Life Insurance for Single Individuals Is It Necessary

An analysis of whether single individuals need life insurance and the situations where it can be beneficial.

An analysis of whether single individuals need life insurance and the situations where it can be beneficial.

Life Insurance for Single Individuals Is It Necessary

Hey there! Let's talk about something that often gets overlooked: life insurance for single folks. When you hear 'life insurance,' your mind probably jumps to families, kids, and mortgages, right? It's true that life insurance is super important for people with dependents, but what about those of us flying solo? Do single individuals really need life insurance? The short answer is: it depends, but often, yes! Let's dive into why, when, and what kind of life insurance might make sense for you, even if you're not planning a big family anytime soon.

Understanding Life Insurance Basics What It Is and How It Works

Before we get into the nitty-gritty for single people, let's quickly recap what life insurance actually is. At its core, life insurance is a contract between you and an insurance company. You pay regular premiums, and in return, the insurer promises to pay a lump sum of money (the death benefit) to your chosen beneficiaries if you pass away during the policy term. This money can be used for anything – covering debts, replacing lost income, or even funding future goals. For single individuals, the 'who benefits' part might look a little different, but the fundamental purpose remains the same: financial protection.

Why Single Individuals Might Think They Dont Need Life Insurance Common Misconceptions

It's easy to assume that if you're single, without a spouse or children, life insurance is just an unnecessary expense. Here are some common thoughts that might lead to this conclusion:

- “I don't have dependents.” This is the biggest one. If no one relies on your income, why bother?

- “I don't have much debt.” Maybe you've paid off your student loans or don't have a mortgage. Good for you! But what about other potential costs?

- “I'm young and healthy.” You feel invincible, and honestly, you probably are. But life is unpredictable.

- “It's too expensive.” The perception is that life insurance is a huge financial commitment, especially if you don't see an immediate need.

- “My employer provides some coverage.” Many companies offer basic group life insurance. Is that enough?

While these points have some truth, they often don't tell the whole story. Let's explore the scenarios where life insurance for single individuals isn't just a good idea, but a smart financial move.

Situations Where Life Insurance Is Beneficial for Single Individuals Protecting Your Legacy

Even without a spouse or kids, there are several compelling reasons why a single person might want life insurance:

1. Covering Final Expenses and Debts Avoiding Burdening Loved Ones

No one likes to think about it, but when you pass away, there are costs involved. Funeral and burial expenses can easily run into thousands of dollars. If you don't have life insurance, who will cover these costs? Often, it falls to your parents, siblings, or other close relatives. A life insurance policy, even a small one, can ensure that your loved ones aren't left with a financial burden during an already difficult time. This also extends to any outstanding debts you might have – credit card balances, personal loans, or even a car loan. While some debts might not transfer to your family, others could, or your estate might be responsible, potentially depleting any assets you wanted to leave behind.

2. Supporting Aging Parents or Other Relatives Providing Ongoing Care

Are your parents getting older? Do you contribute to their financial well-being, perhaps helping with medical bills, housing, or daily expenses? If you're a primary or even secondary financial support for your parents, siblings, or other relatives, your passing could create a significant financial void for them. Life insurance can provide a safety net, ensuring they continue to receive the support they need, even if you're no longer there to provide it directly.

3. Leaving a Legacy Charitable Giving and Estate Planning

Maybe you don't have human dependents, but you have causes you care deeply about. Life insurance can be a powerful tool for charitable giving. You can name a charity or non-profit organization as your beneficiary, ensuring that your passion lives on and continues to make an impact after you're gone. This can be a more substantial gift than what you might be able to leave from your liquid assets. It's also a great way to leave a legacy if you don't have direct heirs but want to make a difference.

4. Co-Signed Debts and Business Partnerships Mitigating Financial Risk

Did you co-sign a loan with a parent, sibling, or friend? If you pass away, that co-signed debt could become their sole responsibility. Life insurance can protect them from this unexpected financial burden. Similarly, if you're a single business owner or have a business partner, life insurance can be crucial for business continuity. A key person policy can provide funds to help the business recover from the loss of your expertise or to facilitate a buy-sell agreement, ensuring a smooth transition.

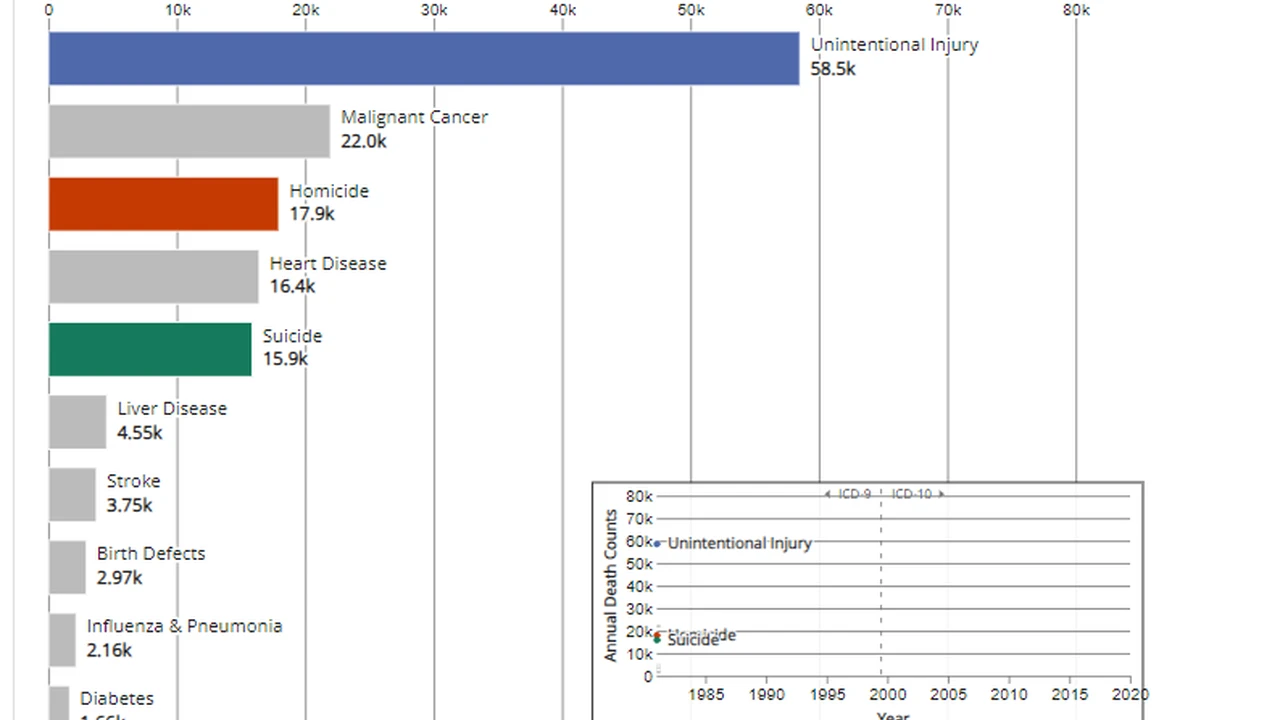

5. Future Insurability Locking in Low Rates and Good Health

This is a big one, especially for young, healthy single individuals. Life insurance rates are primarily based on your age and health. The younger and healthier you are when you purchase a policy, the lower your premiums will be. Even if you don't have an immediate need for a large policy, buying a smaller, affordable policy now can lock in those favorable rates. Life is unpredictable; your health could change, or you might develop dependents later in life. Having a policy in place now means you're covered, and you won't have to worry about being uninsurable or facing much higher premiums down the road.

Types of Life Insurance for Single Individuals Exploring Your Options

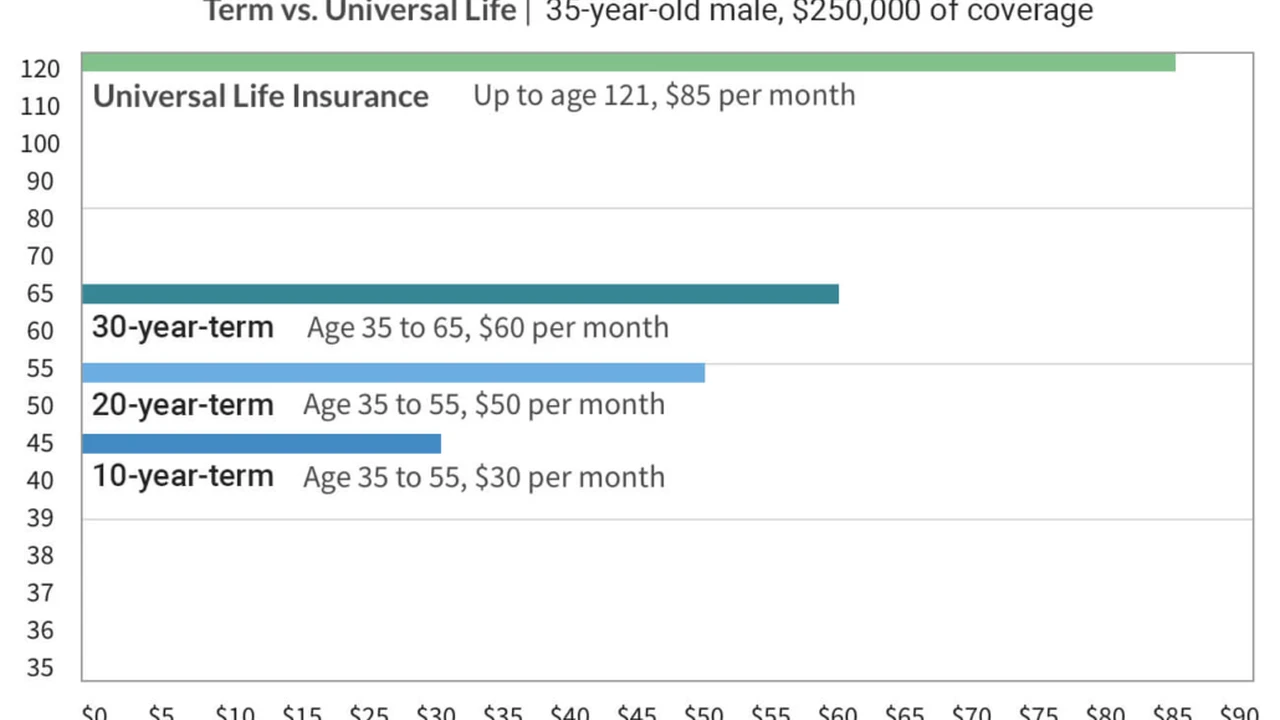

So, you're convinced that life insurance might be a good idea. Now, what kind should you consider? The two main types are Term Life and Permanent Life (like Whole Life or Universal Life).

Term Life Insurance for Single Individuals Affordable and Flexible

Term life insurance is often the most straightforward and affordable option. It provides coverage for a specific period (the 'term'), typically 10, 20, or 30 years. If you pass away during that term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires, and there's no payout. It's like renting insurance – you get coverage for a set period.

- Pros for Singles: It's generally much cheaper than permanent life insurance, making it accessible even on a tighter budget. It's great for covering specific, temporary needs like a co-signed loan or providing support for aging parents for a defined period. You can get a significant amount of coverage for a relatively low premium.

- Cons for Singles: It doesn't build cash value, and once the term ends, you'll need to buy a new policy (likely at a higher rate) if you still need coverage.

Recommended Products and Scenarios:

- Scenario: Covering Final Expenses and Short-Term Debts. A 10-year or 20-year term policy for $50,000 to $100,000 could be perfect.

- Product Example: Haven Life Term Life Insurance. Known for its easy online application process and competitive rates. For a healthy 30-year-old single individual, a 20-year, $100,000 policy might cost around $10-15 per month.

- Product Example: Ethos Term Life Insurance. Offers instant decisions for many applicants and flexible term lengths. Similar pricing to Haven Life, focusing on a streamlined digital experience.

- Scenario: Supporting Aging Parents for a Defined Period. If you anticipate your parents needing financial support for the next 15-20 years, a 20-year term policy for $250,000 to $500,000 could be appropriate, depending on their needs.

- Product Example: Policygenius (Broker). Not an insurer itself, but a great platform to compare quotes from multiple top-rated carriers like Pacific Life, Transamerica, and Lincoln Financial. This allows you to find the most competitive rates for your specific term and coverage needs.

Permanent Life Insurance for Single Individuals Long-Term Benefits and Cash Value

Permanent life insurance, such as Whole Life or Universal Life, provides coverage for your entire life, as long as premiums are paid. It also includes a cash value component that grows over time on a tax-deferred basis. You can borrow against this cash value or even withdraw from it.

- Pros for Singles: Lifelong coverage means you're always protected. The cash value can be a useful financial tool, acting as a savings component or a source of funds later in life. It's excellent for long-term estate planning or leaving a substantial legacy.

- Cons for Singles: Significantly more expensive than term life insurance. The cash value growth can be slow, and it might not be the most efficient way to save or invest if your primary goal is just financial growth.

Recommended Products and Scenarios:

- Scenario: Leaving a Significant Legacy or Charitable Gift. If you want to ensure a substantial sum goes to a specific person or charity, a whole life policy guarantees that payout.

- Product Example: MassMutual Whole Life Insurance. Known for its strong financial ratings and consistent dividend payments, which can enhance cash value growth. A $250,000 whole life policy for a healthy 30-year-old might range from $150-250 per month, depending on riders and dividend options.

- Product Example: Northwestern Mutual Whole Life Insurance. Another highly-rated mutual company with a long history of strong performance and dividends. Similar pricing structure to MassMutual.

- Scenario: Future Insurability and Long-Term Financial Planning. If you want to lock in coverage for life and potentially use the cash value as a financial resource down the road, a permanent policy makes sense.

- Product Example: Guardian Life Whole Life Insurance. Offers competitive policies with strong cash value growth potential and dividend payouts.

- Scenario: Flexible Premiums and Cash Value Growth (Universal Life). If you want lifelong coverage but prefer more flexibility in premium payments and potentially higher cash value growth linked to market performance (Indexed Universal Life), this could be an option.

- Product Example: Pacific Life Indexed Universal Life (IUL). Offers cash value growth tied to market indexes, with downside protection. Premiums can vary widely based on the chosen death benefit, index strategy, and riders, but expect it to be more than term and potentially similar to whole life, with more variability.

Comparing Products and Pricing for Single Individuals What to Look For

When you're shopping for life insurance as a single person, here's what to keep in mind:

1. Assess Your Actual Needs Determining Coverage Amount

Don't just guess. Think about:

- Final Expenses: How much would a funeral cost in your area? (Estimate $10,000 - $20,000)

- Outstanding Debts: Credit cards, personal loans, car loans, student loans (if co-signed).

- Support for Others: How much would your parents or other relatives need if your financial contribution stopped? For how long?

- Charitable Giving: How much do you want to leave to your favorite cause?

- Future Goals: Do you want to ensure funds are available for a future business venture or a specific legacy?

For many single individuals, a term policy ranging from $50,000 to $500,000 might be sufficient, depending on their specific circumstances. Permanent policies would typically start at similar death benefit amounts but with higher premiums.

2. Consider Your Budget Affordability and Value

Life insurance should fit comfortably into your budget. Don't overbuy if it means struggling to pay premiums. A smaller, affordable policy that stays in force is always better than a large one that lapses. Term life is usually the most budget-friendly entry point.

3. Research Reputable Insurers Financial Strength and Customer Service

Look for companies with strong financial ratings (A.M. Best, S&P, Moody's) and good customer service reviews. You want an insurer that will be around to pay claims when needed. Companies like MassMutual, Northwestern Mutual, Guardian, Pacific Life, and Transamerica are generally well-regarded. Online brokers like Policygenius or SelectQuote can help you compare multiple carriers at once.

4. Read the Fine Print Understanding Policy Details

Pay attention to policy terms, exclusions, and any riders you might be considering. For permanent policies, understand how the cash value grows and any fees involved.

5. Get Quotes and Compare Shop Around for the Best Deal

Don't settle for the first quote you get. Use online comparison tools or work with an independent agent who can shop multiple carriers for you. Prices for the same coverage can vary significantly between companies.

The Best Time to Buy Life Insurance for Single Individuals Act Now

The absolute best time to buy life insurance is when you're young and healthy. Even if you're single and don't have immediate dependents, securing a policy now can save you a lot of money in the long run. Your rates will be lower, and you'll lock in your insurability before any potential health issues arise. Think of it as an investment in your future self and the peace of mind it provides for those who care about you.

Making the Decision Is Life Insurance Right for You

Ultimately, the decision to get life insurance as a single individual is a personal one. It requires a bit of self-reflection about your current financial situation, your relationships, and your future goals. If you have any financial obligations that would fall to others, if you support aging parents, if you want to leave a charitable legacy, or if you simply want to lock in low rates for future insurability, then life insurance is definitely worth considering. It's not just about protecting others; it's about taking control of your financial future and ensuring your wishes are honored, no matter what life throws your way.

Don't let the 'single' status deter you from exploring this important financial tool. A little planning now can make a huge difference down the road, for you and for the people who matter most in your life.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)