Child Life Insurance Policies Benefits and Considerations

Understand the benefits of purchasing life insurance for children and important factors to consider.

Child Life Insurance Policies Benefits and Considerations

Why Consider Child Life Insurance Protecting Their Future

When we think about life insurance, our minds often jump to protecting adults – the primary breadwinners, the mortgage payers, the ones with dependents. But what about our children? The idea of insuring a child’s life can feel counterintuitive, even morbid, to some. However, child life insurance isn't about profiting from a tragedy; it's a strategic financial tool designed to offer a safety net and a head start for their future. It’s about securing insurability, building cash value, and providing peace of mind. In this comprehensive guide, we’ll delve deep into the world of child life insurance, exploring its benefits, the different types available, key considerations, and even some specific product recommendations for families in the US and Southeast Asia.

Types of Child Life Insurance Understanding Your Options

Just like adult policies, child life insurance comes in various forms, each with its own unique features and advantages. Understanding these types is crucial to making an informed decision for your family.

Whole Life Insurance for Children A Foundation for Life

Whole life insurance is perhaps the most common and popular choice for children. It’s a permanent policy, meaning it lasts for the child’s entire life, as long as premiums are paid. Here’s why it’s often favored:

- Guaranteed Insurability: This is a major selling point. By purchasing a whole life policy when a child is young and healthy, you lock in their insurability for life, regardless of any future health issues they might develop. This is invaluable, as health conditions later in life could make obtaining affordable coverage difficult or impossible.

- Cash Value Growth: Whole life policies accumulate cash value on a tax-deferred basis. This cash value grows over time and can be accessed later in life through loans or withdrawals. It can serve as a financial resource for college tuition, a down payment on a home, or even supplemental retirement income.

- Fixed Premiums: Premiums for child whole life policies are typically very low because the child is young and healthy. These premiums are guaranteed to remain level for the life of the policy, providing predictable costs for decades.

- Death Benefit: While no one wants to think about it, the primary purpose of life insurance is to provide a death benefit. In the tragic event of a child’s passing, this benefit can cover funeral expenses, medical bills, and allow parents time off work to grieve without immediate financial strain.

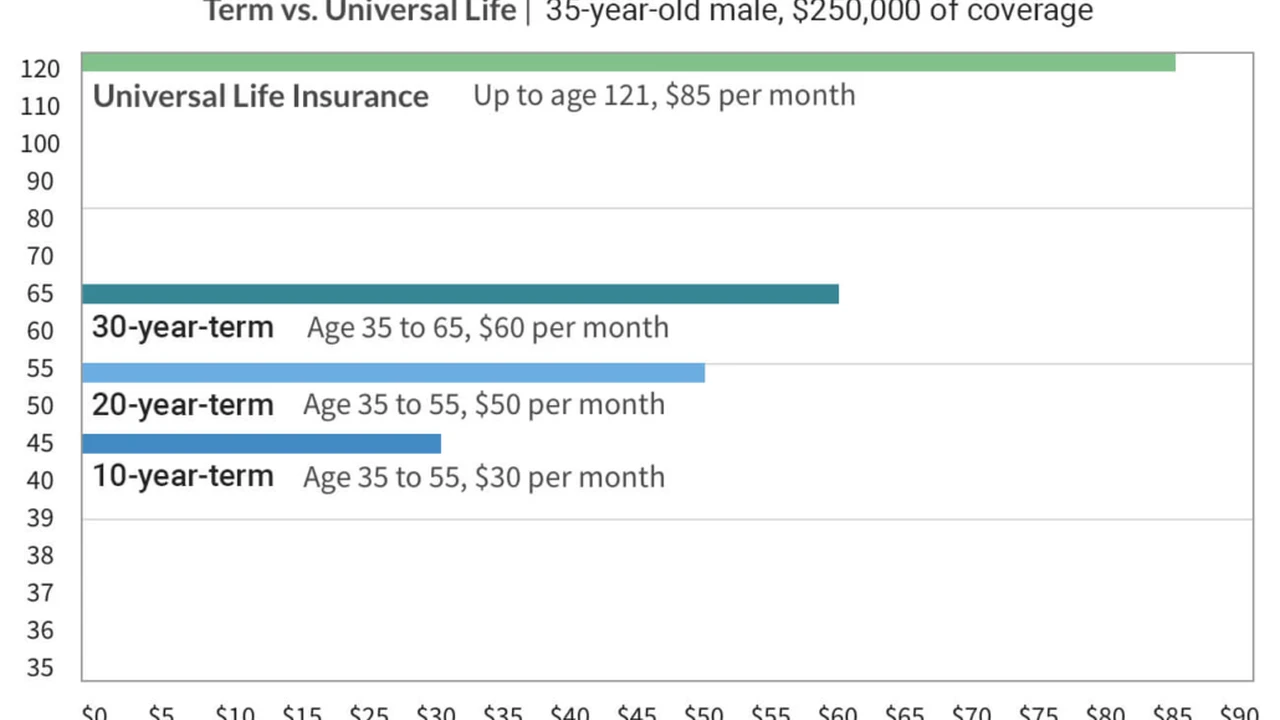

Term Life Insurance for Children Limited but Affordable Coverage

While less common than whole life, term life insurance for children does exist, often as a rider on a parent’s policy. It provides coverage for a specific period (e.g., 10, 20, or 30 years). Its main advantages are:

- Affordability: Term life is generally much cheaper than whole life, making it accessible for families on a tighter budget.

- Specific Needs: It can be useful for covering specific, temporary financial needs, though these are less common for children.

However, term life for children typically does not build cash value and expires at the end of the term, meaning the child would need to reapply for coverage later, potentially at a higher cost and subject to new underwriting.

Universal Life Insurance for Children Flexibility and Cash Value

Universal life (UL) insurance offers more flexibility than whole life. It’s also a permanent policy with a cash value component, but it allows for adjustable premiums and death benefits. For children, UL can be attractive because:

- Flexible Premiums: Parents can adjust premium payments within certain limits, which can be helpful if financial circumstances change.

- Adjustable Death Benefit: The death benefit can be increased or decreased over time, offering adaptability as the child grows and their needs evolve.

- Cash Value Growth: Similar to whole life, UL policies accumulate cash value, though the growth rate can be more variable depending on the policy type (e.g., Indexed UL, Variable UL).

The trade-off for this flexibility can be more complex policy structures and potentially higher fees compared to whole life.

Key Benefits of Child Life Insurance More Than Just a Death Benefit

Beyond the immediate financial protection, child life insurance offers several compelling long-term advantages:

Guaranteed Future Insurability A Priceless Asset

This is arguably the most significant benefit. By securing a policy early, you ensure that your child will have life insurance coverage as an adult, regardless of any health issues that may arise later in life. Imagine a scenario where your child develops a chronic illness in their teens or early twenties. Obtaining life insurance at that point could be extremely difficult or prohibitively expensive. A child life policy guarantees they can convert or continue their coverage, often without further medical exams, into adulthood.

Building Cash Value A Financial Head Start

Permanent child life insurance policies build cash value over time. This cash value is a living benefit that can be accessed for various purposes:

- Education Funding: The cash value can be used to help pay for college tuition, vocational training, or other educational expenses.

- Down Payment for a Home: As they enter adulthood, the accumulated cash value can provide a significant boost towards a down payment on their first home.

- Emergency Fund: It can serve as a readily available source of funds for unexpected financial needs.

- Supplemental Retirement Income: If left untouched, the cash value can grow substantially, potentially providing a tax-advantaged income stream in retirement.

The tax-deferred growth of cash value is a powerful feature, allowing the money to compound over many decades.

Affordable Premiums Locking in Low Rates

Children are typically in excellent health, which translates to very low insurance premiums. These rates are locked in for the life of a whole life policy, meaning your child will pay the same low premium for their coverage even as they age and their health status potentially changes. This can result in substantial savings over their lifetime compared to purchasing a policy as an adult.

Estate Planning for the Future A Legacy Tool

While not immediately relevant for a child, a permanent life insurance policy can become a valuable component of their future estate plan. It can provide liquidity for estate taxes, facilitate wealth transfer, and ensure a legacy for their own beneficiaries.

Important Considerations Before Buying Child Life Insurance Making the Right Choice

While the benefits are clear, it’s essential to consider several factors before committing to a child life insurance policy.

Your Own Life Insurance Coverage Prioritizing Protection

Before insuring your child, ensure that you, as the primary income earner(s), have adequate life insurance coverage. Your death would likely have a far greater immediate financial impact on your family than that of a child. Prioritize protecting your income and your family’s financial stability first.

Financial Goals and Budget Aligning with Your Plan

Consider your overall financial goals. Are you primarily looking for guaranteed insurability, or is the cash value growth a significant factor? How does the premium fit into your current budget? Child life insurance is a long-term commitment, so ensure it aligns with your broader financial strategy.

Policy Riders Enhancing Coverage

Many child life insurance policies offer riders that can enhance their value:

- Guaranteed Purchase Option Rider: This rider allows the child to purchase additional life insurance coverage at specified future dates (e.g., at age 25, 30, or upon marriage) without needing a medical exam. This further reinforces the guaranteed insurability benefit.

- Waiver of Premium Rider: This rider ensures that if the policy owner (usually the parent) becomes disabled, the premiums for the child’s policy will be waived, keeping the coverage in force.

Inflation and Future Needs Planning for Tomorrow

While a $25,000 or $50,000 death benefit might seem sufficient today, consider the impact of inflation over many decades. The cash value growth can help offset this, but it’s worth discussing with a financial advisor how to ensure the policy remains relevant to future financial needs.

Product Recommendations and Use Cases for US and Southeast Asian Markets

Let’s look at some specific product types and scenarios, keeping in mind that actual policy names and features vary by insurer and region. Always consult with a licensed insurance agent for personalized advice.

For US Families Focusing on Guaranteed Growth and Flexibility

Use Case 1: Long-Term Wealth Building and Guaranteed Insurability

Scenario: Parents want to ensure their newborn has lifelong coverage and a growing cash fund for future needs like college or a down payment, without worrying about future health issues.

Recommended Product Type: Participating Whole Life Insurance for Children.

Why:

- Guaranteed Cash Value Growth: Provides predictable, steady growth that can be accessed later.

- Dividends: Participating policies may pay dividends, which can be used to purchase paid-up additions, further increasing the death benefit and cash value.

- Guaranteed Insurability Rider: Essential for locking in future coverage options.

- Low, Level Premiums: Premiums are locked in at a very low rate for life.

Example Providers (Illustrative, not endorsements):

- MassMutual Whole Life: Known for strong dividends and robust cash value growth. A $50,000 policy for a newborn might have premiums around $30-50/month, with cash value growing steadily over decades.

- New York Life Whole Life: Another mutual company with a long history of strong performance and dividends. Similar premium ranges for comparable coverage.

- Guardian Whole Life: Offers competitive policies with good cash value accumulation and dividend potential.

Typical Cost: For a $50,000 whole life policy for a newborn, expect premiums in the range of $30-$60 per month, depending on the insurer and specific policy features. A $100,000 policy might be $50-$100 per month.

Use Case 2: Maximum Flexibility and Market-Linked Growth Potential

Scenario: Parents are comfortable with some market exposure for potentially higher cash value growth and want the ability to adjust premiums and death benefits over time.

Recommended Product Type: Indexed Universal Life (IUL) Insurance for Children.

Why:

- Cash Value Linked to Market Index: Offers potential for higher cash value growth than whole life, tied to the performance of a stock market index (e.g., S&P 500), but with downside protection (a floor).

- Flexible Premiums and Death Benefit: Allows for adjustments as financial situations change.

- Loan Access: Cash value can be accessed via loans, often at favorable rates.

Example Providers (Illustrative):

- National Life Group IUL: Popular for its strong indexing strategies and living benefits.

- Pacific Life IUL: Offers various indexing options and competitive caps/participation rates.

- Transamerica IUL: Known for its flexibility and range of riders.

Typical Cost: IUL premiums can be more variable. For a $50,000 policy for a newborn, initial premiums might be similar to whole life ($30-$60/month), but the funding strategy can be more aggressive to maximize cash value, potentially leading to higher contributions over time if desired.

For Southeast Asian Markets Focusing on Affordability and Education Planning

The Southeast Asian market often sees a strong emphasis on education planning and affordable protection. While product names and regulations vary significantly by country (e.g., Singapore, Malaysia, Thailand, Indonesia), the underlying principles remain similar.

Use Case 1: Basic Protection and Education Savings

Scenario: Parents in countries like Malaysia or Indonesia want to ensure their child has basic life protection and a growing fund that can be used for future education expenses.

Recommended Product Type: Investment-Linked Policies (ILP) with a child rider or specific Child Savings/Education Plans (often structured as endowment or whole life policies).

Why:

- Combines Protection and Investment: ILPs offer a death benefit alongside an investment component, which can be directed towards education goals.

- Flexibility: Some ILPs offer flexibility in premium payments and fund allocation.

- Affordability: Often designed to be accessible to a broader market.

Example Providers (Illustrative, specific products vary by country):

- Great Eastern (e.g., in Singapore/Malaysia): Offers various endowment and ILP plans tailored for children’s education and protection.

- Prudential (e.g., in Thailand/Indonesia): Has a range of child-focused savings and protection plans.

- AIA (across SEA): Strong presence with diverse offerings, including ILPs and traditional whole life policies for children.

Typical Cost: For a basic child protection and savings plan in Southeast Asia, premiums can start from as low as $20-$50 USD equivalent per month, depending on the sum assured and investment component. More comprehensive plans will naturally be higher.

Use Case 2: Guaranteed Insurability and Long-Term Financial Security

Scenario: Parents in Singapore or Malaysia want to secure their child’s insurability for life and provide a robust cash value component for future financial milestones.

Recommended Product Type: Traditional Whole Life Insurance or Participating Whole Life Insurance.

Why:

- Guaranteed Lifelong Coverage: Provides certainty of protection regardless of future health.

- Guaranteed Cash Value: Predictable growth of cash value, often with non-guaranteed bonuses/dividends.

- Financial Discipline: Encourages consistent savings through fixed premiums.

Example Providers (Illustrative):

- NTUC Income (Singapore): Offers various whole life plans with competitive features.

- Manulife (across SEA): Strong regional presence with whole life options.

- Hong Leong Assurance (Malaysia): Provides traditional whole life products.

Typical Cost: For a $50,000 USD equivalent whole life policy for a newborn in Singapore or Malaysia, premiums might range from $40-$80 USD equivalent per month, depending on the insurer and specific benefits.

Comparing Child Life Insurance Products Key Factors to Evaluate

When comparing different child life insurance policies, keep these factors in mind:

Premium Cost and Structure Understanding the Outlay

Compare the monthly or annual premiums. For whole life, ensure you understand if they are guaranteed level. For UL/IUL, understand the flexibility and minimum/maximum contributions.

Cash Value Growth and Access How It Builds and How You Get It

Examine the projected cash value growth. For whole life, look at guaranteed vs. non-guaranteed (dividends). For IUL, understand the indexing strategy, caps, and floors. Also, understand the rules for accessing cash value (loans, withdrawals, surrender charges).

Guaranteed Insurability Options Securing Future Coverage

Check for a guaranteed purchase option rider and understand its terms – when can additional coverage be purchased, and how much?

Riders and Additional Benefits Customizing Protection

Evaluate available riders like waiver of premium, accidental death benefit, or critical illness riders, and how they enhance the policy.

Insurer Reputation and Financial Strength Trusting Your Provider

Choose a financially strong and reputable insurance company. Check ratings from agencies like AM Best (for US) or local regulatory bodies. A long-term policy requires a long-term, stable partner.

Policy Conversion Options Flexibility for Adulthood

If it’s a term rider, understand the options for converting it to a permanent policy when the child becomes an adult.

The Bottom Line Is Child Life Insurance Right for Your Family

Child life insurance is not for everyone, and it should never come at the expense of adequate coverage for the primary income earners. However, for families who have their own coverage in place and are looking for a unique way to provide a significant financial head start for their children, it offers compelling benefits. It’s a tool for guaranteed insurability, tax-deferred cash value growth, and a disciplined approach to long-term savings. By understanding the different types of policies, their benefits, and key considerations, you can make an informed decision that aligns with your family’s values and financial aspirations, giving your child a valuable asset for their future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)