Life Insurance for Debt Protection Securing Your Future

Discover how life insurance can be used to protect your family from outstanding debts in the event of your passing.

Life Insurance for Debt Protection Securing Your Future

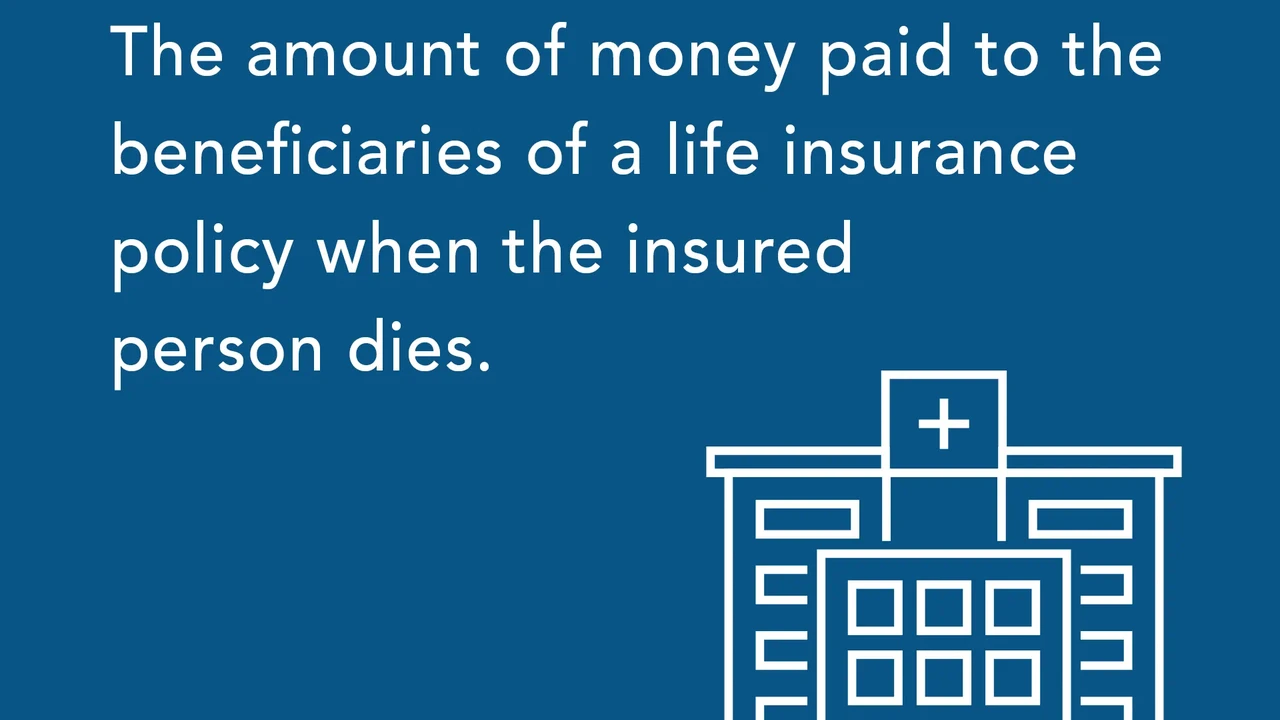

Hey there! Let's talk about something super important but often overlooked: how life insurance can be your family's superhero when it comes to debt. Nobody likes thinking about debt, especially not the kind that lingers after you're gone. But here's the deal: if you have a family, a mortgage, student loans, or even credit card balances, your passing could leave your loved ones with a financial burden they're not prepared for. That's where life insurance steps in, offering a safety net that can literally save your family from financial distress.

Think about it. You work hard to provide for your family, build a home, and maybe even start a business. All these things often come with debt. While you're here, you're managing it, making payments, and keeping things afloat. But what happens if you're suddenly not around? Will your spouse be able to keep up with the mortgage? Will your kids be saddled with your student loans? These are tough questions, but answering them now with a solid life insurance plan can bring immense peace of mind.

In this comprehensive guide, we're going to dive deep into how life insurance acts as a powerful tool for debt protection. We'll explore different types of policies, specific scenarios where it shines, compare some popular products, and even touch on pricing. Our goal is to equip you with the knowledge to make informed decisions, ensuring your family's financial future is secure, no matter what life throws their way.

Understanding Debt and Its Impact on Your Family Life Insurance Solutions

Before we get into the nitty-gritty of life insurance, let's first understand the types of debt that can really hit your family hard if you're not around. It's not just about the big stuff; even smaller debts can accumulate and become overwhelming.

Mortgage Debt and Life Insurance Protecting Your Home

For most families, the mortgage is the biggest debt. It's also often tied to their most valuable asset: their home. If the primary earner passes away, the surviving family members might struggle to make those monthly payments. This could lead to foreclosure, forcing them to sell the home and uproot their lives during an already difficult time. Life insurance can provide a lump sum that pays off the mortgage, allowing your family to stay in their home and maintain stability.

Student Loan Debt and Life Insurance Navigating Educational Loans

Student loan debt is a huge burden for many, and it's not always clear what happens to it after death. Federal student loans are typically discharged upon the borrower's death. However, private student loans are a different story. Many private lenders will hold the co-signer (often a parent or spouse) responsible for the remaining balance. This can be a massive financial shock. A life insurance policy can be specifically tailored to cover these private student loan balances, protecting your co-signers from unexpected financial obligations.

Credit Card Debt and Personal Loans Life Insurance Coverage

While credit card debt and personal loans might seem smaller than a mortgage, they can quickly add up. If you have significant balances, these debts can become the responsibility of your estate. This means that assets you intended for your family could be used to pay off creditors instead. A life insurance payout can cover these debts, ensuring your family receives the full inheritance you planned for them, free from creditor claims.

Business Debts and Life Insurance Protecting Your Enterprise

If you're a business owner, your business often carries its own set of debts, from lines of credit to equipment loans. Your personal guarantee might be tied to these. If you pass away, these business debts could fall to your family or jeopardize the future of your business. Key person life insurance, or even a personal policy with a sufficient death benefit, can provide the capital needed to cover these business obligations, ensuring your legacy continues or your family isn't burdened by business failures.

Types of Life Insurance for Debt Protection Term vs Whole Life

When it comes to using life insurance for debt protection, two main types usually come to mind: term life insurance and whole life insurance. Each has its own strengths and weaknesses, making them suitable for different debt scenarios.

Term Life Insurance for Specific Debt Periods Affordable Coverage

Term life insurance is like renting an apartment; you get coverage for a specific period, or 'term,' usually 10, 20, or 30 years. It's generally the most affordable option, making it a popular choice for covering debts that have a clear end date, like a mortgage or a specific student loan repayment period.

How it works: You choose a term length that aligns with your debt repayment schedule. For example, if you have a 30-year mortgage, a 30-year term life policy makes a lot of sense. If you pass away within that term, your beneficiaries receive a tax-free death benefit. If you outlive the term, the policy expires, and there's no payout.

Pros:

- Affordability: Lower premiums compared to whole life, allowing you to get substantial coverage for less.

- Simplicity: Easy to understand and straightforward.

- Targeted Protection: Ideal for covering specific, time-bound debts.

Cons:

- No Cash Value: It's pure protection; there's no savings or investment component.

- Expires: Once the term ends, so does the coverage. Renewing can be very expensive.

Whole Life Insurance for Permanent Debt Protection and Estate Planning

Whole life insurance, on the other hand, is permanent coverage that lasts your entire life, as long as premiums are paid. It also builds cash value over time, which you can borrow against or withdraw from. This makes it a more robust solution for long-term debt protection and overall financial planning.

How it works: You pay a fixed premium for life, and the policy guarantees a death benefit to your beneficiaries. A portion of your premium goes into a cash value account that grows on a tax-deferred basis. This cash value can be accessed during your lifetime.

Pros:

- Lifelong Coverage: Guarantees a payout no matter when you pass away.

- Cash Value Growth: Provides a savings component that can be used for various financial needs, including supplementing retirement income or covering unexpected expenses.

- Fixed Premiums: Premiums remain level throughout your life, making budgeting easier.

Cons:

- Higher Premiums: Significantly more expensive than term life insurance for the same death benefit.

- Less Flexibility: Premiums are fixed, and the policy structure is less adaptable than universal life.

Specific Scenarios and Product Recommendations Tailoring Your Coverage

Let's get practical. How do these policies actually work in real-life situations, and what specific products might be a good fit? Remember, these are general recommendations, and it's always best to consult with a licensed financial advisor to tailor a plan to your unique circumstances.

Scenario 1: Protecting Your Mortgage with Term Life Insurance

This is perhaps the most common use of life insurance for debt protection. If you have a 30-year mortgage, a 30-year term life policy with a death benefit equal to or slightly more than your mortgage balance is a fantastic idea.

Recommended Products:

- Haven Life Term Life Insurance: Known for its straightforward online application process and competitive rates. They offer terms up to 30 years and coverage up to $3 million. It's great for tech-savvy individuals who want a quick and easy experience.

- Policygenius (Brokerage): Not a direct insurer, but an excellent platform to compare quotes from multiple top-rated carriers like Pacific Life, Transamerica, and Lincoln Financial. This allows you to find the most competitive rates for your specific term and coverage needs. Their advisors can help you pinpoint the right term length and death benefit to match your mortgage.

- Ethos Life Insurance: Offers instant decisions for many applicants without a medical exam, making it super convenient. They provide term policies up to $2 million, which can cover a substantial mortgage.

Usage Scenario: John and Mary just bought their dream home with a $400,000, 30-year mortgage. John is the primary earner. They decide to get a 30-year term life policy for $400,000 on John. If John passes away, Mary receives the $400,000, which she can use to pay off the mortgage, ensuring she and their children can stay in their home without financial stress.

Scenario 2: Covering Private Student Loans with Life Insurance

If you have private student loans with a co-signer, protecting them is crucial. A term life policy can be a good fit here, especially if you have a clear repayment timeline.

Recommended Products:

- Ladder Life Insurance: Offers flexible term policies where you can adjust your coverage up or down as your debt decreases. This is perfect for student loans, as you can reduce your death benefit (and premiums) as you pay down the loan. They offer coverage from $100,000 to $8 million.

- Bestow Life Insurance: Another no-medical-exam option for term life, offering quick approvals. If your student loan balance isn't astronomically high, Bestow can provide coverage up to $1.5 million, which is often sufficient for many private student loan situations.

Usage Scenario: Sarah has $80,000 in private student loans, co-signed by her mother. She gets a 15-year term life policy for $80,000. If Sarah passes away, the death benefit covers the remaining loan, protecting her mother from having to take on that debt.

Scenario 3: Protecting Against General Consumer Debt and Final Expenses

For credit card debt, personal loans, and ensuring your family isn't burdened by funeral costs, a smaller term policy or even a guaranteed issue whole life policy might be appropriate.

Recommended Products:

- Mutual of Omaha Guaranteed Whole Life: This is a guaranteed issue policy, meaning no medical exam or health questions. It's designed for final expenses and smaller debts, typically offering coverage from $2,000 to $25,000. While more expensive per dollar of coverage, it's accessible to almost anyone, regardless of health.

- Gerber Life Grow-Up Plan (for children): While not directly for adult debt, this whole life policy for children can be a smart long-term play. It builds cash value and guarantees insurability later in life, which can be a huge asset for future debt protection or financial needs for your child.

- SelectQuote (Brokerage): Similar to Policygenius, SelectQuote allows you to compare various term and whole life options from different carriers, helping you find the best fit for covering general debts and final expenses. They can help you navigate options like simplified issue policies that require fewer health questions.

Usage Scenario: David has about $20,000 in credit card and personal loan debt. He also wants to ensure his funeral expenses are covered. He opts for a 10-year term policy for $50,000. This covers his current debts and provides a buffer for final expenses, ensuring his wife isn't left with these bills.

Scenario 4: Business Debt Protection with Key Person Life Insurance

For business owners, protecting the business from the financial fallout of losing a key individual is paramount. This often involves a term life policy on the key person, with the business as the beneficiary.

Recommended Products:

- MassMutual Term Life: A highly-rated insurer with strong financial stability, MassMutual offers robust term life policies suitable for business needs. They have experienced agents who can help structure policies for key person insurance or buy-sell agreements.

- Northwestern Mutual Term Life: Another top-tier insurer known for its financial strength and personalized service. Their agents can work with business owners to determine the appropriate coverage amount to protect against business debts and ensure continuity.

Usage Scenario: Emily owns a small tech startup with a $250,000 business loan. She is the sole founder and key innovator. She takes out a 15-year term life policy for $250,000 on herself, with the business as the beneficiary. If Emily passes away, the death benefit can be used to pay off the business loan, preventing the company from collapsing and protecting her family from personal guarantees.

Comparing Products and Pricing Factors Affecting Your Premiums

When you're looking at life insurance, it's not just about the death benefit; it's also about what you'll pay. Premiums can vary wildly based on several factors. Let's break down some general pricing considerations and how different products stack up.

Factors Influencing Life Insurance Premiums Understanding the Costs

Several key factors determine how much you'll pay for life insurance:

- Age: This is a big one. The younger and healthier you are when you buy a policy, the lower your premiums will be.

- Health: Your current health, medical history, and family medical history play a significant role. Conditions like diabetes, heart disease, or a history of cancer can increase premiums.

- Lifestyle: Smoking, excessive alcohol consumption, and engaging in high-risk hobbies (like skydiving or race car driving) will lead to higher premiums.

- Gender: Women generally live longer than men, so they often pay lower premiums for the same coverage.

- Coverage Amount (Death Benefit): The more coverage you need, the higher your premiums will be.

- Policy Type: As discussed, term life is generally cheaper than whole life for the same death benefit.

- Term Length (for Term Life): Longer terms typically mean higher premiums.

General Pricing Comparison Term vs Whole Life Insurance

To give you a rough idea, let's look at some hypothetical examples. These are illustrative and actual quotes will vary significantly.

Example: Healthy 35-year-old non-smoker, male, seeking $500,000 in coverage.

- 20-Year Term Life Insurance:

- Estimated Monthly Premium: $25 - $40

- Why this range: Varies by insurer, specific health profile, and underwriting. Online-only providers might be on the lower end.

- 30-Year Term Life Insurance:

- Estimated Monthly Premium: $40 - $65

- Why this range: Longer term means more risk for the insurer, hence higher premiums.

- Whole Life Insurance (for $500,000 coverage):

- Estimated Monthly Premium: $400 - $600+

- Why this range: Significantly higher due to lifelong coverage and the cash value component. This is a substantial difference, highlighting why term life is often preferred for pure debt protection.

Example: Healthy 45-year-old non-smoker, female, seeking $250,000 in coverage.

- 20-Year Term Life Insurance:

- Estimated Monthly Premium: $20 - $35

- Whole Life Insurance (for $250,000 coverage):

- Estimated Monthly Premium: $250 - $400+

As you can see, the difference in premiums between term and whole life is substantial. If your primary goal is debt protection for a specific period, term life insurance offers the most bang for your buck.

No Medical Exam vs Fully Underwritten Policies Cost Implications

Many of the recommended products above offer 'no medical exam' options. While convenient, these often come with a trade-off:

- No Medical Exam Policies:

- Pros: Fast approval, no needles or doctor visits.

- Cons: Often more expensive than fully underwritten policies for the same coverage, and coverage amounts might be capped (e.g., $1.5 million or $2 million). Insurers take on more risk without a full medical picture, so they charge more.

- Fully Underwritten Policies:

- Pros: Generally offer the lowest premiums for healthy individuals, higher coverage limits available.

- Cons: Requires a medical exam (blood test, urine sample, physical measurements), takes longer for approval.

If you're healthy and not in a rush, a fully underwritten policy will likely get you the best rates for debt protection. If speed and convenience are paramount, and you're okay with potentially higher premiums or lower coverage limits, no-medical-exam options are excellent.

Strategies for Maximizing Debt Protection with Life Insurance Smart Planning

It's not just about buying a policy; it's about buying the right policy and integrating it into your overall financial strategy. Here are some smart ways to use life insurance for debt protection.

Laddering Term Life Policies Matching Coverage to Decreasing Debt

This is a clever strategy, especially for mortgages or other debts that decrease over time. Instead of one large policy, you buy several smaller term policies with different term lengths.

How it works: Let's say you have a $500,000 mortgage. You might buy:

- A $200,000, 10-year term policy (to cover initial high debt and other short-term obligations).

- A $200,000, 20-year term policy (to cover the bulk of the mortgage as it decreases).

- A $100,000, 30-year term policy (to cover the remaining balance in later years).

As each policy expires, your coverage decreases, and so do your total premiums. This ensures you have adequate coverage when your debt is highest, and you're not overpaying for coverage you don't need later on.

Naming the Right Beneficiaries Ensuring Funds Go Where Needed

This might seem obvious, but it's critical. Make sure your beneficiaries are clearly designated and updated regularly. For debt protection, you might name your spouse or a trust as the primary beneficiary. If you want to ensure specific debts are paid, you can include instructions in your will or a letter of instruction, though the death benefit will still go to the named beneficiary who then uses it as instructed.

For business debts, the business itself is often named as the beneficiary of a key person policy.

Regularly Reviewing Your Coverage Adapting to Life Changes

Life isn't static, and neither should your life insurance policy be. Major life events like getting married, having children, buying a new home, taking on new debt, or paying off existing debt should trigger a review of your policy.

- New Debt: If you take on a new mortgage or significant loan, you might need to increase your coverage.

- Debt Paid Off: If you've paid off a major debt, you might be able to reduce your coverage (if using a flexible term policy like Ladder) or consider if you still need that specific policy.

- Income Changes: If your income significantly increases or decreases, your financial needs and ability to pay premiums might change.

A good rule of thumb is to review your policy every 3-5 years, or after any major life event.

Considering Riders for Enhanced Protection Adding Value to Your Policy

Many life insurance policies offer riders that can enhance their debt protection capabilities:

- Waiver of Premium Rider: If you become totally disabled and can't work, this rider waives your premiums, keeping your policy in force so your debt protection remains intact.

- Accelerated Death Benefit Rider (Living Benefits): This allows you to access a portion of your death benefit while you're still alive if you're diagnosed with a terminal illness. This money could be used to pay down debts, cover medical expenses, or simply provide financial relief during a difficult time.

- Guaranteed Insurability Rider: This allows you to purchase additional coverage at certain life stages (e.g., marriage, birth of a child) without undergoing a new medical exam. This is great for anticipating future debt increases.

The Bottom Line Securing Your Family's Financial Future

Look, thinking about life insurance and debt isn't the most fun topic, but it's one of the most responsible things you can do for your family. Imagine the peace of mind knowing that if something unexpected happens to you, your loved ones won't have to worry about losing their home, being saddled with student loans, or struggling to pay off credit card bills. That's the power of life insurance for debt protection.

Whether you choose an affordable term policy to cover a specific mortgage, or a more comprehensive whole life plan for lifelong security and cash value growth, the key is to act. Don't put it off. Get quotes, compare options, and talk to a financial professional who can help you navigate the choices. Your family's financial future is worth protecting, and life insurance is a proven way to do just that. It's not just a policy; it's a promise to your loved ones that they'll be taken care of, no matter what.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)