Guaranteed Whole Life Insurance for Peace of Mind

Understand the benefits of guaranteed whole life insurance and how it provides lifelong coverage without medical exams.

Guaranteed Whole Life Insurance for Peace of Mind

Life insurance is one of those things many of us know we need, but often put off. Maybe you're worried about the medical exam, or perhaps you've been turned down for traditional policies due to health issues. If that sounds familiar, then guaranteed whole life insurance might be exactly what you're looking for. It's a type of policy designed to offer peace of mind, ensuring your loved ones are financially protected, no matter your health status.

What is Guaranteed Whole Life Insurance No Medical Exam Needed

Guaranteed whole life insurance, often referred to as guaranteed issue whole life insurance, is a type of permanent life insurance that doesn't require a medical exam or health questionnaire for approval. That's right – no doctors, no blood tests, no probing questions about your medical history. If you meet the age requirements (typically between 50 and 85, though some providers offer it for younger or older applicants), you're generally guaranteed acceptance. This makes it an incredibly attractive option for individuals who might not qualify for traditional life insurance due to pre-existing health conditions, or for those who simply prefer a hassle-free application process.

Unlike term life insurance, which covers you for a specific period, whole life insurance provides coverage for your entire life, as long as premiums are paid. It also builds cash value over time, which you can access later in life through loans or withdrawals. However, with guaranteed issue policies, the primary focus is usually on providing a death benefit to cover final expenses, rather than significant cash value growth.

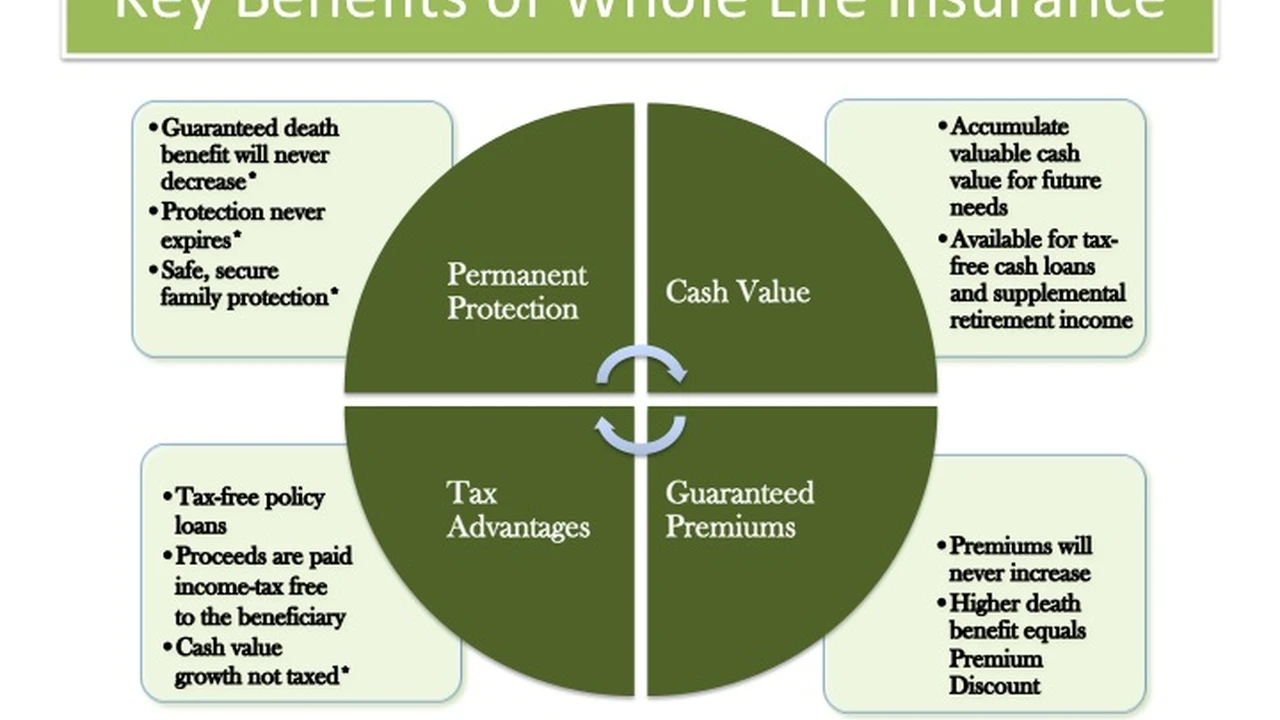

Key Benefits of Guaranteed Whole Life Insurance Lifelong Coverage and Simplicity

The main draw of guaranteed whole life insurance lies in its simplicity and accessibility. Here are some of the core benefits:

- Guaranteed Acceptance: This is the biggest advantage. As long as you fall within the eligible age range, you cannot be denied coverage due to health reasons. This is a game-changer for many who have been declined by other insurers.

- No Medical Exam or Health Questions: The application process is straightforward and quick. You won't have to undergo a medical exam or answer detailed health questions, saving you time and potential stress.

- Lifelong Coverage: Once approved, your policy remains in force for your entire life, as long as you pay your premiums. This provides lasting security for your beneficiaries.

- Fixed Premiums: Your premiums are typically fixed for the life of the policy. This means your payments won't increase as you age or if your health declines, making budgeting easier.

- Cash Value Accumulation: While not as robust as traditional whole life policies, guaranteed issue policies do build a small amount of cash value over time. This cash value can be borrowed against or withdrawn, though doing so will reduce the death benefit.

- Peace of Mind: Knowing that your final expenses will be covered, and your loved ones won't be burdened with costs, offers significant peace of mind.

Who Should Consider Guaranteed Whole Life Insurance Ideal Candidates

Guaranteed whole life insurance isn't for everyone, but it's an excellent solution for specific situations:

- Seniors: Many seniors, especially those over 60 or 70, find it difficult to qualify for traditional life insurance due to age and health. Guaranteed issue policies offer a viable path to coverage.

- Individuals with Pre-Existing Health Conditions: If you have chronic illnesses like heart disease, cancer, diabetes, or other serious health issues, guaranteed issue insurance ensures you can still get coverage.

- Those Seeking Final Expense Coverage: The primary purpose of these policies is often to cover funeral costs, medical bills not covered by health insurance, and other end-of-life expenses.

- People Who Dislike Medical Exams: If you have a strong aversion to medical exams or simply want a quick and easy application process, this is a great option.

- Anyone Who Has Been Denied Traditional Life Insurance: If you've been turned down by other insurers, guaranteed issue is often the last resort for obtaining coverage.

Understanding the Limitations and Graded Death Benefit Important Considerations

While guaranteed whole life insurance offers significant advantages, it's crucial to understand its limitations:

- Higher Premiums: Because the insurer takes on more risk by not assessing your health, premiums for guaranteed issue policies are generally higher than for traditional whole life or term policies with similar death benefits.

- Lower Death Benefit Amounts: The coverage amounts are typically lower, often ranging from $5,000 to $25,000, making them suitable for final expenses but not for large income replacement needs.

- Graded Death Benefit: This is a critical feature to understand. Most guaranteed issue policies come with a 'graded death benefit' clause. This means that if the insured person passes away within the first two or three years of the policy (the 'waiting period'), the beneficiaries will typically only receive a refund of the premiums paid, plus a small amount of interest (e.g., 10%). The full death benefit is usually only paid out if the insured dies after this waiting period. This clause protects the insurer from individuals buying a policy knowing they have a terminal illness.

- Limited Cash Value Growth: While there is cash value, it grows very slowly and is not the primary benefit of these policies.

Comparing Guaranteed Whole Life Insurance Products Top Providers and Features

When looking for guaranteed whole life insurance, several reputable providers offer competitive options. Here's a look at some popular choices in the US market, along with their typical features and considerations. Please note that specific product details, availability, and pricing can vary by state and over time, so always get personalized quotes.

Gerber Life Guaranteed Whole Life Insurance

- Target Audience: Often marketed towards seniors, but available for adults.

- Age Range: Typically 50-80 years old.

- Coverage Amounts: Usually from $5,000 to $25,000.

- Graded Death Benefit: Yes, typically a 2-year waiting period. If death occurs within the first two years, beneficiaries receive 110% of premiums paid.

- Key Features: Known for its straightforward application process and strong brand recognition. Premiums are fixed for life.

- Use Case: Excellent for covering funeral costs and small outstanding debts.

- Pricing Example (Illustrative, actual rates vary): For a 65-year-old female, a $10,000 policy might cost around $50-$60 per month. For a 70-year-old male, a $15,000 policy could be $100-$120 per month.

AARP Life Insurance from New York Life Guaranteed Acceptance Whole Life

- Target Audience: AARP members, typically 50+.

- Age Range: 50-80 years old.

- Coverage Amounts: Generally $2,500 to $25,000.

- Graded Death Benefit: Yes, typically a 2-year waiting period. If death occurs within the first two years, beneficiaries receive 125% of premiums paid.

- Key Features: Backed by New York Life, a highly-rated insurer. No medical questions or exams.

- Use Case: Ideal for AARP members seeking reliable final expense coverage.

- Pricing Example (Illustrative, actual rates vary): For a 60-year-old female, a $5,000 policy might be around $30-$40 per month. For a 75-year-old male, a $20,000 policy could be $150-$180 per month.

Colonial Penn Guaranteed Acceptance Whole Life Insurance

- Target Audience: Seniors, often advertised on TV.

- Age Range: 50-85 years old.

- Coverage Amounts: Unique 'unit' system. Each unit provides a specific amount of coverage based on age and gender. Max units can lead to coverage up to around $50,000, but often lower for older ages.

- Graded Death Benefit: Yes, a 2-year waiting period. If death occurs within the first two years, beneficiaries receive all premiums paid plus 7% interest.

- Key Features: Known for its 'guaranteed acceptance' and 'rate lock' features. The unit system can be a bit confusing for some.

- Use Case: Good for those who want a simple, no-questions-asked policy, especially for final expenses.

- Pricing Example (Illustrative, actual rates vary): Colonial Penn uses a unit system. For example, one unit might cost $9.95 per month. For a 60-year-old female, one unit might provide $1,669 in coverage. For an 80-year-old male, one unit might provide $406 in coverage. You can buy multiple units.

Mutual of Omaha Guaranteed Whole Life Insurance

- Target Audience: Individuals seeking final expense coverage.

- Age Range: Typically 45-85 years old.

- Coverage Amounts: From $2,000 to $25,000.

- Graded Death Benefit: Yes, a 2-year waiting period. If death occurs within the first two years, beneficiaries receive 110% of premiums paid.

- Key Features: A well-respected insurer with a strong financial rating. Offers a straightforward application.

- Use Case: Reliable option for covering funeral costs and other end-of-life expenses.

- Pricing Example (Illustrative, actual rates vary): For a 68-year-old female, a $10,000 policy might cost around $65-$75 per month. For a 72-year-old male, a $15,000 policy could be $130-$140 per month.

How to Choose the Best Guaranteed Whole Life Policy Making an Informed Decision

Choosing the right guaranteed whole life policy involves considering a few key factors:

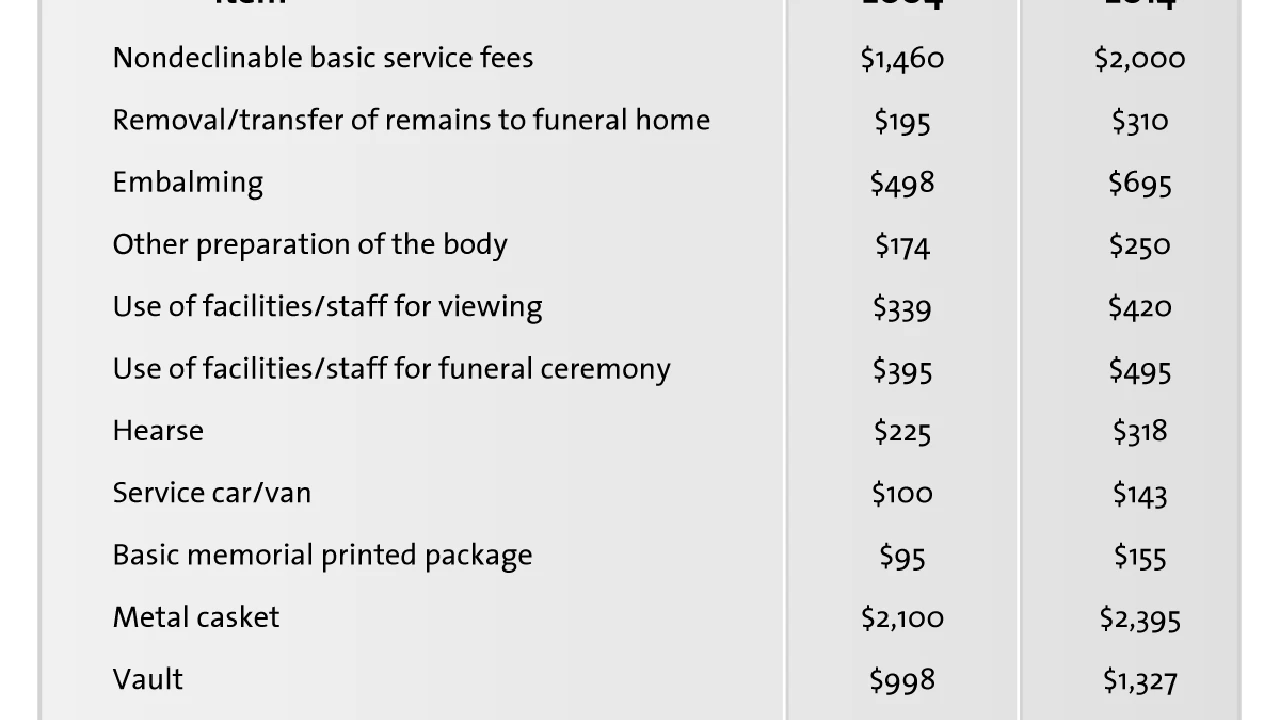

- Coverage Amount: Determine how much coverage you truly need. For final expenses, estimate funeral costs, outstanding medical bills, and any small debts you want to cover.

- Premiums: Compare monthly premiums across different providers for the same coverage amount. Remember, these policies are generally more expensive than traditional ones.

- Graded Death Benefit Terms: Pay close attention to the waiting period (usually 2 years) and what percentage of premiums or interest is returned if death occurs during that period.

- Insurer Reputation and Financial Strength: Choose a company with a strong financial rating (e.g., A.M. Best, S&P) to ensure they can pay out claims.

- Customer Service: Consider reviews and reputation for customer service, as you or your beneficiaries may need to interact with them.

- Age Eligibility: Ensure you fall within the provider's acceptable age range.

Application Process for Guaranteed Whole Life Insurance Simple Steps

The application process for guaranteed whole life insurance is remarkably simple, often taking just a few minutes:

- Determine Your Needs: Decide on the coverage amount you think you'll need for final expenses.

- Get Quotes: Contact several providers or use an online comparison tool to get quotes.

- Complete the Application: This usually involves providing your name, address, date of birth, and designating beneficiaries. There are no health questions or medical exams.

- Review and Accept: Read through the policy details, especially the graded death benefit clause, and accept the terms.

- Start Payments: Your coverage typically begins once your first premium payment is processed.

Maximizing the Value of Your Guaranteed Whole Life Policy Smart Strategies

While guaranteed whole life insurance is straightforward, there are ways to make the most of it:

- Purchase Early (if eligible): If you anticipate health issues in the future but are currently healthy enough for guaranteed issue, buying it earlier in the eligible age range can lock in lower premiums.

- Combine with Other Coverage: If you need more substantial coverage for income replacement but can't get traditional whole life, consider a small guaranteed issue policy for final expenses alongside a term policy (if you qualify for term).

- Inform Beneficiaries: Make sure your beneficiaries know about the policy, where to find it, and how to file a claim. This is crucial for a smooth payout process.

- Review Periodically: Even though premiums are fixed, it's a good idea to review your policy every few years to ensure the death benefit still aligns with your estimated final expenses.

Guaranteed Whole Life Insurance in Southeast Asia Regional Considerations

While the concept of guaranteed whole life insurance is universal, its availability and specific features can vary in Southeast Asian markets. Insurers in countries like Singapore, Malaysia, Thailand, and the Philippines may offer similar 'guaranteed acceptance' or 'simplified issue' products, often targeting seniors or those with pre-existing conditions for final expense planning.

- Local Regulations: Each country will have its own insurance regulations, which can affect policy terms, age limits, and consumer protections.

- Product Names: The exact terminology might differ. Look for 'guaranteed acceptance,' 'simplified issue,' or 'final expense' plans.

- Coverage Amounts: Death benefits might be denominated in local currencies and tailored to local cost of living and funeral expenses.

- Graded Benefit Periods: The waiting period for the full death benefit (e.g., 1 or 2 years) is a common feature globally, but specific terms should be verified locally.

- Providers: Major international insurers (e.g., Prudential, AIA, Manulife, Great Eastern) often have a presence in Southeast Asia and may offer such products, alongside local insurance companies.

- Distribution Channels: Policies might be available through agents, banks (bancassurance), or increasingly, online platforms.

For example, in Singapore, you might find 'Direct Purchase Insurance' (DPI) options that are simplified, though not always guaranteed issue for all ages/health conditions. For guaranteed issue specifically, you'd look for products designed for seniors or those with health challenges. Always consult with a local financial advisor or insurance agent in the specific Southeast Asian country to understand the best options available for your situation.

Common Questions About Guaranteed Whole Life Insurance FAQs

Is guaranteed whole life insurance worth it?

It is absolutely worth it for individuals who cannot qualify for traditional life insurance due to health reasons or age, and who want to ensure their final expenses are covered without burdening their family. For those in good health, more traditional policies might offer better value.

Can I be denied guaranteed whole life insurance?

No, you cannot be denied based on your health. The only reasons for denial would be if you fall outside the eligible age range or if you provide fraudulent information on your application.

How long does it take to get approved?

Approval is typically instant or within a few days, as there's no medical underwriting process.

What is the graded death benefit?

The graded death benefit means that if you pass away within the first two or three years of the policy, your beneficiaries will only receive a refund of the premiums paid, plus a small amount of interest, rather than the full death benefit. The full death benefit is paid out after this waiting period.

Does guaranteed whole life insurance build cash value?

Yes, it does build cash value, but typically at a much slower rate and to a lesser extent than traditional whole life policies. The primary benefit is the death benefit, not cash value accumulation.

Can I get guaranteed whole life insurance if I have cancer?

Yes, that's one of the main reasons people choose guaranteed whole life insurance. Your health status, including a cancer diagnosis, will not prevent you from being approved.

Are the premiums tax deductible?

Generally, life insurance premiums are not tax deductible in the US. However, the death benefit is typically paid out tax-free to beneficiaries.

Can I cancel my policy?

Yes, you can cancel your policy at any time. If you cancel, you may receive the accumulated cash value, minus any surrender charges, though for guaranteed issue policies, this amount is often minimal, especially in the early years.

Guaranteed whole life insurance offers a valuable solution for many, providing a straightforward path to lifelong coverage and the peace of mind that comes with knowing your final wishes are financially secured. By understanding its unique features, benefits, and limitations, you can make an informed decision about whether it's the right choice for your personal circumstances.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)