Life Insurance for People with Pre Existing Conditions

Tips and strategies for individuals with pre-existing health conditions to secure life insurance coverage.

Life Insurance for People with Pre Existing Conditions Navigating Coverage Options

Let's talk about something that often feels like a big hurdle: getting life insurance when you have a pre-existing health condition. It's a common concern, and honestly, it can be a bit more complex than for someone in perfect health. But here's the good news: it's absolutely possible to get life insurance, even with conditions like diabetes, heart disease, or a history of cancer. It just requires a bit more strategy and understanding of your options. We're going to break down everything you need to know, from how insurers view different conditions to specific products that might be a good fit, and even some real-world examples to help you navigate this journey.

Understanding How Pre Existing Conditions Impact Life Insurance Eligibility and Premiums

First things first, why do pre-existing conditions matter to life insurance companies? Well, it all boils down to risk. Insurers assess the likelihood of paying out a death benefit. A pre-existing condition, especially a chronic or severe one, can increase that perceived risk. This doesn't mean you're uninsurable; it just means the insurer will want a clearer picture of your health to determine your eligibility and, ultimately, your premium rates.

When you apply for life insurance, especially a fully underwritten policy, you'll typically go through a medical exam and answer a detailed health questionnaire. The insurer will look at several factors related to your condition:

- The specific condition: Is it well-managed? What's the prognosis?

- Severity: Is it mild, moderate, or severe?

- Treatment and control: Are you adhering to your doctor's recommendations? Are your medications effective?

- Date of diagnosis: How long have you had the condition?

- Recent medical history: Have there been any recent hospitalizations or changes in your condition?

- Overall health: Do you have other health issues that might compound the risk?

Based on this assessment, you'll be assigned a health rating, which directly impacts your premiums. Someone with a well-managed condition might get a 'standard' or 'preferred' rating with a slight surcharge, while someone with a more severe or uncontrolled condition might be rated 'substandard' (meaning higher premiums) or, in some cases, declined for traditional coverage.

Strategies for Securing Life Insurance with Health Challenges

Don't get discouraged if you have a pre-existing condition. There are several strategies you can employ to increase your chances of getting coverage and potentially lower your costs:

Be Honest and Thorough in Your Application

This is paramount. Never hide or misrepresent your health history. If an insurer discovers discrepancies during the underwriting process or, worse, after you've passed away (during the contestability period, usually the first two years of the policy), your policy could be voided, and your beneficiaries might not receive the death benefit. Provide all requested medical records, doctor's contact information, and be as detailed as possible.

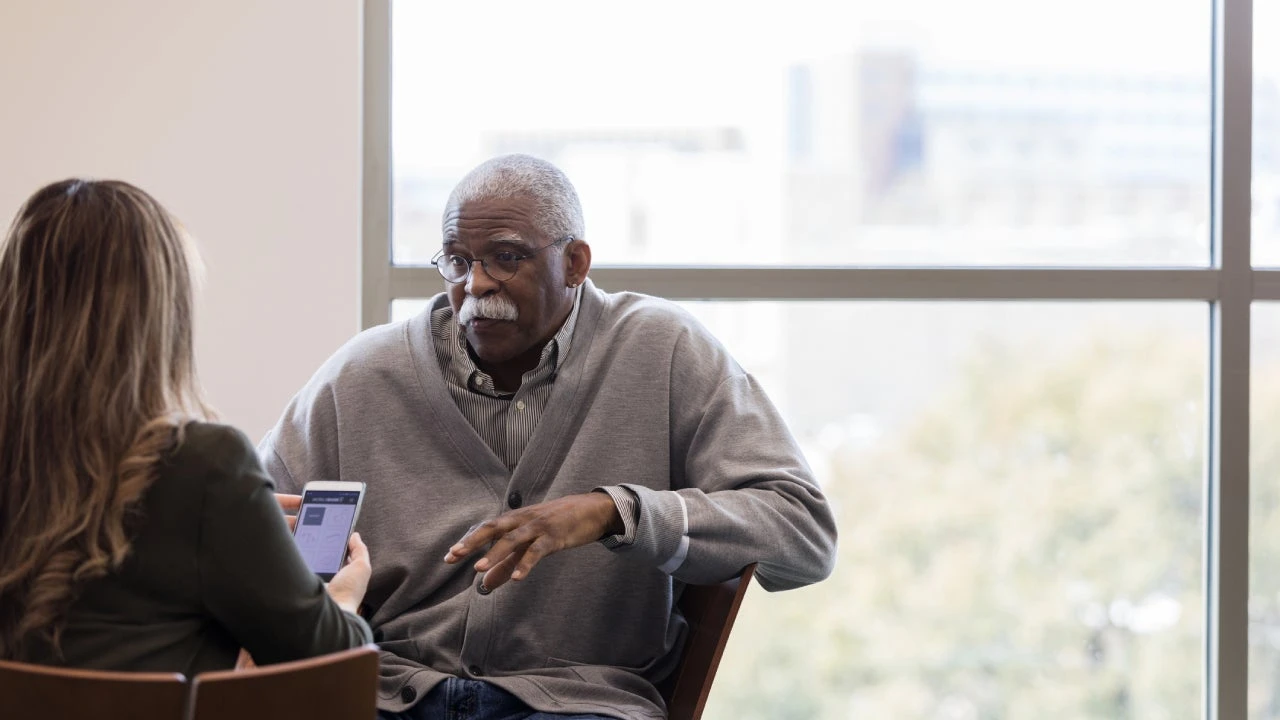

Shop Around and Compare Multiple Insurers

Different insurance companies have different underwriting guidelines and risk appetites. One insurer might view your condition more favorably than another. What one company considers a high risk, another might see as manageable. Working with an independent agent or broker who specializes in impaired risk life insurance can be incredibly beneficial here. They have access to multiple carriers and understand which ones are more lenient for specific conditions.

Improve Your Health Where Possible

If your condition is manageable through lifestyle changes, making those changes can significantly impact your rates. For example, if you have high blood pressure or type 2 diabetes, losing weight, exercising regularly, and managing your diet can lead to better control of your condition, which insurers will view positively. Even quitting smoking can dramatically reduce your premiums, often after just one year.

Consider a Waiting Period

Sometimes, if you've recently had a major health event (like cancer treatment or a heart attack), insurers might ask for a waiting period before offering coverage. This allows them to see how well you recover and manage your health post-event. While it means delaying coverage, it could lead to more favorable terms down the line.

Specific Life Insurance Products for Individuals with Pre Existing Conditions

If traditional fully underwritten policies are proving difficult or too expensive, don't despair. There are several specialized life insurance products designed for individuals with health challenges:

Simplified Issue Life Insurance Fast Approval Fewer Questions

Simplified issue policies require fewer health questions and typically no medical exam. Approval is often much faster. While they are more accessible, they usually come with higher premiums and lower death benefits compared to fully underwritten policies. They're a good option if you have a moderate pre-existing condition that might make traditional underwriting difficult but isn't severe enough for guaranteed issue.

Product Recommendation: Mutual of Omaha Living Promise Whole Life Insurance

- Type: Simplified Issue Whole Life

- Key Features: Offers level death benefits, builds cash value, and has a graded death benefit for the first two years (meaning if death occurs from natural causes within the first two years, beneficiaries receive premiums paid plus interest, not the full death benefit).

- Use Case: Excellent for individuals with moderate health issues (e.g., well-controlled diabetes, history of certain cancers after a waiting period) who want permanent coverage without a medical exam.

- Pricing Example (Illustrative, actual rates vary): A 60-year-old male with well-controlled diabetes might pay around $100-$150 per month for a $25,000 policy.

Guaranteed Issue Life Insurance No Health Questions Guaranteed Acceptance

This is the most accessible type of life insurance for individuals with significant health issues. As the name suggests, acceptance is guaranteed, regardless of your health history. There are no medical exams or health questions. However, these policies typically have the highest premiums, the lowest death benefits, and almost always include a graded death benefit period (usually two years). This means if you die from natural causes within the first two years, your beneficiaries will only receive the premiums you've paid, plus a small amount of interest, not the full death benefit. It's primarily designed to cover final expenses.

Product Recommendation: AARP Life Insurance Program (New York Life)

- Type: Guaranteed Acceptance Whole Life

- Key Features: No health questions, guaranteed acceptance for AARP members aged 50-80 (or 50-75 in some states), builds cash value, graded death benefit for the first two years.

- Use Case: Ideal for seniors with serious health conditions who need coverage for final expenses and cannot qualify for other types of life insurance.

- Pricing Example (Illustrative, actual rates vary): An 80-year-old female with multiple health conditions might pay around $150-$200 per month for a $10,000 policy.

Group Life Insurance Through Your Employer or Association

If you're employed, check if your employer offers group life insurance. These policies often provide a basic level of coverage (e.g., 1-2 times your annual salary) with minimal or no medical underwriting. This means your pre-existing condition might not be a factor for the basic coverage. You might also have the option to purchase additional coverage, though this often requires some level of underwriting.

Product Recommendation: Employer-Sponsored Group Term Life Insurance

- Type: Group Term Life

- Key Features: Often free or low-cost to employees, minimal or no medical questions for basic coverage, portable in some cases.

- Use Case: An excellent starting point for anyone with a pre-existing condition, as it provides immediate coverage without individual underwriting hurdles.

- Pricing Example: Often provided as a benefit, with optional additional coverage at competitive group rates (e.g., $0.10-$0.30 per $1,000 of coverage per month, depending on age and health for supplemental amounts).

Return of Premium Term Life Insurance with Health Considerations

While not specifically designed for pre-existing conditions, some individuals with well-managed conditions might qualify for Return of Premium (ROP) term life insurance. This type of policy returns all the premiums you've paid if you outlive the term. It's more expensive than traditional term life, but for those who qualify, it offers a unique benefit. Underwriting for ROP is similar to traditional term, so it's best for those with less severe or very well-controlled conditions.

Product Recommendation: Protective Life Custom Choice UL (with ROP rider)

- Type: Universal Life with Term-like features and ROP rider

- Key Features: Offers flexible coverage, potential for ROP, and can be customized. Underwriting is similar to traditional term.

- Use Case: For individuals with well-managed conditions who want the potential for premium return and can pass traditional underwriting.

- Pricing Example (Illustrative, actual rates vary): A 45-year-old non-smoker with well-controlled high cholesterol might pay around $150-$200 per month for a $500,000, 30-year ROP policy.

Comparing Product Scenarios and Pricing for Pre Existing Conditions

Let's look at a few hypothetical scenarios to illustrate how different conditions might lead to different product choices and pricing:

Scenario 1: Well-Controlled Type 2 Diabetes

Applicant: John, 55, non-smoker, diagnosed with Type 2 diabetes 5 years ago. Manages it well with diet, exercise, and oral medication. A1C consistently below 7.0. No other major health issues.

- Traditional Fully Underwritten Term Life ($500,000, 20-year term): John might qualify for a 'standard' or 'standard plus' rating with a moderate surcharge. Premiums could range from $100-$150 per month. Insurers like Banner Life or Pacific Life are often more favorable for well-controlled diabetes.

- Simplified Issue Whole Life ($50,000): If John prefers permanent coverage or wants to avoid a medical exam, he could get a simplified issue policy. Premiums might be around $150-$200 per month. Mutual of Omaha or Gerber Life could be options.

Scenario 2: History of Cancer (5 Years in Remission)

Applicant: Sarah, 48, non-smoker, successfully treated for early-stage breast cancer 5 years ago. No recurrence, regular check-ups are clear. No other health issues.

- Traditional Fully Underwritten Term Life ($750,000, 20-year term): Many insurers have waiting periods after cancer treatment. After 5 years in remission for early-stage cancer, Sarah might qualify for a 'standard' or 'standard plus' rating, possibly with a small surcharge. Premiums could be $120-$180 per month. Companies like Lincoln Financial or Prudential are known for being more flexible with cancer history.

- Simplified Issue Term Life ($250,000): If Sarah wants to avoid the full underwriting process, some simplified issue policies might be available, though the death benefit might be capped lower. Premiums would be higher than fully underwritten, perhaps $200-$250 per month.

Scenario 3: Recent Heart Attack (within 2 years)

Applicant: David, 65, former smoker (quit 1 year ago), had a heart attack 18 months ago. Now on medication, stable, but has some residual heart damage. No other major health issues.

- Traditional Fully Underwritten: David would likely face a significant waiting period (e.g., 2-5 years post-event) before being considered for traditional coverage. If approved, premiums would be very high ('substandard' rating).

- Simplified Issue Whole Life ($25,000): Some simplified issue policies might be available, but they would likely have a graded death benefit. Premiums could be $180-$250 per month.

- Guaranteed Issue Whole Life ($10,000): This would be David's most accessible option for immediate coverage, albeit with a graded death benefit. Premiums might be $150-$200 per month. AARP or Gerber Life are common providers.

Scenario 4: Multiple Chronic Conditions (e.g., Diabetes, High Blood Pressure, Obesity)

Applicant: Maria, 70, non-smoker, has Type 2 diabetes, high blood pressure, and is obese. All are managed with medication but not perfectly controlled. Has had a few hospitalizations in the past 3 years related to these conditions.

- Traditional Fully Underwritten: Maria would likely be declined due to the combination and severity of conditions.

- Simplified Issue: Very unlikely to qualify due to recent hospitalizations and multiple conditions.

- Guaranteed Issue Whole Life ($5,000-$15,000): This is Maria's most viable option. It will provide coverage for final expenses, with a graded death benefit. Premiums would be high for the coverage amount, perhaps $100-$200 per month for a $10,000 policy.

Tips for a Smoother Application Process with Pre Existing Conditions

Gather All Medical Records in Advance

Having your medical history, including dates of diagnosis, treatments, medications, and recent test results (like A1C for diabetes or cholesterol levels), readily available can speed up the underwriting process. It also ensures accuracy.

Work with an Independent Agent Specializing in Impaired Risk

These agents have experience placing policies for individuals with health conditions. They know which carriers are more lenient for specific ailments and can help you present your case in the best light. They can also pre-screen your application with multiple insurers to find the best fit without multiple formal applications.

Be Prepared for Follow-Up Questions

Underwriters will likely have additional questions about your condition, treatment, and overall health. Respond promptly and thoroughly to avoid delays.

Consider a Policy with a Graded Death Benefit if Necessary

While not ideal, a graded death benefit policy (common in simplified and guaranteed issue plans) is often the only option for individuals with severe health issues. It provides coverage, even if it's limited in the initial years, and ensures your loved ones will receive something.

Don't Give Up After One Rejection

If one insurer declines your application or offers rates you can't afford, don't assume all hope is lost. As mentioned, different companies have different guidelines. A rejection from one doesn't mean a rejection from all.

The Bottom Line on Life Insurance and Pre Existing Conditions

Having a pre-existing health condition doesn't automatically disqualify you from getting life insurance. It simply means you'll need to be more proactive and informed about your options. By understanding how insurers assess risk, exploring specialized products like simplified issue or guaranteed issue, and working with knowledgeable professionals, you can find a policy that provides the financial protection your loved ones deserve. The key is to be honest, persistent, and strategic in your approach. Your peace of mind, and your family's financial security, are worth the effort.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)