The Role of Life Insurance in Financial Planning

Discover how life insurance integrates into a holistic financial plan for long-term security and wealth protection.

Discover how life insurance integrates into a holistic financial plan for long-term security and wealth protection.

The Role of Life Insurance in Financial Planning

Life insurance often gets a bad rap. Some people see it as an unnecessary expense, while others find it too complicated to understand. But here's the thing: when you peel back the layers, life insurance isn't just about death; it's about life. It's about protecting the life you've built, the people you love, and the financial future you envision. Think of it as a cornerstone in your overall financial planning strategy, a safety net that catches your loved ones if you're no longer there to provide. It’s not just a product; it’s a promise, a commitment to your family’s well-being, even in your absence.

In this comprehensive guide, we're going to dive deep into how life insurance seamlessly integrates into a holistic financial plan. We'll explore its various facets, from providing immediate financial relief to serving as a powerful tool for wealth accumulation and estate planning. We'll also look at specific product recommendations, real-world scenarios, and practical advice to help you make informed decisions. Whether you're just starting your financial journey or looking to optimize an existing plan, understanding the role of life insurance is absolutely crucial.

Understanding Life Insurance Beyond the Basics What is Life Insurance

At its core, life insurance is a contract between you and an insurance company. In exchange for regular premium payments, the insurer promises to pay a lump sum of money, known as a death benefit, to your chosen beneficiaries upon your passing. Simple enough, right? But the beauty of life insurance lies in its versatility and the myriad ways it can be tailored to meet diverse financial needs.

It’s not just about replacing lost income. While that’s a primary function, life insurance can also cover outstanding debts like mortgages, car loans, and credit card balances. It can fund your children’s education, provide for a spouse’s retirement, or even cover final expenses, sparing your family from unexpected financial burdens during a difficult time. The death benefit is typically tax-free for beneficiaries, which is a significant advantage, especially when compared to other forms of inheritance.

Beyond the basic protection, many life insurance policies, particularly permanent ones, offer a cash value component that grows over time on a tax-deferred basis. This cash value can be accessed during your lifetime through loans or withdrawals, providing a flexible source of funds for emergencies, educational expenses, or even supplementing retirement income. This dual benefit of protection and potential growth makes certain life insurance policies powerful financial instruments.

Immediate Financial Protection How Life Insurance Safeguards Your Family

Let's face it, life is unpredictable. While we all hope for a long and healthy life, preparing for the unexpected is a sign of responsible financial planning. The most immediate and perhaps most critical role of life insurance is to provide financial protection for your loved ones when you're no longer able to. This isn't just about maintaining their current lifestyle; it's about ensuring their future remains secure and their dreams aren't derailed by a sudden loss of income.

Income Replacement and Living Expenses Life Insurance Benefits

For many families, the primary breadwinner's income is essential for covering daily living expenses, from groceries and utilities to housing costs and transportation. If that income suddenly disappears, the financial strain can be immense. Life insurance steps in to fill that void, providing a steady stream of funds that can replace lost income for years, or even decades. This allows your family to maintain their standard of living, pay bills, and avoid making drastic lifestyle changes during a period of grief.

Consider a scenario where a young family with two children relies heavily on one parent's salary. A substantial term life insurance policy could provide enough capital to replace that income for 10, 20, or even 30 years, giving the surviving parent time to adjust, re-enter the workforce if necessary, or simply focus on raising their children without immediate financial pressure. This peace of mind is invaluable.

Debt Coverage and Mortgage Protection Life Insurance for Debts

Most households carry some form of debt, whether it's a mortgage, car loans, student loans, or credit card balances. Upon your passing, these debts don't simply vanish. They often become the responsibility of your surviving family members, adding another layer of stress to an already difficult situation. Life insurance can be specifically structured to cover these outstanding obligations.

For instance, a term life insurance policy can be purchased with a death benefit amount that matches your mortgage balance. If you pass away, the policy pays out, and your family can use those funds to pay off the mortgage, ensuring they retain their home without the burden of monthly payments. This is often referred to as 'mortgage protection insurance' and is a crucial consideration for homeowners. Similarly, it can clear other significant debts, preventing creditors from pursuing your estate or your loved ones.

Education Funding and Future Planning Life Insurance for Education

For parents, ensuring their children receive a good education is often a top priority. College tuition, even for public universities, can be incredibly expensive, and the costs continue to rise. Life insurance can be a powerful tool for guaranteeing that your children's educational aspirations are met, regardless of what happens to you.

A well-structured life insurance policy can provide a dedicated fund for college expenses, vocational training, or any other educational pursuit. This means your children won't have to take on massive student loans or compromise on their dreams due to financial constraints. It's a way of investing in their future, ensuring they have the resources to succeed, even if you're not there to guide them every step of the way.

Final Expenses and Estate Settlement Life Insurance for Funeral Costs

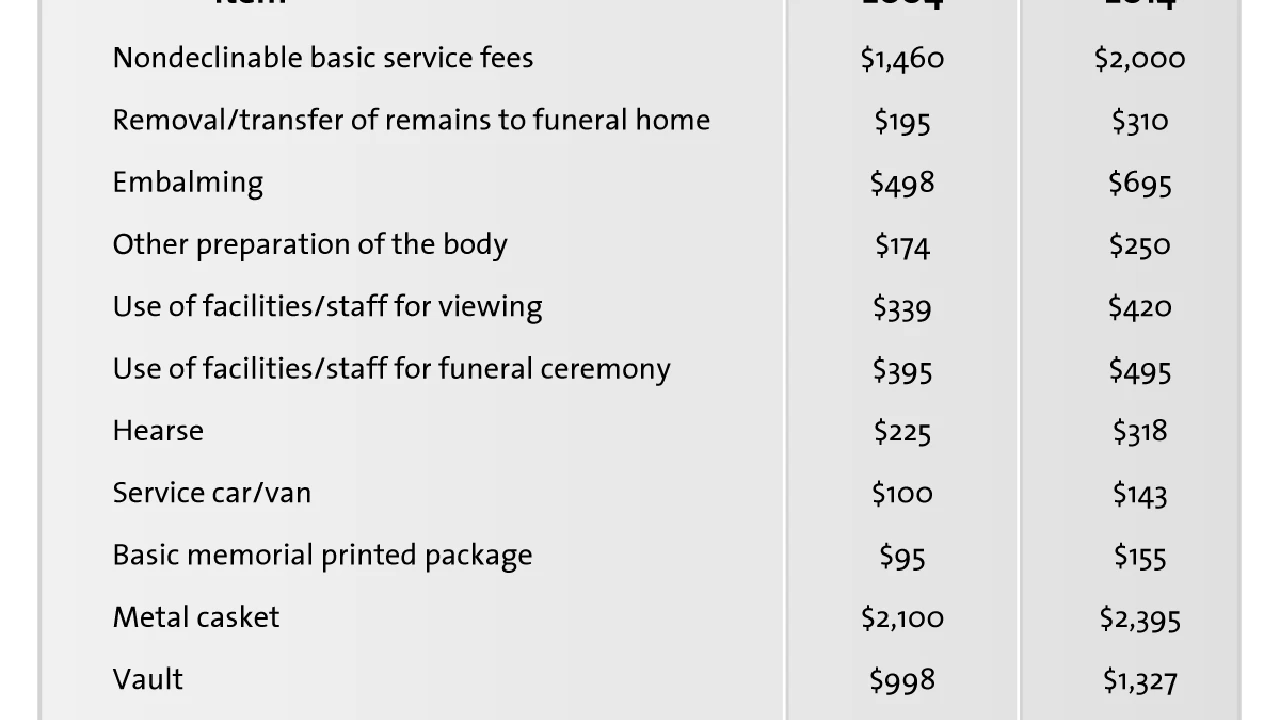

The costs associated with a funeral, burial, or cremation can be surprisingly high, often ranging from several thousand to tens of thousands of dollars. These expenses, coupled with potential legal and administrative costs for settling an estate, can place an immediate financial burden on grieving families. Final expense life insurance, a type of whole life insurance with a smaller death benefit, is specifically designed to cover these costs.

Even a standard term or whole life policy can allocate a portion of its death benefit to cover these immediate expenses, ensuring your family doesn't have to dip into savings or go into debt to give you a dignified farewell. This thoughtful planning can alleviate a significant amount of stress during an already emotional time.

Wealth Accumulation and Estate Planning The Long-Term Benefits of Life Insurance

While immediate protection is a primary benefit, certain types of life insurance, particularly permanent policies, offer significant advantages for long-term wealth accumulation and sophisticated estate planning. These policies go beyond simply providing a death benefit; they can become living assets that contribute to your financial growth and legacy.

Cash Value Growth and Tax Advantages Life Insurance as an Asset

Permanent life insurance policies, such as whole life and universal life, include a cash value component that grows over time on a tax-deferred basis. This means you don't pay taxes on the growth until you withdraw the money, and even then, there are often ways to access it tax-efficiently through policy loans. This tax-deferred growth can be a powerful advantage, especially over many years.

The cash value can be accessed for various purposes during your lifetime. You can take out policy loans, which typically don't require credit checks and have flexible repayment terms. You can also make withdrawals, though these can reduce the death benefit. This accessibility makes the cash value a flexible financial resource for emergencies, funding a down payment on a home, or even supplementing retirement income. It's like having a personal, tax-advantaged savings account embedded within your insurance policy.

Estate Planning and Wealth Transfer Life Insurance for Legacy

For individuals with significant assets, life insurance plays a crucial role in estate planning. The death benefit, as mentioned, is generally paid out tax-free to beneficiaries, making it an efficient way to transfer wealth. This is particularly valuable in situations where an estate might face substantial estate taxes.

For example, if your estate is largely comprised of illiquid assets like real estate or a family business, your heirs might be forced to sell these assets to pay estate taxes. A life insurance policy can provide the necessary liquidity to cover these taxes, allowing your beneficiaries to retain the assets you intended for them. It ensures your legacy is preserved and passed on according to your wishes, without being eroded by taxes or forced sales.

Furthermore, life insurance can be used to equalize inheritances among heirs, especially if some beneficiaries receive non-liquid assets (like a family business) while others receive cash. It can also be used to make charitable donations, leaving a lasting impact on causes you care about.

Business Succession Planning Life Insurance for Business Owners

For business owners, life insurance is not just about personal protection; it's about business continuity. Key person insurance protects a business from the financial loss that would occur if a vital employee, owner, or executive were to pass away. The death benefit can cover the costs of recruiting and training a replacement, compensate for lost revenue, and help the business navigate a difficult transition period.

Life insurance is also critical for funding buy-sell agreements. In a partnership or closely held corporation, a buy-sell agreement outlines how a deceased owner's share of the business will be purchased by the surviving owners. Life insurance provides the necessary funds to execute this agreement, ensuring a smooth transition of ownership, preventing disputes, and providing fair compensation to the deceased owner's family. Without it, the surviving owners might not have the capital to buy out the deceased's share, potentially leading to the forced sale or dissolution of the business.

Choosing the Right Life Insurance Policy Types and Considerations

With various types of life insurance available, selecting the right policy can feel overwhelming. The best choice depends on your individual circumstances, financial goals, and budget. Let's break down the main types and what to consider.

Term Life Insurance Affordable and Flexible Protection

Term life insurance is often considered the simplest and most affordable type of life insurance. It provides coverage for a specific period, or 'term,' typically 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires, and there's no payout. It's like renting insurance – you get coverage for a set period, and then it's gone.

Pros:

- Affordability: Generally much cheaper than permanent life insurance, especially for younger individuals.

- Simplicity: Easy to understand and straightforward.

- Specific Needs: Ideal for covering specific financial obligations that have a defined end date, such as a mortgage or raising young children.

Cons:

- No Cash Value: Does not build cash value.

- Expires: Coverage ends after the term, and renewing can be significantly more expensive.

Recommended Products:

- Haven Life (US): Known for its fully online application process and competitive rates, especially for healthy individuals. Offers terms up to 30 years.

- Policygenius (US/Southeast Asia): An independent broker that allows you to compare quotes from multiple top-rated insurers, ensuring you find the best rate for your specific needs.

- FWD Life Insurance (Southeast Asia): Popular in markets like Singapore, Thailand, and Vietnam, offering various term life plans with competitive premiums and digital-first services.

Use Case: A young couple with a new mortgage and two small children needs to ensure their income is replaced and their mortgage is paid off if one parent passes away before the children are grown. A 20-year term policy covering the mortgage and income replacement would be ideal.

Whole Life Insurance Guaranteed Coverage and Cash Value

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as premiums are paid. It also includes a cash value component that grows at a guaranteed rate over time. This cash value can be accessed through loans or withdrawals.

Pros:

- Lifelong Coverage: Provides protection for your entire life.

- Guaranteed Cash Value Growth: The cash value grows at a predictable rate.

- Fixed Premiums: Premiums typically remain level for the life of the policy.

- Estate Planning: Excellent for estate planning and wealth transfer due to guaranteed death benefit.

Cons:

- Higher Premiums: Significantly more expensive than term life insurance.

- Less Flexible: Less flexibility in premium payments compared to universal life.

Recommended Products:

- MassMutual (US): A highly-rated mutual company known for strong dividends and robust whole life products.

- New York Life (US): Another top mutual insurer with a long history of financial strength and competitive whole life offerings.

- Great Eastern Life (Southeast Asia): A prominent insurer in Singapore and Malaysia, offering comprehensive whole life plans with participating features (dividends).

Use Case: An individual in their 40s wants to ensure lifelong coverage, build a tax-advantaged cash reserve, and leave a guaranteed inheritance for their grandchildren. A whole life policy would meet these objectives.

Universal Life Insurance Flexible Premiums and Adjustable Benefits

Universal life (UL) insurance is another form of permanent life insurance, but it offers more flexibility than whole life. Policyholders can often adjust their premium payments and death benefit amounts within certain limits. It also has a cash value component that grows based on an interest rate set by the insurer, which can fluctuate.

Pros:

- Flexibility: Adjustable premiums and death benefits.

- Cash Value Growth: Builds cash value that can be accessed.

- Lifelong Coverage: Provides permanent protection.

Cons:

- Complexity: Can be more complex to understand than term or whole life.

- Interest Rate Risk: Cash value growth can be tied to fluctuating interest rates (for traditional UL).

- Potential for Lapse: If cash value is depleted by fees and insufficient premiums, the policy can lapse.

Recommended Products:

- Pacific Life (US): Offers a range of universal life products, including indexed universal life (IUL) with strong performance potential.

- Transamerica (US): Known for its competitive universal life and indexed universal life options.

- Prudential (US/Southeast Asia): A global insurer with a strong presence in Southeast Asia, offering various UL products, including those with investment-linked features.

Use Case: A small business owner needs flexible coverage that can adapt to changing income levels and also wants to use the cash value for future business opportunities or retirement. A universal life policy, particularly an Indexed Universal Life (IUL) for potential higher growth, could be a good fit.

Indexed Universal Life Insurance Market-Linked Growth Potential

Indexed Universal Life (IUL) is a type of universal life insurance where the cash value growth is linked to the performance of a stock market index (like the S&P 500), but with a floor (guaranteed minimum return) and a cap (maximum return). This offers potential for higher cash value growth than traditional UL, while still providing some downside protection.

Pros:

- Growth Potential: Opportunity for higher cash value growth tied to market performance.

- Downside Protection: Typically includes a guaranteed minimum interest rate (floor) to protect against market losses.

- Tax Advantages: Tax-deferred cash value growth and tax-free access through loans.

Cons:

- Complexity: More complex than traditional UL, requiring careful understanding.

- Caps: Growth is capped, meaning you won't participate in all market gains.

- Fees: Can have higher fees and charges than other policy types.

Recommended Products:

- National Life Group (US): A popular choice for IUL, known for its competitive caps and strong performance.

- Allianz Life (US): Offers innovative IUL products with various indexing strategies.

- Manulife (Southeast Asia): Provides IUL options in markets like Vietnam and the Philippines, catering to those seeking market-linked growth.

Use Case: An individual who is comfortable with some market exposure but wants protection against significant losses, and is looking for a tax-advantaged way to accumulate wealth for retirement or other long-term goals. An IUL could offer a balance of growth potential and security.

Variable Universal Life Insurance Investment Control and Risk

Variable Universal Life (VUL) insurance allows policyholders to invest the cash value in various sub-accounts, similar to mutual funds. This offers the potential for significant growth but also carries investment risk, as the cash value can decrease if the investments perform poorly. It combines life insurance with an investment component where you have more control over the investment choices.

Pros:

- High Growth Potential: Direct participation in market gains.

- Investment Control: Choose from a range of investment sub-accounts.

- Flexibility: Adjustable premiums and death benefits.

Cons:

- Investment Risk: Cash value can decrease with poor market performance.

- Complexity: Requires active management and understanding of investment markets.

- Higher Fees: Can have higher fees due to investment management.

Recommended Products:

- Prudential (US): Offers a variety of VUL products with diverse investment options.

- Lincoln Financial Group (US): Known for its robust VUL platforms and investment choices.

- AIA (Southeast Asia): A leading insurer in the region, offering investment-linked policies (ILPs) which are similar to VUL, allowing policyholders to invest in various funds.

Use Case: An investor who is comfortable with market risk, wants to combine life insurance with aggressive investment growth, and is willing to actively manage their sub-accounts. A VUL could be suitable for those seeking maximum growth potential within a life insurance wrapper.

Integrating Life Insurance into Your Holistic Financial Plan Practical Steps

Now that we've explored the different types and their benefits, let's talk about how to actually weave life insurance into your broader financial strategy. It's not a standalone product; it's a piece of a larger puzzle.

Assessing Your Needs How Much Life Insurance Do I Need

The first step is to determine how much coverage you actually need. There's no one-size-fits-all answer, but several methods can help. A common approach is the 'DIME' method:

- D - Debt: Total all your outstanding debts (mortgage, car loans, credit cards, student loans).

- I - Income: Multiply your annual income by the number of years your family would need financial support (e.g., 10-15 years).

- M - Mortgage: The outstanding balance on your home loan.

- E - Education: Estimate future education costs for your children.

Add these figures together, and then subtract any existing liquid assets your family could use (like savings or investments). This gives you a rough estimate of your coverage needs. It's crucial to be realistic about future expenses and inflation.

Reviewing and Adjusting Your Policy Life Insurance Policy Review

Life isn't static, and neither should your life insurance policy be. Major life events – getting married, having children, buying a home, starting a business, getting a promotion, or even getting divorced – should trigger a review of your coverage. Your needs will change, and your policy should reflect those changes.

For example, when you have children, your need for income replacement and education funding increases significantly. When your mortgage is paid off, you might be able to reduce your term coverage or reallocate funds. Regularly reviewing your policy, ideally every 3-5 years or after a major life event, ensures you're adequately protected without being over-insured or under-insured.

Working with a Financial Advisor Life Insurance Expert Advice

Navigating the complexities of life insurance and integrating it into a comprehensive financial plan can be challenging. This is where a qualified financial advisor or insurance professional becomes invaluable. They can help you:

- Assess your specific needs and goals.

- Explain the different policy types and their suitability for your situation.

- Compare quotes from various insurers to find the best value.

- Structure your policy to maximize benefits and minimize costs.

- Integrate life insurance with your other financial instruments, such as retirement accounts, investments, and estate plans.

Look for advisors who are fiduciaries, meaning they are legally obligated to act in your best interest. Their expertise can save you time, money, and ensure you make the most informed decisions for your financial future.

Real-World Scenarios How Life Insurance Makes a Difference

Let's look at a few hypothetical situations to illustrate the tangible impact of life insurance.

Scenario 1 Young Family Protection

The Situation: Sarah and Mark are in their early 30s with two young children, ages 2 and 4. Mark is the primary earner, bringing in $80,000 annually. They have a $300,000 mortgage and minimal savings. Their goal is to ensure their children can go to college and Sarah can maintain their home if Mark passes away.

Life Insurance Solution: Mark purchases a 20-year term life insurance policy with a death benefit of $1,000,000. This amount is calculated to cover the mortgage ($300,000), replace his income for 15 years ($80,000 x 15 = $1,200,000, but they have some savings and Sarah could eventually work), and contribute significantly to college funds for both children. The premiums are affordable for their current budget.

The Impact: Five years later, Mark tragically passes away in an accident. The $1,000,000 death benefit is paid out to Sarah. She uses $300,000 to pay off the mortgage, eliminating that monthly expense. The remaining $700,000 is invested conservatively, providing an income stream that allows her to stay home with the children for several years, grieve, and then slowly transition back into part-time work. The children's college funds are secure, and the family's financial stability is preserved, allowing them to focus on healing rather than financial ruin.

Scenario 2 Business Owner Succession

The Situation: David and Emily co-own a successful marketing agency, each holding a 50% stake. They have a buy-sell agreement in place, stipulating that if one owner dies, the surviving owner will purchase the deceased's share from their estate. The business is valued at $2,000,000.

Life Insurance Solution: David and Emily each purchase a $1,000,000 whole life insurance policy on the other's life. The business pays the premiums, and the policies are owned by the business or cross-owned by the partners.

The Impact: Emily unexpectedly passes away. The $1,000,000 death benefit from the policy on Emily's life is paid to David (or the business). David uses these funds to purchase Emily's 50% share from her estate, as per the buy-sell agreement. Emily's family receives fair compensation for her share of the business, and David gains full ownership, ensuring the business continues to operate smoothly without financial strain or legal disputes. The whole life policies also built cash value, which could have been used for business liquidity if needed.

Scenario 3 Estate Tax Planning for High Net Worth

The Situation: Mr. Lee, a wealthy individual in Singapore, has an estate valued at $15,000,000, primarily consisting of real estate and a private art collection. He wants to ensure his children inherit these assets without having to sell them to cover potential estate duties or other taxes.

Life Insurance Solution: Mr. Lee establishes an irrevocable life insurance trust (ILIT) and purchases a $5,000,000 universal life insurance policy, with the ILIT as the owner and beneficiary. He gifts funds to the trust to pay the premiums. Because the policy is owned by the ILIT, the death benefit is generally excluded from his taxable estate.

The Impact: Upon Mr. Lee's passing, the $5,000,000 death benefit is paid directly to the ILIT, tax-free. The trustee then uses these funds to pay any estate duties, administrative costs, or other expenses, providing the necessary liquidity. This allows Mr. Lee's children to inherit the real estate and art collection intact, without being forced to sell valuable assets to cover taxes. The life insurance acts as a 'tax-free' source of funds to preserve his legacy.

The Future of Life Insurance Innovation and Trends

The life insurance industry isn't static; it's constantly evolving, driven by technological advancements, changing consumer expectations, and new data analytics capabilities. Understanding these trends can help you anticipate future offerings and make more informed decisions.

Insurtech and Digital Transformation Life Insurance Technology

Insurtech, the intersection of insurance and technology, is revolutionizing how life insurance is bought, sold, and managed. Online platforms and mobile apps are making it easier than ever to get quotes, apply for policies, and manage your coverage. Companies like Haven Life and Ladder Life in the US offer fully digital application processes, often providing instant decisions for healthy applicants, eliminating the need for traditional medical exams for many.

In Southeast Asia, insurers like FWD and AIA are also investing heavily in digital platforms, offering seamless customer experiences and personalized services. This digital transformation is making life insurance more accessible, transparent, and convenient for consumers, especially younger generations who prefer online interactions.

Personalized Underwriting and Wearable Tech Life Insurance Data

The use of data analytics and artificial intelligence is leading to more personalized underwriting processes. Insurers are increasingly using data from electronic health records, prescription histories, and even wearable fitness trackers (with customer consent) to assess risk more accurately. This can lead to more competitive premiums for healthy individuals and a faster underwriting process.

Some insurers are even offering incentives for healthy behaviors, such as discounts for policyholders who meet certain fitness goals tracked by wearables. This shift towards 'living benefits' and proactive health management is a significant trend, moving life insurance beyond just a death benefit to a tool that encourages and rewards a healthier lifestyle.

Hybrid Policies and Living Benefits Life Insurance Riders

The demand for more comprehensive and flexible coverage is driving the development of hybrid policies and enhanced living benefits. Many life insurance policies now offer riders that allow policyholders to access a portion of their death benefit while still alive, under certain circumstances.

- Accelerated Death Benefit Riders: Allow access to funds if diagnosed with a terminal illness.

- Chronic Illness Riders: Provide funds if unable to perform a certain number of daily living activities (e.g., bathing, dressing).

- Long-Term Care Riders: Combine life insurance with long-term care coverage, providing funds for nursing home care, assisted living, or in-home care.

These living benefits transform life insurance into a more versatile financial tool, providing protection not just for your beneficiaries, but also for your own financial well-being during challenging health situations. This trend is particularly relevant as populations age and the costs of long-term care continue to rise.

Environmental Social and Governance ESG in Life Insurance

Increasingly, consumers are looking for companies that align with their values. The life insurance industry is responding by incorporating Environmental, Social, and Governance (ESG) factors into their operations and investment strategies. This means insurers are focusing on sustainable investments, ethical business practices, and social responsibility.

For policyholders, this can mean choosing an insurer that invests in renewable energy, supports community initiatives, or has a strong track record of diversity and inclusion. While not directly impacting policy benefits, it reflects a broader shift towards conscious consumerism and corporate responsibility within the financial sector.

Ultimately, life insurance is more than just a financial product; it's a fundamental component of a well-rounded financial plan. It provides peace of mind, protects your loved ones, and can even serve as a powerful tool for wealth accumulation and legacy building. By understanding its various forms, assessing your needs, and working with knowledgeable professionals, you can harness the power of life insurance to secure your financial future and ensure your family's well-being for generations to come.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)