Comparing Universal Life Insurance Providers in Southeast Asia

Review simplified issue life insurance policies for faster approval with fewer medical questions.

Comparing Simplified Issue Life Insurance Policies

Life insurance is one of those things we all know we need, but often put off. The traditional application process can feel daunting: medical exams, blood tests, urine samples, and a deep dive into your health history. For many, this is a significant barrier. Maybe you have a pre-existing condition that makes you wary of the underwriting process, or perhaps you simply don't have the time or desire for a lengthy medical examination. This is where simplified issue life insurance steps in, offering a streamlined path to coverage.

Simplified issue life insurance is designed for speed and convenience. It allows you to get coverage without a medical exam, relying instead on a health questionnaire. While it might not offer the lowest premiums for perfectly healthy individuals, it's an invaluable option for those who need coverage quickly, have minor health issues, or simply prefer a less intrusive application process. But with various providers and policy structures, how do you choose the best simplified issue policy for your needs? Let's break it down.

What is Simplified Issue Life Insurance and How Does It Work?

Simplified issue life insurance is a type of life insurance that doesn't require a medical exam. Instead, applicants answer a series of health-related questions on the application form. The insurer uses these answers, along with other data points like prescription drug databases (MIB Group, prescription checks), and motor vehicle records, to assess your risk. If you meet the insurer's criteria, you can often get approved for coverage within days, sometimes even minutes.

The key difference from fully underwritten policies is the absence of a physical exam. This makes it much faster and more accessible. However, because the insurer has less information about your health, they take on a higher risk. This increased risk is typically reflected in higher premiums compared to a fully underwritten policy for someone in excellent health. Also, simplified issue policies often come with lower coverage amounts than traditional policies, usually ranging from $25,000 to $500,000, though some can go higher.

Another important aspect to understand is the 'graded death benefit' clause that some simplified issue policies include. A graded death benefit means that if you pass away within the first two or three years of the policy (the 'waiting period'), your beneficiaries might only receive a return of the premiums paid, often with interest, rather than the full death benefit. This waiting period is a way for insurers to mitigate the risk of insuring individuals with undisclosed serious health conditions. After the waiting period, the full death benefit is paid out. Not all simplified issue policies have a graded death benefit, but it's a crucial detail to check.

Who Benefits Most from Simplified Issue Life Insurance Coverage?

Simplified issue life insurance isn't for everyone, but it's a perfect fit for several specific scenarios:

- Individuals with Minor Health Issues: If you have a pre-existing condition that might make traditional underwriting difficult or expensive (like well-controlled diabetes, high blood pressure, or a history of certain cancers that are now in remission), simplified issue can be a viable option.

- Those Who Need Quick Coverage: If you have an urgent need for life insurance, perhaps for a loan requirement, a new business venture, or simply want peace of mind without delay, simplified issue offers a much faster approval process.

- People Who Dislike Medical Exams: Let's face it, not everyone enjoys needles or doctor visits. If the thought of a medical exam is enough to deter you from getting coverage, simplified issue removes that hurdle.

- Older Applicants: As we age, health issues become more common. Simplified issue can be a good option for seniors who might find traditional underwriting more challenging or who are looking for coverage for final expenses.

- Busy Professionals: If your schedule is packed and you can't spare the time for a medical exam appointment, simplified issue offers a convenient alternative.

It's important to distinguish simplified issue from 'guaranteed issue' life insurance. Guaranteed issue policies require no health questions or medical exams whatsoever, and acceptance is guaranteed regardless of health. However, they typically have much lower coverage amounts, higher premiums, and almost always include a graded death benefit. Simplified issue falls in between fully underwritten and guaranteed issue, offering a balance of speed, accessibility, and potentially better rates than guaranteed issue for those who can answer a few health questions favorably.

Key Factors to Compare in Simplified Issue Policies Premiums and Benefits

When you're looking at different simplified issue policies, several factors should guide your comparison:

Coverage Amount Options and Limits

Simplified issue policies typically have lower maximum death benefits compared to fully underwritten policies. Most commonly, you'll find options ranging from $25,000 to $500,000. Some carriers might offer up to $1 million, but these are less common for pure simplified issue. Consider how much coverage your family truly needs. Is it just for final expenses, or do you need to replace income, pay off a mortgage, or fund a child's education? Match the coverage amount to your financial obligations.

Premium Costs and Affordability

Premiums for simplified issue policies are generally higher than for fully underwritten policies for a healthy individual, due to the reduced underwriting. However, they can be more affordable than guaranteed issue policies. Premiums are determined by your age, gender, the coverage amount, and your answers to the health questionnaire. Get quotes from multiple providers to compare rates. Remember, the cheapest policy isn't always the best if it doesn't meet your needs or has restrictive clauses.

Graded Death Benefit Waiting Periods and Exclusions

This is a critical factor. Many simplified issue policies include a graded death benefit, meaning the full death benefit isn't paid if you die within the first two or three years of the policy. Instead, your beneficiaries receive a refund of premiums paid, often with a small amount of interest (e.g., 10%). Understand the length of this waiting period and what circumstances might trigger it. Some policies might waive the graded benefit for accidental death. If you're looking for immediate full coverage, seek out policies without a graded death benefit, though these might be harder to find or have stricter health questions.

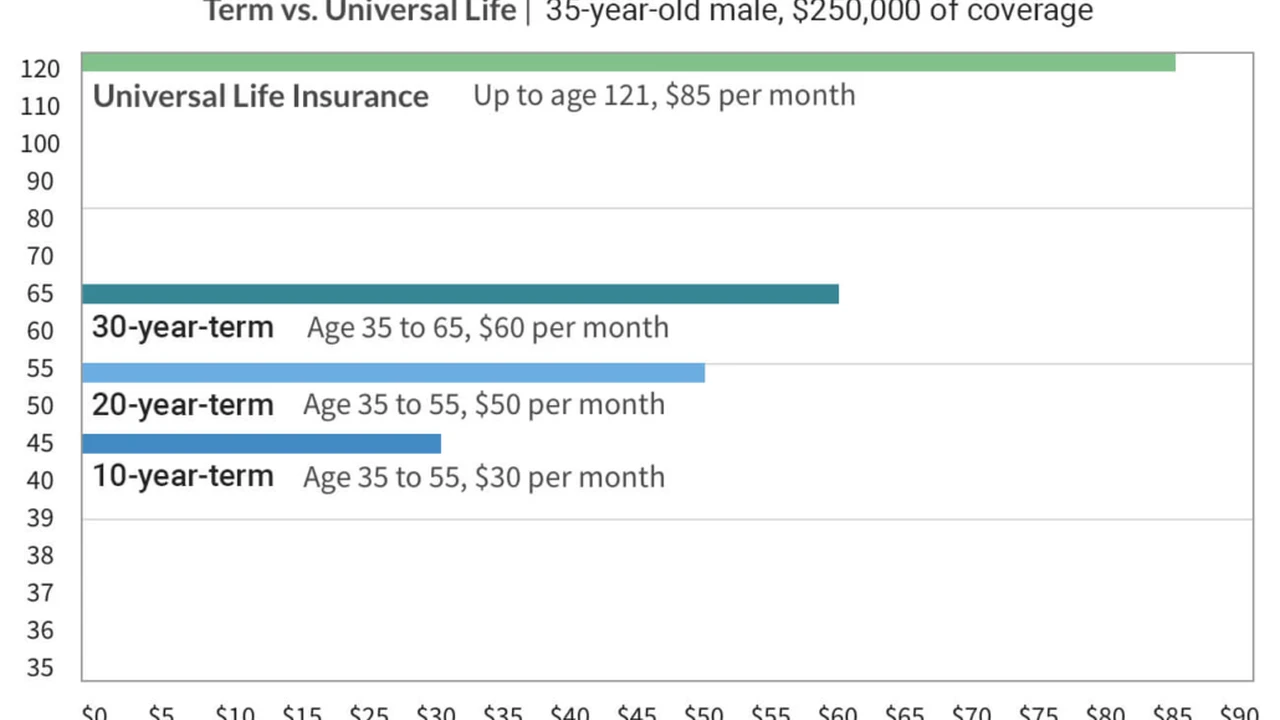

Policy Term Options Term vs Permanent Simplified Issue

Simplified issue policies are available in both term and permanent (whole life or universal life) formats. Simplified issue term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years). Simplified issue whole life insurance offers lifelong coverage and builds cash value. Your choice depends on your needs: temporary coverage for a specific debt or income replacement, or permanent coverage for final expenses or estate planning. Permanent simplified issue policies tend to have higher premiums but offer guaranteed coverage for life.

Riders and Additional Benefits Available

Even simplified issue policies can come with riders that enhance your coverage. Common riders include:

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit early if you're diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premiums if you become totally disabled.

- Child Rider: Provides a small amount of term life insurance for your children.

- Accidental Death Benefit Rider: Pays an additional death benefit if your death is due to an accident.

Check which riders are available and if they add value for your situation.

Top Simplified Issue Life Insurance Providers and Their Offerings

Let's look at some prominent providers in the US market that offer simplified issue life insurance. Keep in mind that product availability and features can vary by state and over time. Always get personalized quotes and review policy documents carefully.

Mutual of Omaha Simplified Issue Whole Life Insurance

Mutual of Omaha is a well-known name in the simplified issue space, particularly for final expense coverage. Their 'Living Promise' whole life insurance is a popular simplified issue product. It's designed primarily for seniors and those looking to cover funeral costs and other end-of-life expenses.

- Coverage Amounts: Typically ranges from $2,000 to $40,000.

- Age Range: Often available for applicants aged 45-85.

- Underwriting: No medical exam, just a few health questions.

- Graded Death Benefit: Yes, for the first two years. If death occurs within the first two years from natural causes, beneficiaries receive 110% of premiums paid. Full death benefit for accidental death from day one.

- Key Features: Builds cash value, guaranteed level premiums, guaranteed death benefit, and available accelerated death benefit rider for terminal or chronic illness.

- Use Case: Excellent for final expense planning, especially for seniors who might not qualify for traditional policies due to health.

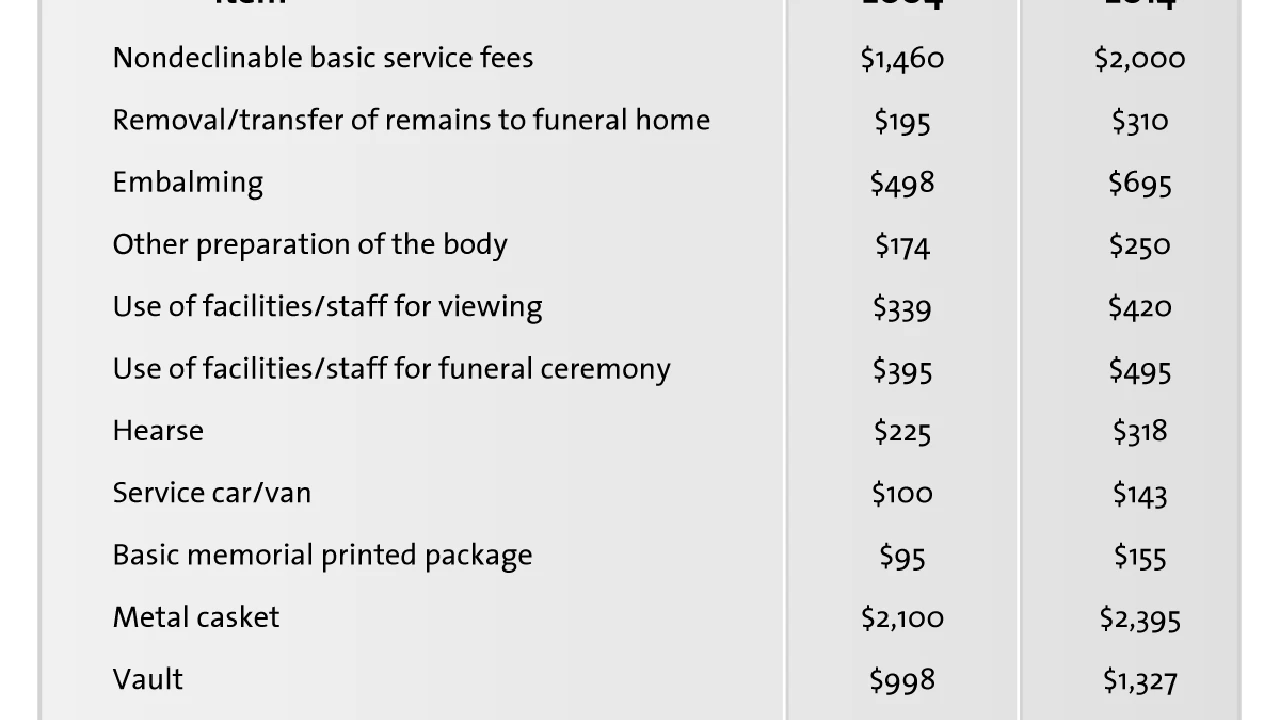

- Estimated Pricing (Illustrative, actual rates vary): For a 65-year-old non-smoking female, a $10,000 policy might cost around $40-50 per month. For a 65-year-old non-smoking male, it could be around $50-60 per month.

Foresters Financial Simplified Issue Term Life Insurance

Foresters Financial offers simplified issue term life insurance, which is less common than simplified issue whole life. Their 'Strong Foundation' term life product can be issued on a simplified basis.

- Coverage Amounts: Can go up to $400,000 or even $500,000 in some cases, which is higher than many simplified issue options.

- Age Range: Typically available for ages 18-70, depending on the term length.

- Underwriting: No medical exam, health questionnaire, and MIB/prescription checks.

- Graded Death Benefit: Generally, no graded death benefit for their term products if approved. This means full coverage from day one.

- Key Features: Level premiums for the term, convertible to a permanent policy, and includes member benefits (like scholarships and grants) as Foresters is a fraternal organization.

- Use Case: Ideal for individuals who need substantial temporary coverage quickly without a medical exam, such as young families or those covering a mortgage.

- Estimated Pricing (Illustrative, actual rates vary): For a 40-year-old non-smoking female, a $250,000, 20-year term policy might be in the range of $40-60 per month. For a 40-year-old non-smoking male, it could be $50-75 per month.

Gerber Life Grow-Up Plan Simplified Issue Whole Life for Children

While often marketed directly to parents, the Gerber Life Grow-Up Plan is a simplified issue whole life policy specifically for children. It's a unique product in the simplified issue market.

- Coverage Amounts: Starts from $5,000 up to $50,000.

- Age Range: Available for children aged 14 days to 14 years.

- Underwriting: No medical exam, just a few basic health questions about the child.

- Graded Death Benefit: No, full coverage from day one.

- Key Features: Coverage doubles automatically at age 18 (with no increase in premium), builds cash value, guaranteed level premiums for life, and the child can take over the policy as an adult.

- Use Case: Parents or grandparents looking to lock in affordable, lifelong coverage for a child, ensuring future insurability regardless of health.

- Estimated Pricing (Illustrative, actual rates vary): For a 5-year-old child, a $10,000 policy might cost around $6-10 per month.

AIG Guaranteed Issue Whole Life Insurance (Simplified for some)

While primarily known for guaranteed issue, AIG also offers simplified underwriting for some of its products, particularly through its network of independent agents. Their guaranteed issue product is often considered when simplified issue is not an option due to health.

- Coverage Amounts: Typically up to $25,000.

- Age Range: Often for ages 50-80.

- Underwriting: No medical exam, no health questions (guaranteed acceptance).

- Graded Death Benefit: Yes, for the first two years. Beneficiaries receive 110% of premiums paid if death is from natural causes within this period.

- Key Features: Guaranteed acceptance, builds cash value, level premiums.

- Use Case: For individuals with significant health issues who cannot qualify for simplified issue or traditional policies, primarily for final expenses.

- Estimated Pricing (Illustrative, actual rates vary): For a 70-year-old non-smoking female, a $10,000 policy might be around $60-80 per month. For a 70-year-old non-smoking male, it could be $80-100 per month.

Transamerica Simplified Issue Term Life Insurance

Transamerica offers a simplified issue term product called 'Trendsetter Super' that can be issued without a medical exam for certain coverage amounts and age bands.

- Coverage Amounts: Can go up to $250,000 or $500,000 depending on age and health profile.

- Age Range: Typically for ages 18-60 for simplified underwriting.

- Underwriting: No medical exam, but a detailed health questionnaire and MIB/prescription checks.

- Graded Death Benefit: Generally, no graded death benefit if approved through their simplified underwriting process.

- Key Features: Level premiums for the term, convertible to a permanent policy, and competitive rates for those who qualify.

- Use Case: Good for individuals needing substantial term coverage quickly, especially those with generally good health but who want to avoid a medical exam.

- Estimated Pricing (Illustrative, actual rates vary): For a 35-year-old non-smoking female, a $250,000, 20-year term policy might be in the range of $30-50 per month. For a 35-year-old non-smoking male, it could be $40-65 per month.

Choosing the Right Simplified Issue Policy for Your Needs

With these options in mind, how do you make the best choice? Here's a practical approach:

Assess Your Coverage Requirements and Financial Goals

First, determine how much life insurance you actually need. Are you looking to cover final expenses (funeral costs, medical bills)? Or do you need to replace income for your family, pay off a mortgage, or fund a child's education? Your coverage amount will dictate which simplified issue policies are even an option. For final expenses, smaller whole life policies like Mutual of Omaha's might suffice. For income replacement, a term policy from Foresters or Transamerica might be more appropriate.

Evaluate Your Health Status and Eligibility for Simplified Underwriting

Be honest about your health. While simplified issue avoids a medical exam, you'll still answer health questions. If you have serious health conditions (e.g., recent cancer diagnosis, heart attack, stroke, or severe diabetes complications), you might not qualify for simplified issue and may need to consider guaranteed issue. If your health issues are minor or well-managed, simplified issue is a strong contender. The fewer 'yes' answers to serious health questions, the better your chances for approval and potentially lower premiums.

Compare Quotes from Multiple Simplified Issue Providers

Don't settle for the first quote you receive. Work with an independent agent or use online comparison tools to get quotes from several different simplified issue providers. Premiums can vary significantly between companies for the same coverage amount, even for simplified issue policies. Pay close attention to the total cost over the policy's life, not just the monthly premium.

Understand the Graded Death Benefit Clause and Waiting Periods

This is crucial. If immediate full coverage is a priority, look for simplified issue policies that do not have a graded death benefit. If you're comfortable with a waiting period (e.g., for final expense planning where death isn't imminent), then policies with a graded benefit might be more accessible or affordable. Always know exactly what the waiting period is and what conditions trigger it.

Consider the Policy Type Term or Permanent Simplified Issue

Do you need coverage for a specific period (e.g., until your children are grown or your mortgage is paid off)? Then simplified issue term life insurance is likely your best bet. Do you want lifelong coverage, perhaps to cover final expenses or leave a legacy, and appreciate the cash value component? Then simplified issue whole life insurance would be more suitable. Your long-term financial goals should drive this decision.

Read the Fine Print Policy Exclusions and Limitations

Before signing anything, thoroughly read the policy document. Understand any exclusions (e.g., suicide clauses, aviation exclusions) and limitations. Pay attention to how the cash value grows (if it's a permanent policy) and any surrender charges if you cancel the policy early. A good agent can help you navigate these details.

The Application Process for Simplified Issue Life Insurance What to Expect

Applying for simplified issue life insurance is generally straightforward and much quicker than traditional underwriting. Here's a typical breakdown:

Online Application or Agent Assisted Process

Many simplified issue policies can be applied for entirely online, making the process very convenient. You'll fill out a digital application form that includes personal details and the health questionnaire. Alternatively, you can work with an independent insurance agent who can guide you through the application, answer questions, and submit it on your behalf. An agent can also help you compare different providers and find the best fit.

Health Questionnaire and Background Checks

The core of the simplified issue application is the health questionnaire. You'll be asked a series of 'yes' or 'no' questions about your medical history, current health conditions, medications, and lifestyle (e.g., smoking status, hazardous hobbies). Be completely honest in your answers, as misrepresentation can lead to policy cancellation or denial of claims. The insurer will also typically run background checks, which may include:

- Medical Information Bureau (MIB) Check: A database that stores information about previous life insurance applications and medical conditions.

- Prescription Drug Database Check: To verify medications you've been prescribed.

- Motor Vehicle Report (MVR): To check for serious driving infractions.

These checks help the insurer assess your risk without a physical exam.

Approval Times and Policy Issuance

One of the biggest advantages of simplified issue is the speed of approval. Many applicants receive an immediate decision or approval within a few days. Once approved, your policy can be issued quickly, and coverage can begin as soon as you make your first premium payment. This rapid turnaround is a major draw for those who need coverage without delay.

Common Misconceptions About Simplified Issue Life Insurance Debunked

There are a few myths floating around about simplified issue life insurance that are worth clarifying:

Myth 1 It's Only for People with Bad Health

While simplified issue is an excellent option for those with minor health issues, it's not exclusively for them. Many healthy individuals choose simplified issue for its convenience and speed, especially if they have busy schedules or simply prefer to avoid a medical exam. It's a viable option for anyone prioritizing a streamlined application process.

Myth 2 It's Always More Expensive Than Traditional Life Insurance

For a perfectly healthy individual, a fully underwritten policy will almost always offer lower premiums. However, if you have a pre-existing condition that would lead to a higher rating (or even denial) with traditional underwriting, simplified issue might actually be more affordable or even your only option for coverage. The 'cost' is relative to your health profile and priorities.

Myth 3 It's the Same as Guaranteed Issue Life Insurance

This is a common confusion. Simplified issue requires you to answer health questions, and approval is not guaranteed. Guaranteed issue, on the other hand, asks no health questions and guarantees acceptance, regardless of your health. Guaranteed issue policies typically have higher premiums, lower coverage limits, and almost always a graded death benefit. Simplified issue offers a middle ground.

Myth 4 You Can Lie on the Application and Get Away With It

Absolutely not. Insurers conduct background checks (MIB, prescription databases) to verify your health information. If you misrepresent your health on the application, the insurer can deny a claim, cancel your policy, or adjust the death benefit. Honesty is always the best policy when applying for life insurance.

Maximizing the Value of Your Simplified Issue Life Insurance Policy

Once you have a simplified issue policy, there are ways to ensure it continues to serve your needs effectively:

Regularly Review Your Coverage Needs and Financial Situation

Life changes. Marriages, births, new homes, career changes, and debt fluctuations all impact your life insurance needs. Review your policy every few years, or after any major life event, to ensure your coverage amount is still adequate. If your health improves significantly, you might even consider applying for a fully underwritten policy to potentially secure lower rates.

Understand Your Policy's Cash Value Growth for Permanent Policies

If you have a simplified issue whole life policy, understand how its cash value grows. This cash value is a living benefit you can access through loans or withdrawals. While it's not designed to be a primary investment vehicle, it can provide a source of funds for emergencies or other needs later in life.

Keep Beneficiary Information Up to Date

Always ensure your beneficiary designations are current. Life events like divorce, marriage, or the birth of a child mean you might need to update who receives your death benefit. Keeping this information current ensures your policy pays out to the right people when the time comes.

Consider Converting Term to Permanent Coverage If Available

If you have a simplified issue term policy, check if it has a convertibility feature. This allows you to convert your term policy into a permanent policy (like whole life or universal life) without undergoing a new medical exam, regardless of your health at the time of conversion. This can be a valuable option if your health declines but you still need lifelong coverage.

Simplified issue life insurance is a valuable tool in the life insurance landscape, offering a practical solution for many who find traditional underwriting too cumbersome or challenging. By understanding its features, comparing providers, and being honest about your health, you can secure the coverage you need with minimal hassle.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)