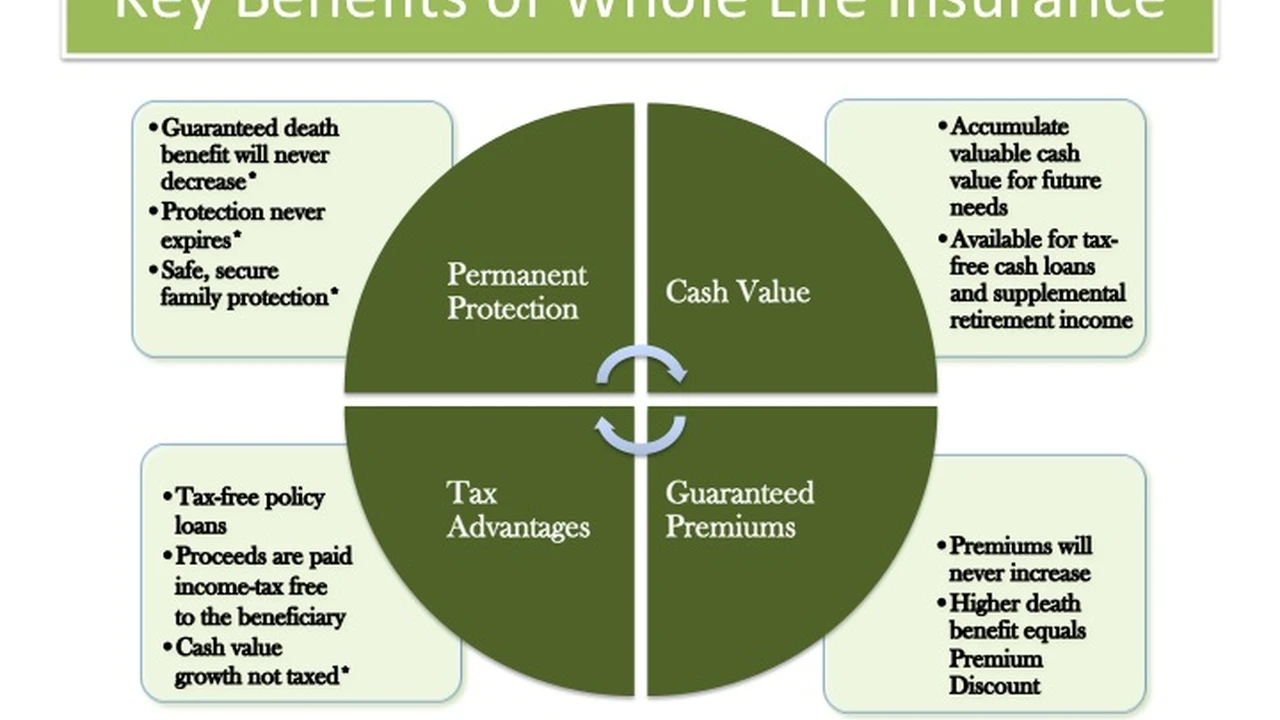

- Whole Life Insurance: This is a type of permanent life insurance. It covers you for your entire life, as long as you pay the premiums. It also builds cash value over time, which you can borrow against or withdraw. It's generally more expensive than term life.

- Universal Life Insurance: Another permanent option, universal life offers more flexibility than whole life. You can often adjust your premium payments and death benefit. It also has a cash value component that grows over time.

For most families, especially those on a budget, term life insurance is often the best starting point. It provides maximum coverage for the lowest cost during the years you need it most.

H2 Where to Compare Life Insurance Quotes Online Comparison Sites Brokerages Direct Insurers

Okay, you know what you need. Now, where do you go to get those quotes? You've got a few main avenues:

H3 Online Comparison Websites Aggregator Tools for Life Insurance

These are super popular because they let you get multiple quotes from different insurers all in one place. You fill out one form, and they pull quotes for you. Examples include:

- Policygenius: A well-known independent insurance marketplace that partners with many top insurers. They offer a user-friendly interface and often provide personalized advice.

- SelectQuote: Another popular option that allows you to compare rates from various carriers. They also have agents available to help you navigate options.

- Quotacy: Focuses on making the process simple and transparent, with a strong emphasis on customer support.

Pros: Convenience, quick comparisons, broad range of options. Cons: May not include every single insurer, sometimes you'll get follow-up calls/emails from multiple companies.

H3 Independent Insurance Brokerages Online Agents for Life Insurance

These are companies that work with multiple insurance carriers but also offer a more personalized touch. They have licensed agents who can help you understand your options, answer questions, and guide you through the application process. They often have access to exclusive rates or policies not found on general comparison sites. Examples:

- Ladder Life: While also a direct insurer, Ladder has a strong online presence and offers a very streamlined process for term life, allowing you to adjust coverage as needed.

- Haven Life: Backed by MassMutual, Haven Life offers fully online term life insurance with instant decisions for many applicants.

Pros: Expert advice, personalized recommendations, help with complex situations. Cons: Might not show as many options as a pure aggregator, but the quality of advice can be higher.

H3 Direct From Insurer Websites Buying Life Insurance Directly

You can also go directly to the websites of individual insurance companies. This is a good idea if you already have a preferred insurer or want to check their specific offerings. Some major players include:

- Northwestern Mutual: A very reputable company, though their online quoting might be less instant than others.

- State Farm: Offers a wide range of insurance products, including life insurance, often through local agents.

- Geico Life Insurance (via partners): While known for auto insurance, they also offer life insurance through partnerships.

Pros: Direct relationship with the insurer, potentially specific deals. Cons: You have to visit multiple sites to compare, less convenient.

H2 Best Practices for Comparing Life Insurance Quotes Online Tips for Finding the Best Rates

Now that you know where to look, let's talk about how to effectively compare those quotes.

H3 Be Accurate and Honest with Your Information Life Insurance Application Accuracy

This is crucial! When you're filling out forms for quotes, provide accurate information about your age, health, lifestyle (smoking, drinking), medical history, and occupation. If you provide inaccurate information, your actual premium could be much higher than the quote, or worse, your policy could be denied or voided later on. It's better to get a slightly higher quote upfront than to face issues down the line.

H3 Compare Apples to Apples Life Insurance Policy Comparison

Make sure you're comparing policies with the same coverage amount, term length (if it's term life), and type of policy. A 20-year, $500,000 term policy will naturally be cheaper than a whole life policy with the same death benefit. Don't just look at the premium; look at what you're getting for that premium.

H3 Look Beyond the Premium Insurer Ratings Customer Service

While cost is a big factor, it shouldn't be the only one. Consider:

- Insurer's Financial Strength: You want an insurer that will be around to pay out when needed. Check ratings from agencies like A.M. Best, Standard & Poor's, and Moody's. An 'A' rating or higher is generally good.

- Customer Service and Reputation: Read reviews! What do other policyholders say about their experience with claims, customer support, and overall satisfaction? Websites like J.D. Power and the Better Business Bureau can be helpful.

- Policy Features and Riders: Does the policy offer any valuable riders (add-ons) like accelerated death benefits (allowing you to access funds if you become terminally ill) or waiver of premium (waiving premiums if you become disabled)?

H3 Understand the Underwriting Process Medical Exams Health Questions

Many life insurance policies, especially for higher coverage amounts, will require a medical exam. This typically involves a paramedical professional coming to your home or office to take blood and urine samples, measure blood pressure, and ask health questions. Some companies offer 'no medical exam' policies, which can be quicker but often come with higher premiums or lower coverage limits. Be prepared for this step, as it will finalize your actual premium.

H3 Don't Be Afraid to Ask Questions Life Insurance Agent Support

If you're using a brokerage or a comparison site with agent support, use it! Ask about anything you don't understand. A good agent can clarify policy terms, explain riders, and help you compare complex options. They can also advocate for you with the insurance company.

H2 Specific Product Examples and Use Cases for Life Insurance

Let's look at some hypothetical scenarios and how different products might fit, along with some general pricing ideas. Keep in mind, these prices are highly variable based on age, health, and specific insurer.

H3 Scenario 1 Young Family with a Mortgage Term Life Insurance for Families

- User Profile: 35-year-old non-smoking male, good health, married with two young children, $300,000 mortgage, annual income $70,000.

- Needs: Cover mortgage, replace income for 15-20 years, cover children's education.

- Recommended Product: 20-year Term Life Insurance.

- Example Product/Provider:

- Haven Life (backed by MassMutual): Offers a streamlined online application. For a 35-year-old male, a $750,000, 20-year term policy could be around $35-$45 per month. They often provide instant decisions for healthy applicants.

- Protective Life: Known for competitive term rates. A similar policy might be in the $30-$40 range.

- Why it fits: Term life provides substantial coverage for the years the family is most financially vulnerable (mortgage, young kids) at an affordable price. The coverage amount is sufficient to pay off the mortgage and provide income replacement for a significant period.

H3 Scenario 2 Individual Seeking Long-Term Wealth Building Whole Life Insurance Cash Value

- User Profile: 45-year-old non-smoking female, excellent health, high income, looking for estate planning and cash value growth.

- Needs: Permanent coverage, tax-advantaged savings, potential for policy loans.

- Recommended Product: Participating Whole Life Insurance.

- Example Product/Provider:

- Northwestern Mutual: A leader in whole life insurance, known for strong dividends and financial strength. A $1,000,000 whole life policy could have premiums starting from $800-$1,200 per month, depending on specific riders and dividend options.

- MassMutual: Another highly-rated mutual company offering competitive whole life products with good dividend performance. Similar pricing range to Northwestern Mutual.

- Why it fits: Whole life provides guaranteed lifelong coverage and builds cash value that grows tax-deferred. The policyholder can access this cash value through loans or withdrawals, making it a flexible financial tool for retirement or other needs. Dividends can further enhance returns.

H3 Scenario 3 Flexible Coverage with Investment Potential Universal Life Insurance Flexibility

- User Profile: 50-year-old non-smoking male, good health, business owner, needs flexible premiums and potential for higher cash value growth.

- Needs: Permanent coverage, ability to adjust premiums, potential for market-linked returns on cash value.

- Recommended Product: Indexed Universal Life (IUL) or Variable Universal Life (VUL).

- Example Product/Provider:

- Pacific Life (for IUL): Offers various IUL products with different indexing strategies. A $1,000,000 IUL policy might have target premiums around $600-$900 per month, with the potential for cash value growth tied to market indices (like the S&P 500) but with downside protection.

- Transamerica (for VUL): Provides VUL options where the cash value is invested in sub-accounts similar to mutual funds. Premiums for a $1,000,000 VUL could be in a similar range, but with higher risk and reward potential.

- Why it fits: IUL and VUL offer permanent coverage with flexible premiums. IUL provides cash value growth linked to market indices, often with a floor to protect against losses, making it attractive for those seeking growth without direct market exposure. VUL offers direct investment in sub-accounts for potentially higher returns but also higher risk. These are often used for advanced financial planning and business succession.

H3 Scenario 4 Older Individual with Health Concerns Guaranteed Issue Final Expense Life Insurance

- User Profile: 70-year-old female, some health issues (e.g., diabetes, high blood pressure), wants to cover funeral costs and leave a small legacy.

- Needs: Guaranteed coverage, no medical exam, affordable premiums for final expenses.

- Recommended Product: Guaranteed Issue Whole Life or Final Expense Insurance.

- Example Product/Provider:

- Colonial Penn: Famous for its guaranteed acceptance life insurance. A $10,000 policy for a 70-year-old female could be around $50-$70 per month. Note that these policies often have a graded death benefit, meaning full coverage isn't available for the first 2-3 years.

- Mutual of Omaha: Offers competitive final expense policies, often with simplified underwriting (fewer health questions, no medical exam). A $15,000 policy might be in the $70-$100 range per month, depending on health answers.

- Why it fits: These policies are designed for individuals who might not qualify for traditional life insurance due to age or health. They offer guaranteed acceptance (or simplified issue) and are specifically tailored to cover end-of-life expenses, providing peace of mind for loved ones.

H2 Common Pitfalls to Avoid When Comparing Life Insurance Quotes Online Mistakes to Avoid

Even with the best intentions, it's easy to stumble. Here are some things to watch out for:

H3 Only Focusing on the Lowest Premium Value Over Cost in Life Insurance

The cheapest option isn't always the best. A super low premium might mean less coverage, a shorter term, or a less financially stable insurer. Always balance cost with the quality and suitability of the policy.

H3 Not Understanding the Policy Terms and Conditions Fine Print Life Insurance

Life insurance policies can be complex. Don't just skim the summary. Read the actual policy document or ask an agent to explain any clauses you don't understand, especially regarding exclusions, riders, and cash value growth (if applicable).

H3 Ignoring Insurer Ratings and Reputation Financial Strength of Life Insurers

As mentioned, the financial strength of the insurer is paramount. A low-rated company might struggle to pay claims in the future. Always check those A.M. Best ratings!

H3 Getting Too Many Quotes and Getting Overwhelmed Streamlining Life Insurance Search

While comparing is good, getting dozens of quotes can lead to analysis paralysis and a flood of calls from agents. Stick to 3-5 solid quotes from reputable providers that meet your initial criteria. Use a good comparison site to narrow down your options first.

H3 Delaying the Purchase Age Health Impact on Life Insurance

Life insurance generally gets more expensive as you get older or if your health declines. The best time to buy life insurance is usually when you're young and healthy. Don't put it off if you know you need it.

H2 Final Thoughts on Online Life Insurance Comparison Making Informed Decisions

Comparing life insurance quotes online is a powerful tool that puts you in control. By understanding your needs, knowing where to look, and following these best practices, you can confidently navigate the market and secure the right protection for your loved ones. Remember, life insurance isn't just a financial product; it's a promise to your family that they'll be taken care of, no matter what. So take your time, do your homework, and make an informed decision that brings you peace of mind.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)