Guaranteed Universal Life Insurance for Lifelong Coverage

Discover the benefits of guaranteed universal life insurance, offering fixed premiums and a guaranteed death benefit.

Discover the benefits of guaranteed universal life insurance, offering fixed premiums and a guaranteed death benefit.

Guaranteed Universal Life Insurance for Lifelong Coverage

Life insurance is one of those things many of us know we need, but often put off thinking about. We get caught up in the day-to-day, and planning for the distant future can feel overwhelming. But what if there was a type of life insurance that offered simplicity, predictability, and lifelong protection? That's where Guaranteed Universal Life (GUL) insurance comes in. It's a powerful tool designed to provide peace of mind, ensuring your loved ones are financially secure no matter how long you live.

Unlike term life insurance, which covers you for a specific period, GUL is a form of permanent life insurance. This means it's designed to last your entire life, as long as you pay your premiums. But what makes it 'guaranteed' and 'universal'? Let's break it down.

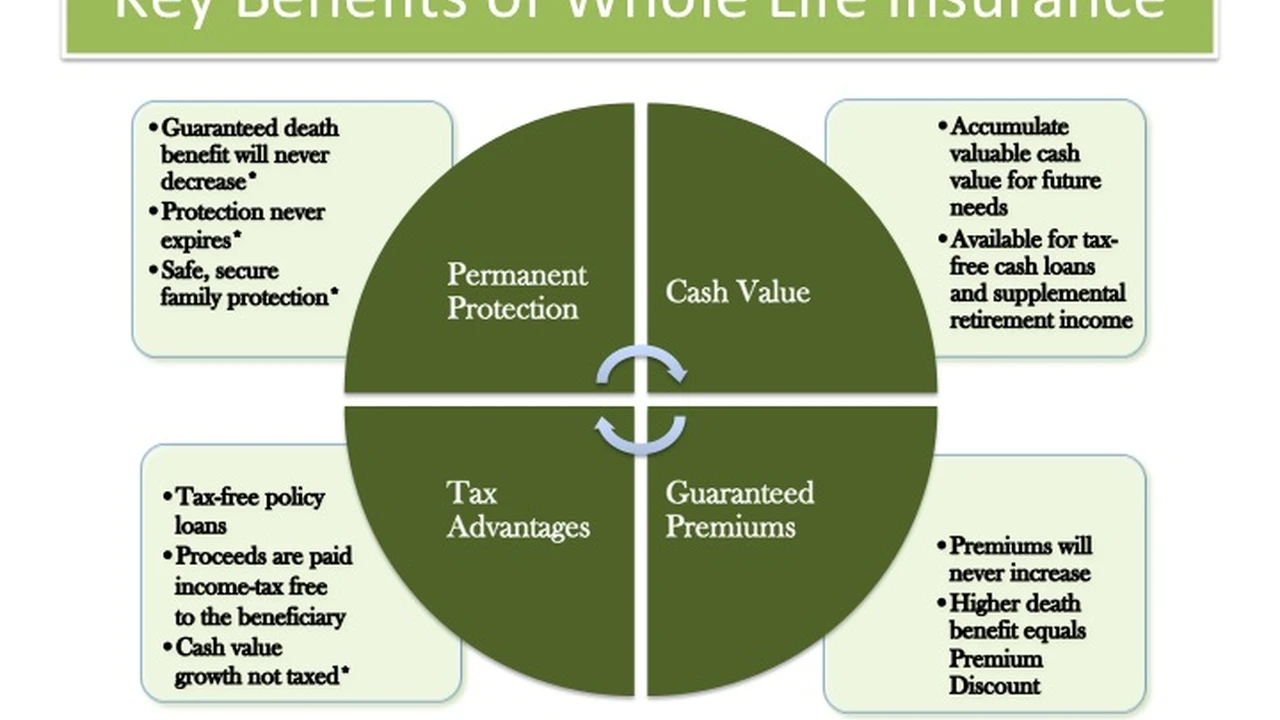

The 'guaranteed' part refers to the fact that your premiums and death benefit are typically fixed. Once you lock in your policy, your payments won't suddenly jump, and your beneficiaries will receive the promised amount. This predictability is a huge draw for many people, especially those on a fixed income or who simply prefer stability in their financial planning. The 'universal' aspect highlights its flexibility compared to traditional whole life insurance. While GUL doesn't build significant cash value like some other permanent policies, it often allows for some adjustments to premiums or death benefits, though these are usually less flexible than other universal life products.

So, if you're looking for a straightforward, lifelong insurance solution without the complexities of investment components, GUL might be exactly what you need. It's about ensuring that when the time comes, your family is taken care of, without any surprises along the way.

Understanding Guaranteed Universal Life Insurance How It Works

Let's dive a bit deeper into the mechanics of Guaranteed Universal Life insurance. At its core, GUL is a permanent life insurance policy that focuses on providing a guaranteed death benefit for your entire life. This is its primary function, and it excels at it.

Fixed Premiums and Death Benefit: One of the most attractive features of GUL is its predictability. When you purchase a GUL policy, you typically agree to a set premium payment schedule. As long as you make these payments, your policy remains in force, and the death benefit is guaranteed to be paid out to your beneficiaries upon your passing. This contrasts sharply with other universal life policies where premiums can fluctuate, or the death benefit might be tied to market performance.

No Significant Cash Value Growth: This is a crucial distinction. While GUL is a type of universal life insurance, it's often structured to minimize or eliminate the cash value component that's prominent in whole life or other universal life policies. The premiums you pay primarily go towards covering the cost of insurance and maintaining the death benefit guarantee. This means you won't typically be able to borrow against a GUL policy's cash value or surrender it for a substantial lump sum. For some, this is a disadvantage, but for others, it's a benefit because it means lower premiums compared to policies that build significant cash value.

Guaranteed Maturity Age: GUL policies are designed to last until a very advanced age, often 90, 95, 100, 105, 110, or even 121. As long as you continue to pay your premiums, the policy will not lapse before this guaranteed maturity age. This provides true lifelong coverage, which is a significant advantage for estate planning or ensuring final expenses are covered.

Simplicity and Peace of Mind: Because GUL policies are less complex than other permanent life insurance options, they are often easier to understand and manage. You know what you're paying, and you know what your beneficiaries will receive. This simplicity translates into significant peace of mind for many policyholders.

Flexibility (Limited): While not as flexible as traditional Universal Life (UL) or Indexed Universal Life (IUL), GUL policies can offer some limited flexibility. For instance, you might be able to adjust your death benefit (usually downwards) or change your premium payment schedule, though doing so could impact the guarantee. It's essential to understand these limitations and how any changes might affect the policy's long-term viability.

In essence, GUL is for those who prioritize a guaranteed death benefit over cash value accumulation. It's a straightforward solution for lifelong protection, making it an excellent choice for specific financial planning needs.

Who Benefits Most from Guaranteed Universal Life Insurance Ideal Use Cases

Guaranteed Universal Life insurance isn't for everyone, but for certain individuals and families, it's an incredibly effective and valuable financial tool. Let's explore some of the ideal use cases where GUL truly shines.

Estate Planning and Wealth Transfer Strategies

One of the most common and powerful applications of GUL is in estate planning. If your goal is to leave a specific amount of money to your heirs, cover estate taxes, or ensure a legacy, GUL is an excellent choice. Because the death benefit is guaranteed and lasts your entire life, you can be confident that the funds will be available when needed. This predictability is invaluable for complex estate plans, allowing you to precisely calculate how much coverage you need to meet your objectives without worrying about market fluctuations or policy lapses.

Covering Final Expenses and Burial Costs

For many, the primary concern is ensuring that their loved ones aren't burdened with the costs associated with their passing. Funeral expenses, medical bills, and other end-of-life costs can quickly add up. GUL provides a guaranteed death benefit that can be specifically earmarked to cover these expenses, offering immense relief to grieving families. This is particularly appealing to seniors who want to ensure their final wishes are honored without imposing financial strain on their children or spouse.

Long-Term Care Planning and Supplemental Income

While GUL doesn't build significant cash value, many policies offer riders that can enhance their utility. One increasingly popular rider is a long-term care (LTC) rider. This allows you to access a portion of your death benefit while you're still alive to pay for long-term care services, such as nursing home care, assisted living, or in-home care. This can be a cost-effective way to address potential LTC needs without purchasing a separate, often expensive, standalone LTC policy. It provides a dual benefit: protection for your family if you pass away without needing LTC, and financial support if you do.

Business Succession Planning and Key Person Protection

Business owners can also find GUL policies beneficial. For instance, in a buy-sell agreement, GUL can provide the guaranteed funds needed for surviving partners to purchase the deceased partner's share of the business. This ensures a smooth transition and prevents financial disruption. Similarly, for key person insurance, a GUL policy can protect the business from the financial loss incurred by the death of a critical employee, providing funds for recruitment, training, and lost revenue.

Individuals Seeking Predictable, Lifelong Coverage

Beyond specific financial goals, GUL is ideal for anyone who simply wants straightforward, lifelong life insurance without the investment component. If you're not interested in managing cash value or dealing with market volatility, but you still want the assurance of permanent coverage, GUL is a perfect fit. It's often chosen by those who have already maximized their retirement savings or have other investment vehicles and simply need a reliable death benefit.

In summary, GUL is a specialized tool that excels in providing guaranteed, lifelong financial protection. Its predictability and focus on the death benefit make it an excellent choice for estate planning, covering final expenses, and providing peace of mind for those who prioritize certainty in their life insurance.

Comparing Top Guaranteed Universal Life Insurance Providers and Products

When considering a Guaranteed Universal Life (GUL) policy, it's crucial to compare offerings from various providers. While the core concept of GUL is consistent – guaranteed death benefit and fixed premiums – the specifics can vary. These variations include the guaranteed maturity age, available riders, customer service reputation, and, of course, pricing. Here, we'll look at some prominent providers in the US and Southeast Asia, discuss their typical GUL product features, and provide hypothetical pricing scenarios.

Important Disclaimer: The product names, features, and pricing mentioned below are illustrative and based on general market knowledge. Actual policy details, availability, and costs will vary significantly based on your age, health, lifestyle, location, and the specific underwriting criteria of each insurer. Always obtain personalized quotes from licensed agents or financial advisors.

US Market Providers and Products

1. Pacific Life Pacific Estate Protector

- Product Focus: Pacific Life is well-regarded for its strong financial ratings and competitive GUL offerings. The Pacific Estate Protector is designed for long-term guarantees.

- Key Features:

- Guaranteed Death Benefit: Provides a guaranteed death benefit up to age 121, ensuring lifelong coverage.

- Fixed Premiums: Premiums are fixed and guaranteed not to increase, offering budget predictability.

- Riders: Often includes an Accelerated Death Benefit Rider for chronic or terminal illness, allowing early access to a portion of the death benefit. May also offer a Long-Term Care Rider.

- Minimal Cash Value: Designed for death benefit protection, not cash value accumulation.

- Typical Scenario & Hypothetical Pricing (US):

- Applicant: 45-year-old healthy male, non-smoker.

- Death Benefit: $500,000.

- Guaranteed to Age: 121.

- Estimated Monthly Premium: $350 - $450.

- Use Case: Estate planning, ensuring a legacy for children, or covering potential estate taxes.

2. Transamerica Transamerica Financial Foundation IUL (GUL Option)

- Product Focus: While primarily an Indexed Universal Life (IUL) product, Transamerica often allows for a 'GUL-like' configuration by overfunding the policy initially to guarantee the death benefit to a very old age, effectively creating a GUL.

- Key Features:

- Guaranteed Death Benefit: Can be structured to guarantee the death benefit to age 121 with specific premium payments.

- Flexibility: Offers more flexibility than a pure GUL in terms of premium payments (though maintaining the guarantee requires strict adherence to a schedule).

- Riders: Comprehensive suite of riders, including Accelerated Death Benefit for chronic, critical, or terminal illness, and potentially a Long-Term Care rider.

- Potential for Cash Value: If structured as an IUL with a GUL guarantee, there might be some minimal cash value growth potential, but the primary focus for this configuration is the guarantee.

- Typical Scenario & Hypothetical Pricing (US):

- Applicant: 50-year-old healthy female, non-smoker.

- Death Benefit: $750,000.

- Guaranteed to Age: 100.

- Estimated Monthly Premium: $500 - $650 (this might be higher due to the IUL structure, but offers more potential for riders).

- Use Case: Business succession planning, ensuring funds for a buy-sell agreement, or providing a guaranteed payout for a specific charitable donation.

3. Protective Life Protective Custom Choice UL

- Product Focus: Protective offers a Universal Life product that can be designed to provide strong guarantees, making it function very similarly to a GUL.

- Key Features:

- Guaranteed Death Benefit: Can be structured to guarantee the death benefit to a chosen age (e.g., 90, 100, 110, 121) with a fixed premium.

- Premium Flexibility: While designed for fixed premiums to maintain the guarantee, it offers some inherent UL flexibility if the guarantee is not the sole focus.

- Riders: Includes an Accelerated Death Benefit for terminal illness. Other riders like chronic illness or disability waiver of premium may be available.

- Competitive Pricing: Often known for competitive pricing in the guaranteed segment.

- Typical Scenario & Hypothetical Pricing (US):

- Applicant: 60-year-old healthy male, non-smoker.

- Death Benefit: $250,000.

- Guaranteed to Age: 95.

- Estimated Monthly Premium: $280 - $380.

- Use Case: Covering final expenses, leaving a small inheritance, or providing financial support for a dependent with special needs.

Southeast Asia Market Providers and Products

The GUL market in Southeast Asia is evolving, with many insurers offering Universal Life products that can be configured with strong guarantees. Local regulations and market preferences mean that 'pure' GUL products might be less common than in the US, but UL products with guaranteed features serve a similar purpose.

1. AIA (e.g., AIA Platinum Legacy, various UL products)

- Product Focus: AIA is a dominant player across Southeast Asia. They offer various Universal Life products that can be structured to provide long-term guarantees, often with a focus on wealth preservation and transfer.

- Key Features:

- Guaranteed Death Benefit: Many UL products can be designed with a guaranteed death benefit to a high age (e.g., 100) by maintaining a specific premium schedule.

- Premium Payment Options: Often offers flexible premium payment terms, including single premium, limited pay, or regular pay, which can be structured for guarantees.

- Riders: Comprehensive range of riders, including critical illness, disability, and sometimes long-term care benefits, which can be added to enhance coverage.

- Wealth Accumulation (Secondary): While the guarantee is key, some UL products may offer a modest cash value component that can grow over time.

- Typical Scenario & Hypothetical Pricing (Singapore/Malaysia):

- Applicant: 40-year-old healthy female, non-smoker.

- Death Benefit: SGD/MYR 1,000,000.

- Guaranteed to Age: 100.

- Estimated Monthly Premium: SGD 800 - 1,200 / MYR 2,500 - 4,000 (reflecting higher death benefit and potentially some cash value component).

- Use Case: High-net-worth individuals for intergenerational wealth transfer, ensuring a substantial legacy for future generations, or philanthropic giving.

2. Prudential (e.g., PruLife Universal One, various UL products)

- Product Focus: Prudential, another major insurer in the region, provides Universal Life solutions that can be tailored for guaranteed protection. Their products often emphasize financial planning and protection.

- Key Features:

- Guaranteed Death Benefit: Similar to AIA, their UL products can be configured to provide a guaranteed death benefit for life, provided premiums are paid as scheduled.

- Flexible Premium Payments: Offers various premium payment structures to suit different financial situations, which can be optimized for guarantees.

- Riders: Access to a wide array of riders for critical illness, total and permanent disability, and sometimes early stage critical illness.

- Policy Loan Options: While not a primary feature of a GUL-like structure, some UL policies allow for policy loans against any accumulated cash value.

- Typical Scenario & Hypothetical Pricing (Thailand/Indonesia):

- Applicant: 55-year-old healthy male, non-smoker.

- Death Benefit: THB 10,000,000 / IDR 3,000,000,000.

- Guaranteed to Age: 99.

- Estimated Monthly Premium: THB 15,000 - 25,000 / IDR 5,000,000 - 8,000,000.

- Use Case: Protecting business interests, ensuring family financial stability, or providing for a spouse in retirement.

3. Manulife (e.g., Manulife Universal Life, various UL products)

- Product Focus: Manulife offers Universal Life products across Southeast Asia that can be structured to provide strong, long-term guarantees, often appealing to those seeking stable, predictable coverage.

- Key Features:

- Guaranteed Death Benefit: Policies can be designed to offer a guaranteed death benefit up to advanced ages, ensuring lifelong protection.

- Premium Payment Flexibility: Provides options for premium payment frequency and duration, allowing for customization to maintain guarantees.

- Riders: Offers various riders to enhance protection, such as critical illness, accidental death, and waiver of premium.

- Competitive Interest Rates (for UL component): While the guarantee is key, any cash value component might benefit from competitive interest rates.

- Typical Scenario & Hypothetical Pricing (Philippines/Vietnam):

- Applicant: 48-year-old healthy female, non-smoker.

- Death Benefit: PHP 5,000,000 / VND 2,000,000,000.

- Guaranteed to Age: 90.

- Estimated Monthly Premium: PHP 8,000 - 12,000 / VND 3,000,000 - 5,000,000.

- Use Case: Providing for children's education funds in the event of premature death, or ensuring a spouse has financial security.

When evaluating these options, remember to consider the insurer's financial strength ratings (e.g., A.M. Best, S&P), their reputation for customer service, and the specific terms and conditions of the policy. Always work with a qualified financial advisor who can help you compare personalized quotes and tailor a policy to your unique needs and budget.

Key Considerations When Choosing Guaranteed Universal Life Insurance

Selecting the right Guaranteed Universal Life (GUL) insurance policy involves more than just looking at the death benefit amount. To ensure you get the best fit for your financial situation and long-term goals, there are several critical factors you need to consider. Let's break down these important points.

Guaranteed Maturity Age How Long Do You Need Coverage

This is perhaps the most defining feature of a GUL policy. While all GUL policies offer lifelong coverage, the 'lifelong' can vary. Some policies guarantee coverage to age 90, others to 100, 105, 110, or even 121. The longer the guaranteed maturity age, the higher your premiums will likely be. It's essential to assess your needs: are you primarily concerned with covering final expenses, or do you need a policy that will definitely be there for estate planning well into your golden years? Choose a guaranteed age that aligns with your longest-term financial objectives.

Premium Structure and Payment Schedule

GUL policies are known for their fixed premiums, but how those premiums are structured can still vary. Some policies might offer a 'limited pay' option, where you pay premiums for a set number of years (e.g., 10, 15, 20 years) and then the policy is paid up for life. Others require payments until the guaranteed maturity age. Understand the payment schedule and ensure it's sustainable for your budget over the long haul. Missing payments can jeopardize the guarantee, potentially leading to a policy lapse.

Riders and Additional Benefits Enhancing Your Policy

While GUL's primary focus is the death benefit, many insurers offer riders that can significantly enhance the policy's value. Common riders include:

- Accelerated Death Benefit (ADB) Rider: Allows you to access a portion of your death benefit early if you're diagnosed with a terminal or chronic illness. This can be a lifesaver for covering medical expenses or long-term care costs.

- Long-Term Care (LTC) Rider: Specifically designed to provide funds for long-term care services, often converting a portion of the death benefit into a living benefit.

- Waiver of Premium Rider: Waives your premium payments if you become totally disabled and unable to work.

- Guaranteed Insurability Rider: Allows you to purchase additional coverage at certain future dates without further medical underwriting.

Consider which riders are most important to you and if the added cost is justified by the extra protection they provide.

Cash Value Component (or Lack Thereof)

As discussed, GUL policies are not designed for significant cash value accumulation. If building cash value that you can access for loans or withdrawals is a priority, a different type of permanent life insurance, like whole life or traditional universal life, might be a better fit. With GUL, the focus is squarely on the guaranteed death benefit. Understand that surrendering a GUL policy early might result in little to no cash value return.

Insurer's Financial Strength and Reputation

Since GUL is a long-term commitment, the financial stability of the insurance company is paramount. Look for insurers with high financial strength ratings from independent agencies like A.M. Best, Standard & Poor's, Moody's, or Fitch. A strong rating indicates the company's ability to meet its financial obligations, including paying out death benefits, decades into the future. Also, consider their reputation for customer service and claims processing.

Underwriting Process and Health Considerations

Like most life insurance, GUL policies require underwriting. Your age, health, medical history, lifestyle, and even occupation will influence your eligibility and premium rates. Be honest and thorough during the application process. If you have pre-existing conditions, some insurers might be more lenient than others, or you might be offered a higher premium. Understanding the underwriting process can help you prepare and potentially secure a better rate.

Cost and Affordability

While GUL offers predictability, it's still a permanent life insurance product, meaning premiums will be higher than comparable term life policies. Obtain quotes from multiple insurers and compare them carefully. Ensure the premiums are affordable not just now, but for the foreseeable future. A policy that lapses because you can no longer afford the premiums provides no benefit.

By carefully evaluating these considerations, you can make an informed decision and choose a Guaranteed Universal Life insurance policy that provides the lifelong protection and peace of mind you and your family deserve.

The Advantages and Disadvantages of Guaranteed Universal Life Insurance

Every financial product has its strengths and weaknesses, and Guaranteed Universal Life (GUL) insurance is no exception. Understanding both the advantages and disadvantages will help you determine if it's the right fit for your specific financial planning needs. Let's weigh the pros and cons.

Advantages of Guaranteed Universal Life Insurance

1. Lifelong, Guaranteed Coverage

This is the cornerstone benefit of GUL. Unlike term life insurance that expires, GUL provides coverage for your entire life, as long as premiums are paid. The death benefit is guaranteed, meaning your beneficiaries will receive the promised amount regardless of market performance or interest rate fluctuations. This offers unparalleled peace of mind for long-term planning.

2. Predictable and Fixed Premiums

With GUL, your premiums are typically fixed and guaranteed not to increase. This predictability makes budgeting much easier, especially for those on a fixed income or who prefer financial stability. You won't have to worry about unexpected premium hikes that could jeopardize your coverage.

3. Simplicity and Transparency

Compared to other permanent life insurance policies like Whole Life or Indexed Universal Life, GUL is generally simpler to understand. It focuses primarily on the death benefit guarantee, with minimal or no emphasis on cash value growth. This transparency can be appealing to individuals who want straightforward protection without complex investment components.

4. Cost-Effective Permanent Coverage

Because GUL policies typically don't build significant cash value, their premiums are often lower than those for comparable Whole Life policies. This makes GUL a more affordable option for individuals who need lifelong coverage but don't prioritize the cash value accumulation aspect of other permanent policies.

5. Excellent for Estate Planning and Legacy Building

The guaranteed death benefit makes GUL an ideal tool for estate planning. It ensures that funds are available to cover estate taxes, equalize inheritances among heirs, or leave a specific legacy to family members or charities. The certainty of the payout is invaluable in these scenarios.

6. Potential for Living Benefits Through Riders

Many GUL policies offer riders, such as Accelerated Death Benefit riders for chronic or terminal illness, or Long-Term Care riders. These riders allow you to access a portion of your death benefit while you're still alive to cover significant medical or care expenses, providing a valuable 'living benefit' that can protect your assets.

Disadvantages of Guaranteed Universal Life Insurance

1. Limited or No Cash Value Accumulation

This is the most significant drawback for some. Unlike Whole Life or other Universal Life policies, GUL is not designed to build substantial cash value. This means you won't have a significant savings component that you can borrow against or withdraw from in the future. If cash value growth and access are priorities, GUL might not be the best choice.

2. Less Flexibility Than Other Universal Life Policies

While it's a type of Universal Life, GUL offers less flexibility than traditional UL or IUL. To maintain the guarantee, you must adhere strictly to the premium payment schedule. Deviating from this schedule, such as skipping payments or reducing premiums, can jeopardize the guarantee and potentially lead to a policy lapse.

3. Higher Premiums Than Term Life Insurance

Although more affordable than Whole Life, GUL premiums are still significantly higher than those for a comparable term life insurance policy. If your need for coverage is temporary (e.g., until your children are grown or your mortgage is paid off), term life insurance will be a much more cost-effective option.

4. Potential for Policy Lapse if Premiums Are Not Paid

The 'guaranteed' aspect of GUL is contingent upon consistent premium payments. If you stop paying premiums, or if the policy's internal costs eventually exceed the premiums paid (which can happen if you significantly alter the policy or if the guarantee is not to a very high age), the policy can lapse, and you could lose your coverage.

5. Not an Investment Vehicle

GUL should not be viewed as an investment. Its primary purpose is protection. While it provides a guaranteed death benefit, it does not offer the growth potential or investment returns that you might find in other financial products or even other types of life insurance with investment components.

In summary, GUL is an excellent choice for those who prioritize guaranteed, lifelong death benefit protection and predictable costs. However, if cash value accumulation, investment growth, or maximum premium flexibility are your main goals, you might need to explore other life insurance options.

Making the Right Choice Is Guaranteed Universal Life Insurance for You

Deciding on the right life insurance policy is a deeply personal financial decision, and Guaranteed Universal Life (GUL) insurance is a powerful tool that fits specific needs. It's not a one-size-fits-all solution, but for many, its unique blend of predictability and lifelong protection makes it an invaluable asset.

If you've read through the advantages and disadvantages, considered the ideal use cases, and compared some of the product offerings, you should have a clearer picture. But let's bring it all together to help you determine if GUL is truly the best path for your financial future.

When GUL is Likely a Good Fit

- You prioritize a guaranteed death benefit: Your main goal is to ensure a specific amount of money will be paid to your beneficiaries, no matter when you pass away. You value certainty above all else.

- You need lifelong coverage: You have long-term financial obligations, such as estate taxes, a desire to leave a legacy, or a need to cover final expenses that will exist throughout your entire life.

- You prefer predictable costs: You want fixed premiums that won't increase, making it easier to budget and plan for the long term without worrying about fluctuating payments.

- You're not focused on cash value growth: You have other investment vehicles or are not interested in using your life insurance policy as a savings or investment tool. You see life insurance purely as protection.

- You're looking for simplicity: You appreciate a straightforward policy that's easy to understand, without complex investment components or variable returns.

- You want to leverage living benefits: The option to add riders for chronic or terminal illness, or long-term care, is appealing to you as a way to protect against future health-related costs.

When You Might Consider Alternatives to GUL

- You need temporary coverage: If your financial obligations are time-bound (e.g., a mortgage, raising young children), term life insurance will be significantly more affordable.

- You want significant cash value growth: If building a substantial cash value that you can access for loans, withdrawals, or retirement income is a priority, Whole Life, traditional Universal Life, or Indexed Universal Life might be better options.

- You desire maximum flexibility: If you anticipate needing to frequently adjust your premiums or death benefit, or want more control over the investment component, other Universal Life products offer greater flexibility.

- You're on a very tight budget: While GUL is more affordable than Whole Life, it's still more expensive than term life. If every dollar counts, and your needs are temporary, term life might be the only viable option.

Next Steps for Your Life Insurance Journey

If GUL sounds like it aligns with your needs, here's what you should do next:

- Assess Your Needs Thoroughly: Re-evaluate how much coverage you truly need and for how long. Consider your debts, income replacement needs, future expenses, and legacy goals.

- Gather Personalized Quotes: Contact several reputable insurance providers or work with an independent insurance agent. Provide accurate information about your age, health, and lifestyle to get precise quotes.

- Compare Policies and Riders: Don't just look at the premium. Compare the guaranteed maturity age, available riders, the insurer's financial strength, and their customer service reputation.

- Consult a Financial Advisor: A qualified financial advisor can help you integrate life insurance into your broader financial plan, ensuring it complements your other investments and goals. They can also help you understand the nuances of different policies.

- Read the Fine Print: Before signing anything, carefully read the policy document. Understand all terms, conditions, exclusions, and how the guarantee works.

Guaranteed Universal Life insurance offers a powerful solution for those seeking predictable, lifelong financial protection. By understanding its features, benefits, and limitations, you can make an informed decision that provides lasting security for your loved ones and peace of mind for yourself.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)